kindly ans

Q: Could you please only answer the part D question Thankyou

A: Year Revenue Expenses Outlay Cash Flow = Revenues - Expenses - Outlays 0 960000 -960000 1…

Q: Please help thanks

A: Equivalent units: This is one of the processes costing methods, under this method the uncompleted…

Q: question is attached, thanks.

A: a. The records of number of calls made to customers is kept by the sales representative. b. Time…

Q: Please assist with this problem thank you

A: Partnership can be defined as a form of business organization under which two or more parties come…

Q: In need of an answer for letter C. Thank you!

A: Cost accounting:- Cost accounting helps to determine the overall cost of the firm includes both the…

Q: se answer this

A: Step 1 An income statement is a financial statement that depicts the entity's income and…

Q: Sir please help me urgently

A: Calculation of net profit Particulars Amount Sale price 85 Variable cost (58) Contribution…

Q: Please help

A: There are three types of margins viz, 'Gross" , Operating " and "Net". For…

Q: ly. Thank you :)

A: In this question, we have to calculate the interest income of the third year of the contract.

Q: please help me

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Need help from Letter A to C please

A: Return on total assets is a ratio that indicates the income earned relative to total assets.…

Q: Sir please help urgently

A: Loan Instalment 773000 773000 Interest Rate 14% 3% Life 41 years 41 years Date of loan…

Q: litary Sç

A: Which of the following documents are issuede by VA for disability payments…

Q: Assistance please

A: The investments decisions taken by the firm are known as capital budgeting decisions. There are…

Q: Answer please

A: Total payroll =250000 income tax =10%=25000 Remaining =250000-25000=225000 Remaining =225000 Union…

Q: ase hel

A: Long service leaves provision expense refers to the Act established in 1955, which provides the…

Q: hello, help please

A: the formula for contribution margin ratio selling price per unit - variable expense per unit/…

Q: lows: Constru

A: Working notes :-…

Q: need answers thank you.

A: The question is based on the concept of Financial Accounting.

Q: answe

A: We know that cash and cash equivalent are the most liquid assets. Cash equivalent are the short term…

Q: please answer this thank you

A: In this question, we have to find out the taxable income of Kagura under different circumstances.

Q: In need of an answer for letter D. Thank you!

A: The Numerical has covered the concept of Absorption Costing Income Statement. The Absorption Costing…

Q: Vhat is the discou IS

A: The principal amount of a loan or the first deposit in a savings account is used to calculate simple…

Q: ust answer please without explanation please

A: NPV stands for Net Present Value which states the changes in the net worth of the company that would…

Q: Problems

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Hello question is attached, thanks.

A: Income statement: It can be defined as one of the company’s financial statements that shows all the…

Q: Please help me

A: Mixed costs: These have high initial costs as a whole due to the presence of some fixed element in…

Q: A document that (given the required elements) provides direction and allows another to make…

A: The correct option is B The living will is advance directive will which allows other persons…

Q: er question B.

A: The given problem can be computed using VAR and STDEV formula in excel.

Q: hello, I need help please

A: Ratio analysis: Ratio analysis is used in understanding the performance of the business. Return on…

Q: I need all parts of the questions answered. Thanks.

A: Price or Value(VB) of a Bond is computed by discounting all cash benefits that will arise from bond…

Q: please help me answer this I promise to like your answer please

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Can someone anwser and help me through these please? Thank you!

A: Federal Income taxes While calculating the federal income tax there are certain criteria and tax…

Q: ase answer all pro

A: Given information : Time period 23 Par value $1,000 Coupon interest rate 9% Yield to…

Q: Help me answer the letter d and c with solution thank you

A: Degree of operating leverage = Contribution/EBIT Degree of Financial leverage = EBIT/EBT

Q: %

A: Rate of interest refers to the amount earned over the investments made by the investors expressed…

Q: desse

A: Cash , Inventory and Aeccounts Receivables are current assets of…

Q: please answer letter b and explain thoroughly

A: Cost of goods sold is actual cost of goods that are being sold by the business to the customers. It…

Q: Answer only please

A: Operating Activity Activity refers to day to day operations of a business. Cash inflow and outflow…

Q: How to do this. Please explain. Thank you.

A: Price variance = ( Actual unit cost - Standard unit cost ) x Actual quantity purchased

Q: please help

A: Consolidated statements: Consolidated financial statements consist of Balance sheet, Income…

Q: I NEED HELP ! PLEASEEE

A: a. Calculate the total revenue: Room Purchased ADR Total revenue 250 Rooms $139.99 $34,997.50…

Q: Help me answer the letter d and e *with solution thank you

A: Degree of Financial leverage = EBIT/EBT Degree of combined Leverage = Operating Leverage x Financial…

Q: Please help with this question

A: Issue of bonds is a Financial Liability. This is because the Company has to pay a fixed amount of…

Q: if you do

A:

Q: please make your answers clea

A: Income Statement

Q: Please answer

A: Answer a) Computation of effective annual interest rate is as follows: Effective annual interest…

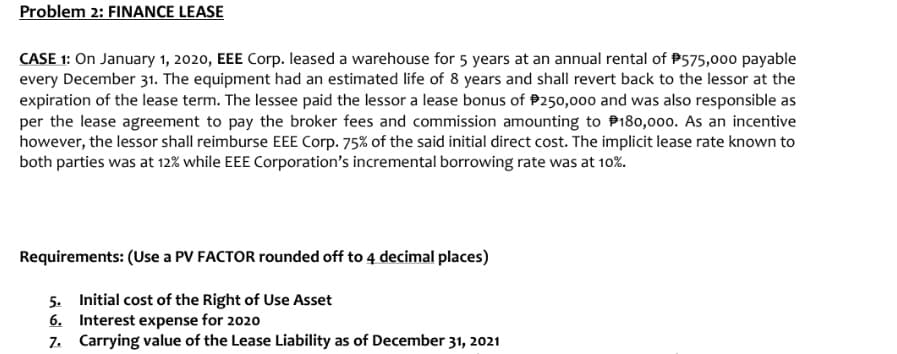

Please kindly answer. Thankyou

Step by step

Solved in 3 steps

- Leased Assets Koffman and Sons signed a four-year lease for a forklift on January 1, 2016. Annual lease payments of $1,510, based on an interest rate of 8%, are to be made every December 31, beginning with December 31, 2016. Required Assume that the lease is treated as an operating lease. Will the value of the forklift appear on Koffmans balance sheet? What account will indicate that lease payments have been made? Assume that the lease is treated as a capital lease. Prepare any journal entries needed when the lease is signed. Explain why the value of the leased asset is not recorded at $6,040 (1,5104). Prepare the journal entry to record the first lease payment on December 31, 2016. Calculate the amount of depreciation expense for the year 2016. At what amount would the lease obligation be presented on the balance sheet as of December 31, 2016?Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.

- Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.

- Unearned Rent Revenue Mannion Property Management leases commercial properties and expects its clients to pay rent on a monthly basis. A new client signs a 4-year lease with a yearly rent of $420,000 and agrees to pay the first 6 months in advance. Required: Make the journal entry to record the following transactions. 1. The customers prepayment of 6 months' rent 2. The necessary adjusting entry after 1 month has passedUse the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).Financial Statement Violations of U.S. GAAP The following are the financial statements issued by Allen Corporation for its fiscal year ended October 31, 2019: Notes to Financial Statements: 1. Long-Term Lease. Under the terms of a 5-year, noncancelable lease for a building, Allen is obligated to make annual rental payments of 40,000 in each of the next 4 fiscal years. 2. Pension Plan. Substai1tially all employees are covered by Allens defined benefit pension plan. Pension expense is equal to the total of pension benefits accrued and paid to retired employees during the year. Because it is a defined benefit plan that is paid every year, no pension liability exists. 3. Patent. The patent had an estimated remaining life of 10 years at the time of purchase. Allens patent was purchased from Apex Corporation on January 1, 2019, for 250,000. 4. Deferred Income Tax Payable. The entire balai1ce in the Deferred Income Tax Payable account arose from tax-exempt municipal bonds that were held during the previous fiscal year, giving rise to a difference between taxable income and reported net earnings for the fiscal year ended October 31, 2019. The deferred liability amount was calculated on the basis of past tax rates. 5. Warrants. On January 1, 2018, one common stock warrant was issued to shareholders of record for each common share owned. An additional share of common stock is to be issued upon exercise of 10 stock warrants and receipt of an amount equal to par value. For the 6 months ended October 31, 2019, the average market value for Allens common stock was 5 per share and no warrants had yet been exercised. 6. Contingent Liability. On October 31, 2019, Allen was contingently liable for product warranties in an amount estimated to aggregate 75,000. Required: Next Level Review the preceding financial state1nents and related notes. Identify any inclusions or exclusions from them that would be in violation of GAAP, and indicate corrective action to be taken. Do not comment as to format or style. Respond in the following order: 1. Balance sheet 2. Notes 3. Income statement 4. Statement of retained earnings 5. General