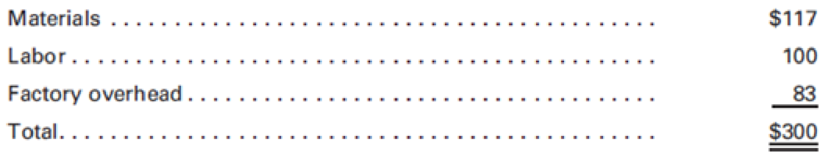

Lloyd Industries manufactures electrical equipment from specifications received from customers. Job X10 was for 1,000 motors to be used in a specially designed electrical complex. The following costs were determined for each motor:

At final inspection, Lloyd discovered that 33 motors did not meet the exacting specifications established by the customer. An examination indicated that 18 motors were beyond repair and should be sold as spoiled goods for $75 each. The remaining 15 motors, though defective, could be reconditioned as first-quality units by the addition of $1,650 for materials, $1,500 for labor, and $1,200 for factory overhead.

Required:

Prepare the

- 1. The scrapping of the 18 motors, with the income from spoiled goods treated as a reduction in the

manufacturing cost of the specific job. - 2. The correction of the 15 defective motors, with the additional cost charged to the specific job.

- 3. The additional cost of replacing the 18 spoiled motors with new motors.

- 4. The sale of the spoiled motors for $75 each.

- 5. If the reconditioned motors sell for $400 each, is Lloyd better off reconditioning the defective motors or selling them as is for $75 as spoiled goods?

Trending nowThis is a popular solution!

Chapter 2 Solutions

Principles of Cost Accounting

- One of the tennis rackets that Ace Sporting Goods manufactures is a titanium model (Slam) that sells for 149. The cost of each Slam consists of: Job 100 produced 100 Slams, of which six were spoiled and classified as seconds. Seconds are sold to discount stores for 50 each. Required: 1. Under the assumption that the loss from spoilage will be distributed to all jobs produced during the current period, use general journal entries to (a) record the costs of production, (b) put spoiled goods into inventory, and (c) record the cash sale of spoiled units. 2. Under the assumption that the loss due to spoilage will be charged to Job 100, use general journal entries to (a) record the costs of production, (b) put spoiled goods into inventory, and (c) record the cash sale of spoiled units.arrow_forwardWalloon Company produced 150 defective units last month at a unit manufacturing cost of 30. The defective units were discovered before leaving the plant. Walloon can sell them as is for 20 or can rework them at a cost of 15 and sell them at the regular price of 50. What is the total relevant cost of reworking the defective units? a. 2,250 b. 3,000 c. 4,500 d. 6,750arrow_forwardZZOOM, Inc., has decided to discontinue manufacturing its Z Best model. Currently, the company has 4,600 partially completed Z Best models on hand. The government has put a recall on a particular part in the Z Best model, so each base model must now be reworked to accommodate the style of the new part. The company has spent $110 per unit to manufacture these Z Best models to their current state. Reworking each Z Best model will cost $22 for materials and $25 for direct labor. In addition, $9 of variable overhead and $34 of allocated fixed overhead (relating primarily to depreciation of plant and equipment) will be allocated per unit. If ZZOOM completes the Z Best models, it can sell them for $180 per unit. On the other hand, another manufacturer is interested in purchasing the partially completed units for $105 each and converting them into Z Plus models. Prepare a differential analysis per unit to determine if ZZOOM should complete the Z Best models or sell them in their current state.arrow_forward

- Verde Company reported operating costs of 50,000,000 as of December 31, 20x5, with the following environmental costs: Required: 1. Prepare an environmental cost report, classifying costs by quality category and expressing each as a percentage of total operating costs. What is the message of this report? 2. Prepare a pie chart that shows the relative distribution of environmental costs by category. What does this report tell you? 3. What if Verde deliberately did not include the cost of damaging the ecosystem because of solid waste disposal in its environmental cost report? Offer possible reasons for this decision. If consciously avoided, is this decision unethical?arrow_forwardTrifecta Distributors has decided to discontinue manufacturing its X Plus model. Currently, the company has 4,600 partially completed X Plus models on hand. The government has put a recall on a particular part in the X Plus model, so each base model must now be reworked to accommodate the style of the new part. The company has spent $110 per unit to manufacture these X Plus models to their current state. Reworking each X Plus model will cost $20 for materials and $20 for direct labor. In addition, $7 of variable overhead and $32 of allocated fixed overhead (relating primarily to depreciation of plant and equipment) will be allocated per unit. Il Trifecta completes the X Plus models, it can sell them for $160 per unit. On the other hand, another manufacturer is interested in purchasing the partially completed units for $104 each and converting them into Z Plus models. Prepare a differential analysis per unit to determine if Trifecta should complete the X Plus models or sell them in their current state.arrow_forwardA machine shop manufactures a stainless steel part that is used in an assembled product. Materials charged to a particular jobamounted to 600. At the point of final inspection, it was discoveredthat the material used was inferior to the specifications required bythe engineering department; therefore, all units had to be scrapped. Record the entries required for scrap under each of the following conditions: a. The revenue received for scrap is to be treated as a reductionin manufacturing cost but cannot be identified with a specificjob. The value of stainless steel scrap is stable and estimatedto be 125 for this job. The scrap is sold two months later forcash at the estimated value of 125. b. Revenue received for scrap is to be treated as a reduction inmanufacturing cost but cannot be identified with a specificjob. A firm price is not determinable for the scrap until it issold. It is sold eventually for 75 cash. c. The production job is a special job, and the 85 received onaccount for the scrap is to be treated as a reduction inmanufacturing cost. (A firm price is not determinable for thescrap until it is sold.) d. Only 40 cash was received for the scrap when it was sold inthe following fiscal period. (A firm price is not determinablefor the scrap until it is sold, and the amount to be received forthe scrap is to be treated as other income.)arrow_forward

- Pasha Company produced 50 defective units last month at a unit manufacturing cost of 30. The defective units were discovered before leaving the plant. Pasha can sell them as is for 20 or can rework them at a cost of 15 and sell them at the regular price of 50. Which of the following is not relevant to the sell-or-rework decision? a. 30 b. 20 c. 15 d. 50arrow_forwardUsing the Taguchi quality loss function, an average loss of 20 per unit is calculated. During the year, 25,000 units were produced. Which of the following statements represents the correct application of the Taguchi loss function? a. The hidden costs of internal failure are 500,000. b. The hidden costs of external failure are 500,000. c. The costs of detection activities are 20 per unit inspected. d. The total external costs are 500,000.arrow_forwardOtero Fibers, Inc., specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. Otero has been in business since 1985 and has been profitable every year since 1993. The company uses a standard cost system and applies overhead on the basis of direct labor hours. Otero has recently received a request to bid on the manufacture of 800,000 blankets scheduled for delivery to several military bases. The bid must be stated at full cost per unit plus a return on full cost of no more than 10 percent after income taxes. Full cost has been defined as including all variable costs of manufacturing the product, a reasonable amount of fixed overhead, and reasonable incremental administrative costs associated with the manufacture and sale of the product. The contractor has indicated that bids in excess of 30 per blanket are not likely to be considered. In order to prepare the bid for the 800,000 blankets, Andrea Lightner, cost accountant, has gathered the following information about the costs associated with the production of the blankets. Direct machine costs consist of items such as special lubricants, replacement of needles used in stitching, and maintenance costs. These costs are not included in the normal overhead rates. Otero recently developed a new blanket fiber at a cost of 750,000. In an effort to recover this cost, Otero has instituted a policy of adding a 0.50 fee to the cost of each blanket using the new fiber. To date, the company has recovered 125,000. Lightner knows that this fee does not fit within the definition of full cost, as it is not a cost of manufacturing the product. Required: 1. Calculate the minimum price per blanket that Otero Fibers could bid without reducing the companys operating income. 2. Using the full-cost criteria and the maximum allowable return specified, calculate Otero Fibers bid price per blanket. 3. Without prejudice to your answer to Requirement 2, assume that the price per blanket that Otero Fibers calculated using the cost-plus criteria specified is greater than the maximum bid of 30 per blanket allowed. Discuss the factors that Otero Fibers should consider before deciding whether or not to submit a bid at the maximum acceptable price of 30 per blanket. (CMA adapted)arrow_forward

- ABC Company manufactures chairs too the exacting specifications of various customers. During January 2020, Job 123 for the production of 1,100 chairs was completed at the following costs per unit: Direct materials 10 Direct labor 8 Applied factory overhead 12 Total 30 Final inspection of Job 123 disclosed 50 defective units and 100 spoiled units. The defective chairs were reworked at a total cost of P500, and the spoiled chairs were sold to a jobber for P1,500. What would be the unit cost of the good units produced on Job 123?arrow_forwardSitChairwn Company manufactures chairs to the exacting specifications of various customers. During January 2020, Job 023 for the production of 1,100 was completed at the following costs per unit: Direct Materials 10 Direct Labor 8 Applied Factory Overhead 12 Final Inspection of the order dislosed 50 defective units and 100 spoiled units. The defective chairs were reworked at a total cost of $50 and the spoiled chairs were sold toa jobber for $150. What would be the unit cost of the good units produced?arrow_forwardABC Company manufactures chairs to the exacting specifications of various customers. During January 2020, Job 123 for the production of 1,100 chairs was completed at the following costs per unit: Direct materials P10 Direct labor 8 Applied factory overhead Total 12 P30 Final inspection of Job 123 disclosed 50 defective units and 100 spoiled units. The defective chairs were reworked at a total cost of P500, and the spoiled chairs were sold to a jobber for P1,500. What would be the unit cost of the good units produced on Job 123? a. 32 b. 29.09arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College