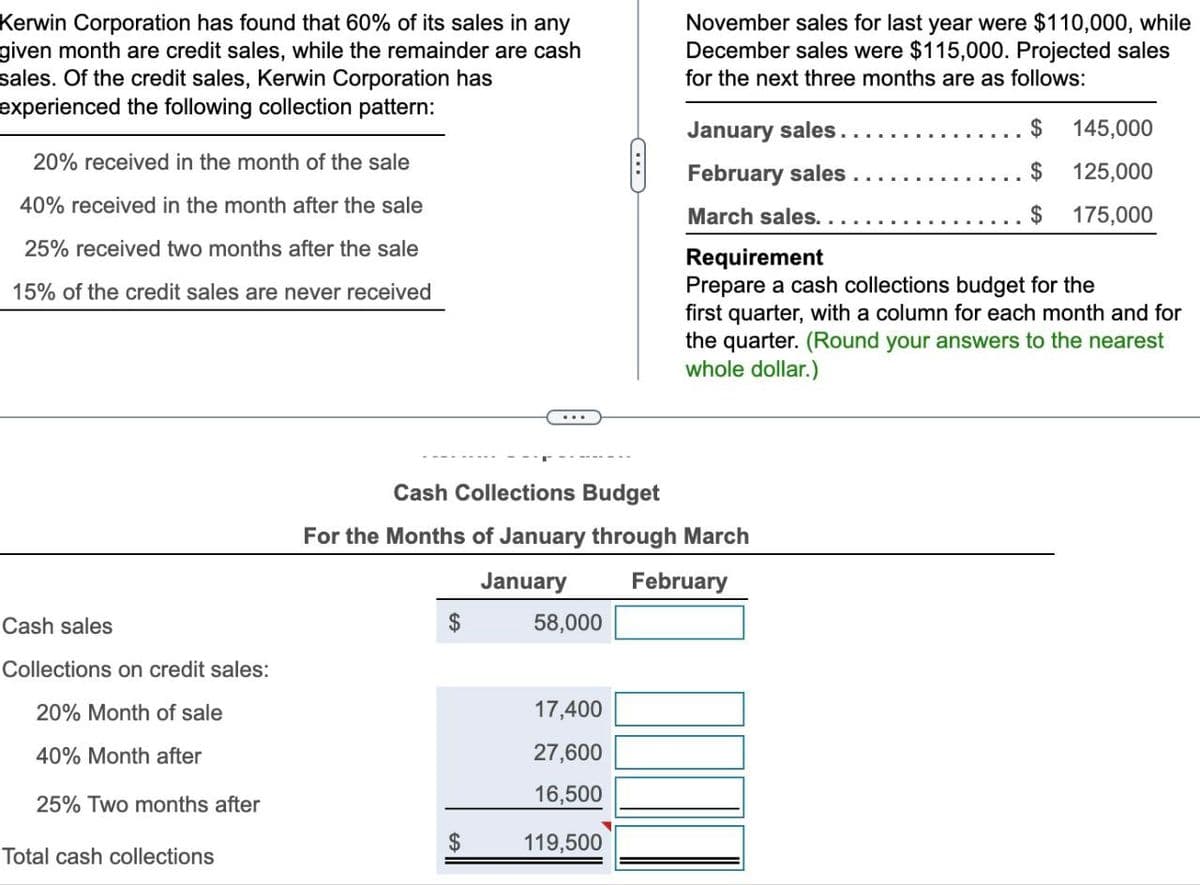

Kerwin Corporation has found that 60% of its sales in any given month are credit sales, while the remainder are cash sales. Of the credit sales, Kerwin Corporation has experienced the following collection pattern: 20% received in the month of the sale 40% received in the month after the sale 25% received two months after the sale 15% of the credit sales are never received C November sales for last year were $110,000, while December sales were $115,000. Projected sales for the next three months are as follows: January sales. February sales March sales.. Requirement $ 145,000 $ 125,000 $ 175,000 Prepare a cash collections budget for the first quarter, with a column for each month and for the quarter. (Round your answers to the nearest whole dollar.) Cash sales Collections on credit sales: 20% Month of sale Cash Collections Budget For the Months of January through March January February 58,000 17,400 40% Month after 27,600 16,500 25% Two months after $ 119,500 Total cash collections

Kerwin Corporation has found that 60% of its sales in any given month are credit sales, while the remainder are cash sales. Of the credit sales, Kerwin Corporation has experienced the following collection pattern: 20% received in the month of the sale 40% received in the month after the sale 25% received two months after the sale 15% of the credit sales are never received C November sales for last year were $110,000, while December sales were $115,000. Projected sales for the next three months are as follows: January sales. February sales March sales.. Requirement $ 145,000 $ 125,000 $ 175,000 Prepare a cash collections budget for the first quarter, with a column for each month and for the quarter. (Round your answers to the nearest whole dollar.) Cash sales Collections on credit sales: 20% Month of sale Cash Collections Budget For the Months of January through March January February 58,000 17,400 40% Month after 27,600 16,500 25% Two months after $ 119,500 Total cash collections

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 11CE: Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted...

Related questions

Question

None

Transcribed Image Text:Kerwin Corporation has found that 60% of its sales in any

given month are credit sales, while the remainder are cash

sales. Of the credit sales, Kerwin Corporation has

experienced the following collection pattern:

20% received in the month of the sale

40% received in the month after the sale

25% received two months after the sale

15% of the credit sales are never received

C

November sales for last year were $110,000, while

December sales were $115,000. Projected sales

for the next three months are as follows:

January sales.

February sales

March sales..

Requirement

$

145,000

$

125,000

$

175,000

Prepare a cash collections budget for the

first quarter, with a column for each month and for

the quarter. (Round your answers to the nearest

whole dollar.)

Cash sales

Collections on credit sales:

20% Month of sale

Cash Collections Budget

For the Months of January through March

January

February

58,000

17,400

40% Month after

27,600

16,500

25% Two months after

$

119,500

Total cash collections

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning