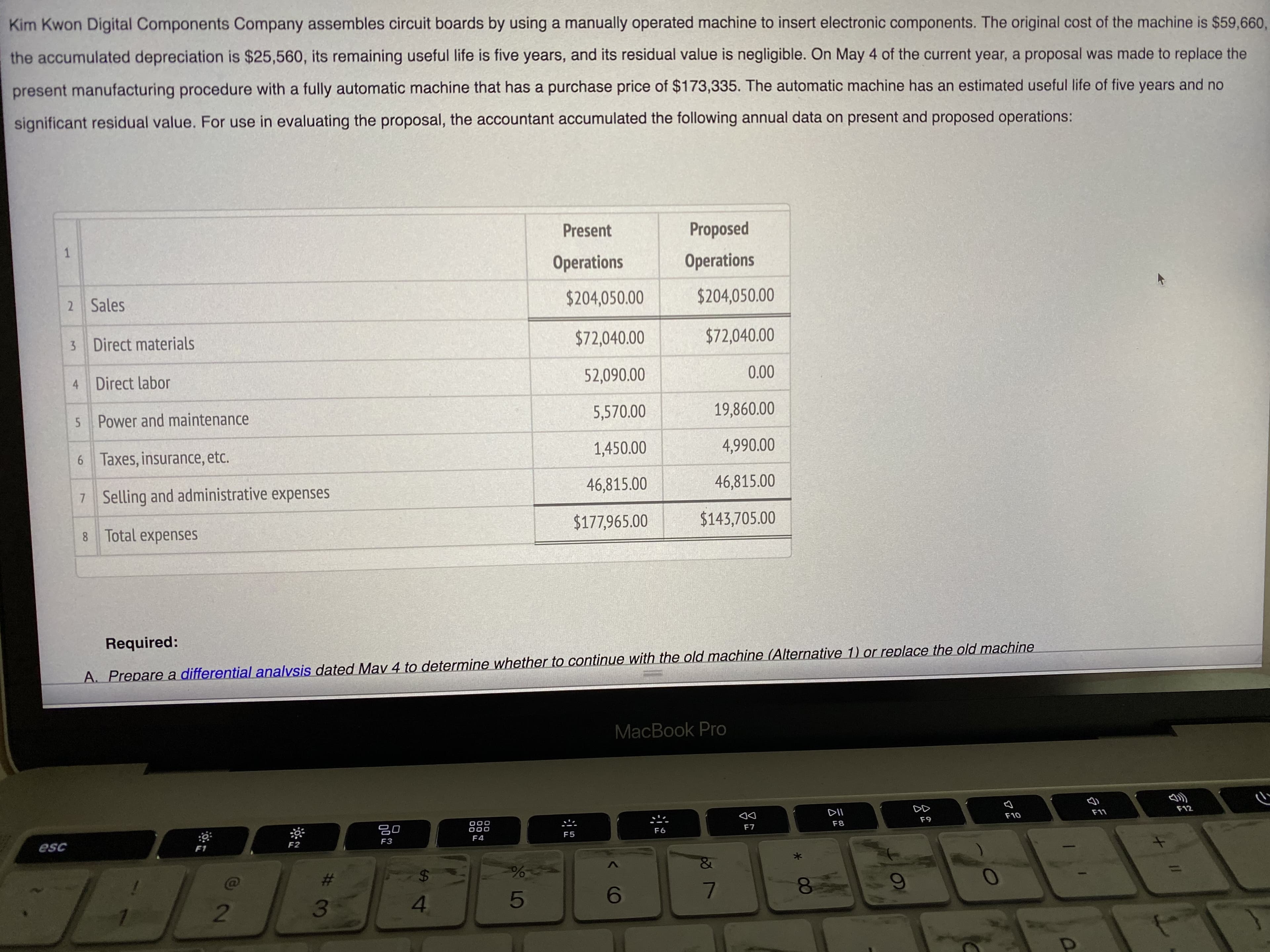

Kim Kwon Digital Components Company assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $59,660 the accumulated depreciation is $25,560, its remaining useful life is five years, and its residual value is negligible. On May 4 of the current year, a proposal was made to replace the present manufacturing procedure with a fully automatic machine that has a purchase price of $173,335. The automatic machine has an estimated useful life of five years and no significant residual value. For use in evaluating the proposal, the accountant accumulated the following annual data on present and proposed operations:

Kim Kwon Digital Components Company assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $59,660 the accumulated depreciation is $25,560, its remaining useful life is five years, and its residual value is negligible. On May 4 of the current year, a proposal was made to replace the present manufacturing procedure with a fully automatic machine that has a purchase price of $173,335. The automatic machine has an estimated useful life of five years and no significant residual value. For use in evaluating the proposal, the accountant accumulated the following annual data on present and proposed operations:

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 10E: Differential analysis for machine replacement Boyer Digital Components Company assembles circuit...

Related questions

Question

Transcribed Image Text:Kim Kwon Digital Components Company assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $59,660

the accumulated depreciation is $25,560, its remaining useful life is five years, and its residual value is negligible. On May 4 of the current year, a proposal was made to replace the

present manufacturing procedure with a fully automatic machine that has a purchase price of $173,335. The automatic machine has an estimated useful life of five years and no

significant residual value. For use in evaluating the proposal, the accountant accumulated the following annual data on present and proposed operations:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning