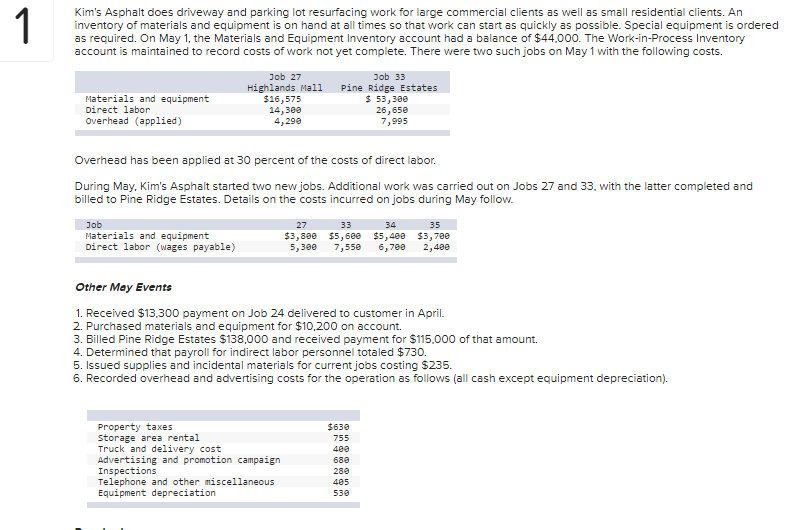

Kim's Asphalt does driveway and parking lot resurfacing work for large commercial clients as well as small residential cliets. An inventory of materials and equipment is on hand at all times so that work can start as quickly as possible. Special equipment is ordere as required. On May 1, the Materials and Equipment Inventory account had a balance of $44.000. The Work-in-Process Inventory account is maintained to record costs of work not yet complete. There were two such jobs on May 1 with the following costs. Haterials and equipment Direct labor overhead (applied) Job 27 Highlands Mall $16,575 14,300 4,290 Job 33 Pine Ridge Estates $ 53,300 26,650 7,995 Overhead has been applied at 30 percent of the costs of direct labor. During May, Kim's Asphalt started two new jobs. Additional work was carried out on Jobs 27 and 33. with the latter completed and billed to Pine Ridge Estates. Details on the costs incurred on jobs during May follow.

Kim's Asphalt does driveway and parking lot resurfacing work for large commercial clients as well as small residential cliets. An inventory of materials and equipment is on hand at all times so that work can start as quickly as possible. Special equipment is ordere as required. On May 1, the Materials and Equipment Inventory account had a balance of $44.000. The Work-in-Process Inventory account is maintained to record costs of work not yet complete. There were two such jobs on May 1 with the following costs. Haterials and equipment Direct labor overhead (applied) Job 27 Highlands Mall $16,575 14,300 4,290 Job 33 Pine Ridge Estates $ 53,300 26,650 7,995 Overhead has been applied at 30 percent of the costs of direct labor. During May, Kim's Asphalt started two new jobs. Additional work was carried out on Jobs 27 and 33. with the latter completed and billed to Pine Ridge Estates. Details on the costs incurred on jobs during May follow.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter5: Product And Service Costing: Job-order System

Section: Chapter Questions

Problem 22E: CleanCom Company specializes in cleaning commercial buildings and construction sites. Each building...

Related questions

Question

Hello

Please provide the

Transcribed Image Text:1

Kim's Asphalt does driveway and parking lot resurfacing work for large commercial clients as well as small residential clients. An

inventory of materials and equipment is on hand at all times so that work can start as quickly as possible. Special equipment is ordered

as required. On May 1, the Materials and Equipment Inventory account had a balance of $44.000. The Work-in-Process Inventory

account is maintained to record costs of work not yet complete. There were two such jobs on May 1 with the following costs.

Job 27

Job 33

Highlands Mal1

$16,575

14,300

4,290

Pine Ridge Estates

$ 53,300

26,658

7,995

Materials and equipment

Direct labor

Overhead (applied)

Overhead has been applied at 30 percent of the costs of direct labor.

During May, Kim's Asphalt started two new jobs. Additional work was carried out on Jobs 27 and 33. with the latter completed and

billed to Pine Ridge Estates. Details on the costs incurred on jobs during May follow.

Job

Materials and equipment

Direct labor (wages payable)

27

33

34

35

$3,800 $5,68e

5,300

7,550

$5,400 $3,700

6,700

2,488

Other May Events

1. Received $13.300 payment on Job 24 delivered to customer in April.

2. Purchased materials and equipment for $10,200 on account.

3. Billed Pine Ridge Estates $138,000 and received payment for $115.000 of that amount.

4. Determined that payroll for indirect labor personnel totaled $730.

5. Issued supplies and incidental materials for current jobs costing $235.

6. Recorded overhead and advertising costs for the operation as follows (all cash except equipment depreciation).

Property taxes

storage area re

Truck and delivery cost

Advertising and promotion campaign

Inspections

Telephone and other miscellaneous

Equipment depreciation

$630

755

400

680

280

405

530

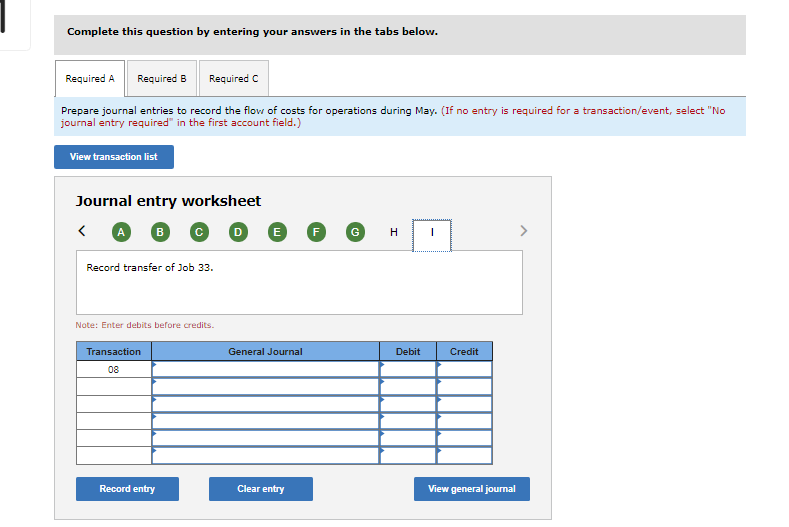

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Prepare journal entries to record the flow of costs for operations during May. (If no entry is required for a transaction/event, select "No

journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

E

F

Record transfer of Job 33.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

08

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,