KEW Enterprises began operations in January 20X1 to manufacture a hand sanitizer that promised to be more effective and gentler on the skin than existing products. Family members, one of whom was delegated to be the office manager and bookkeeper, staffed the company. Although conscientious, the office manager lacked formal accounting training, which became apparent when the growing company was forced in March 20X4 to hire a CPA as controller. Although ostensibly brought in to relieve some of the office manager’s stress, management made it clear to the new controller that they had some concerns about the quality of information they were receiving. Accordingly, the controller made it a priority to review the records of prior years, looking for ways to improve the accounting system. From this review, the following errors were uncovered. The office manager expensed rent on equipment and facilities when paid. Amounts paid in 20X1, 20X2, and 20X3 that represented rent for the subsequent year were $5,000, $4,500, and $4,900, respectively. No adjusting entries were ever made to reflect accrued salaries. The amounts that should have been presented as accrued wages at December 31, 20X1, 20X2, and 20X3, respectively, were $12,000, $13,500, and $8,300. E

KEW Enterprises began operations in January 20X1 to manufacture a hand sanitizer that promised to be more effective and gentler on the skin than existing products. Family members, one of whom was delegated to be the office manager and bookkeeper, staffed the company. Although conscientious, the office manager lacked formal accounting training, which became apparent when the growing company was forced in March 20X4 to hire a CPA as controller. Although ostensibly brought in to relieve some of the office manager’s stress, management made it clear to the new controller that they had some concerns about the quality of information they were receiving. Accordingly, the controller made it a priority to review the records of prior years, looking for ways to improve the accounting system. From this review, the following errors were uncovered.

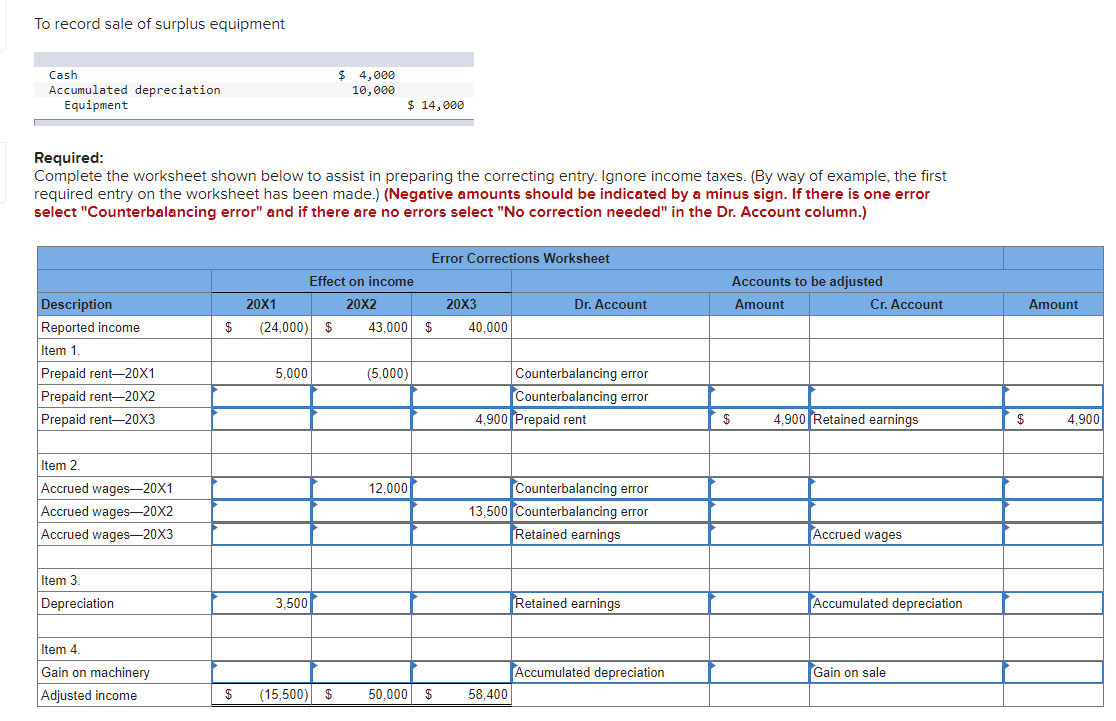

- The office manager expensed rent on equipment and facilities when paid. Amounts paid in 20X1, 20X2, and 20X3 that represented rent for the subsequent year were $5,000, $4,500, and $4,900, respectively.

- No

adjusting entries were ever made to reflect accrued salaries. The amounts that should have been presented as accrued wages at December 31, 20X1, 20X2, and 20X3, respectively, were $12,000, $13,500, and $8,300. - Errors occurred in the

depreciation calculations that resulted in depreciation expense being overstated by $3,500 in 20X1, understated by $7,000 in 20X2, and understated by $6,000 in 20X3. - In February 20X3 some surplus production equipment that originally had cost $14,000 was sold for $4,000; $12,000 in depreciation had correctly been taken on this equipment. The office manager made this entry to record the sale:

Step by step

Solved in 2 steps with 2 images