Kein Company, a manufacturer of furniture which has been established for more than 3 years. As at December, 2018 the company has sold 2,500 units of furniture. The sales price of each furniture is RM150 per unit. The variable cost to produce one furniture is RM100 per unit. Fixed costs for the furniture production is RM50,000. Required: (a) Compute the variable cost ratio and contribution margin ratio. (Two decimal places). (b) Compute the breakeven unit and sales. (c) Calculate the number of furniture kein Company needs to sell in order to achieve a profit of RM200,000 per annum. (d) Using the contribution margin ratio computed in (a), compute additional profit that Kein Company would earn if sales were RM20,000 more than expected. (e) Based on unit sold of 2,500 compute the margin of safety in units and ringgit. (f) Calculate the degree of operating leverage. Now suppose that Kein Company revises the forecast to show a 20 percent increases in sales over the original forecast. What is the percentage change in operating income expected for the revised forecast? What is the total operating income expected by Kein Company after revising the sales forecast?

Kein Company, a manufacturer of furniture which has been established for more than 3 years. As at December, 2018 the company has sold 2,500 units of furniture. The sales price of each furniture is RM150 per unit. The variable cost to produce one furniture is RM100 per unit. Fixed costs for the furniture production is RM50,000. Required: (a) Compute the variable cost ratio and contribution margin ratio. (Two decimal places). (b) Compute the breakeven unit and sales. (c) Calculate the number of furniture kein Company needs to sell in order to achieve a profit of RM200,000 per annum. (d) Using the contribution margin ratio computed in (a), compute additional profit that Kein Company would earn if sales were RM20,000 more than expected. (e) Based on unit sold of 2,500 compute the margin of safety in units and ringgit. (f) Calculate the degree of operating leverage. Now suppose that Kein Company revises the forecast to show a 20 percent increases in sales over the original forecast. What is the percentage change in operating income expected for the revised forecast? What is the total operating income expected by Kein Company after revising the sales forecast?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 47E: Klamath Company produces a single product. The projected income statement for the coming year is as...

Related questions

Question

Requirement

Show your working

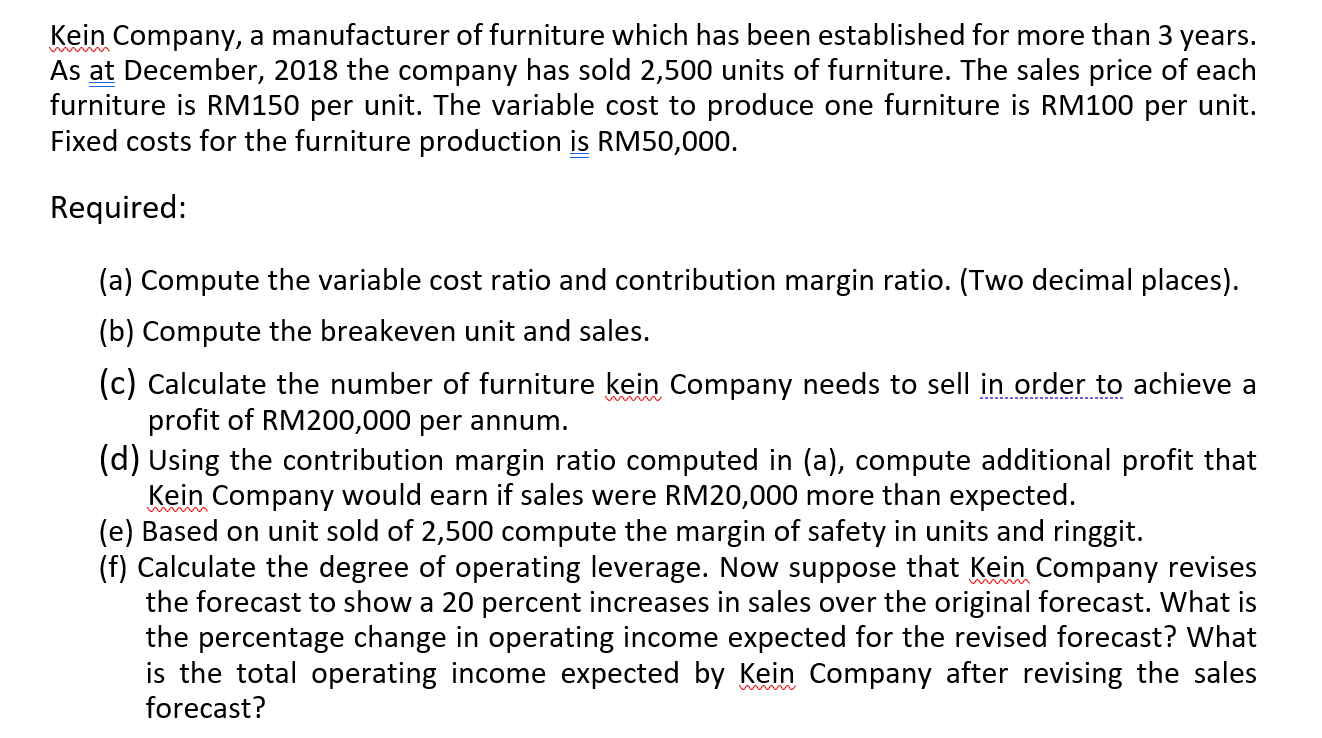

Transcribed Image Text:Kein Company, a manufacturer of furniture which has been established for more than 3 years.

As at December, 2018 the company has sold 2,500 units of furniture. The sales price of each

furniture is RM150 per unit. The variable cost to produce one furniture is RM100 per unit.

Fixed costs for the furniture production is RM50,000.

Required:

(a) Compute the variable cost ratio and contribution margin ratio. (Two decimal places).

(b) Compute the breakeven unit and sales.

(c) Calculate the number of furniture kein Company needs to sell in order to achieve a

profit of RM200,000 per annum.

(d) Using the contribution margin ratio computed in (a), compute additional profit that

Kein Company would earn if sales were RM20,000 more than expected.

(e) Based on unit sold of 2,500 compute the margin of safety in units and ringgit.

(f) Calculate the degree of operating leverage. Now suppose that Kein Company revises

the forecast to show a 20 percent increases in sales over the original forecast. What is

the percentage change in operating income expected for the revised forecast? What

is the total operating income expected by Kein Company after revising the sales

forecast?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning