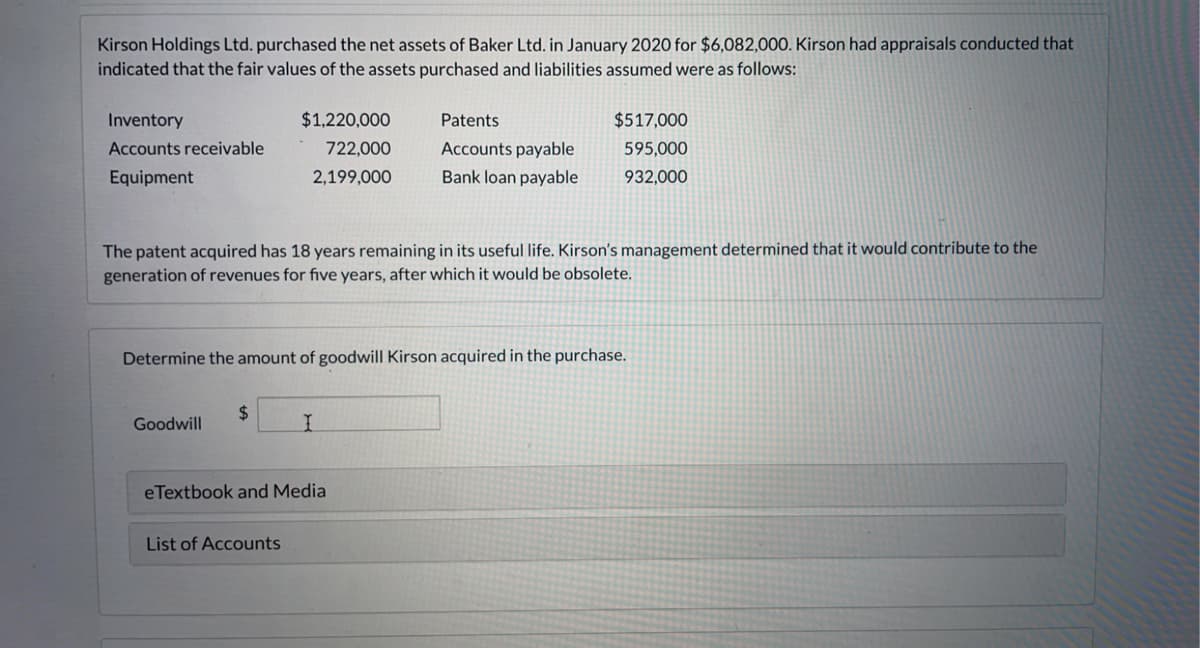

Kirson Holdings Ltd. purchased the net assets of Baker Ltd. in January 2020 for $6,082,000. Kirson had appraisals conducted that indicated that the fair values of the assets purchased and liabilities assumed were as follows: Inventory $1,220,000 Patents $517,000 Accounts receivable 722,000 Accounts payable 595,000 Equipment 2,199,000 Bank loan payable 932,000 The patent acquired has 18 years remaining in its useful life. Kirson's management determined that it would contribute to the generation of revenues for five years, after which it would be obsolete. Determine the amount of goodwill Kirson acquired in the purchase.

Kirson Holdings Ltd. purchased the net assets of Baker Ltd. in January 2020 for $6,082,000. Kirson had appraisals conducted that indicated that the fair values of the assets purchased and liabilities assumed were as follows: Inventory $1,220,000 Patents $517,000 Accounts receivable 722,000 Accounts payable 595,000 Equipment 2,199,000 Bank loan payable 932,000 The patent acquired has 18 years remaining in its useful life. Kirson's management determined that it would contribute to the generation of revenues for five years, after which it would be obsolete. Determine the amount of goodwill Kirson acquired in the purchase.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: During 20X1, Craig Company had the following transactions: a. Purchased 300,000 of 10-year bonds...

Related questions

Question

100%

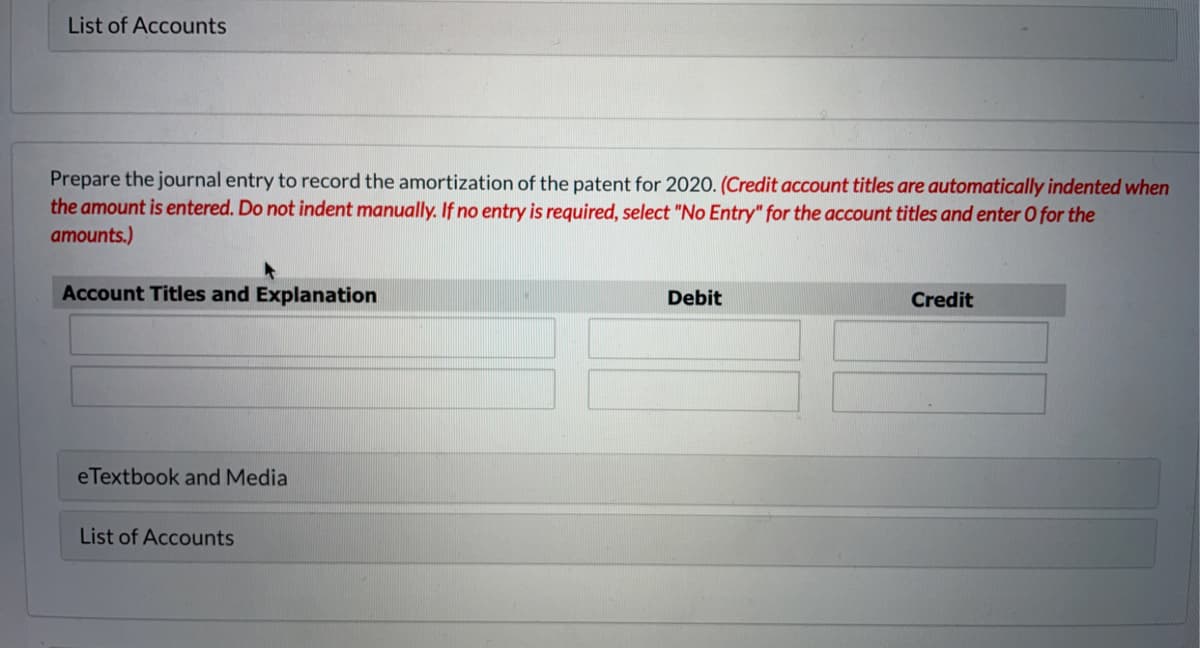

Transcribed Image Text:List of Accounts

Prepare the journal entry to record the amortization of the patent for 2020. (Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts.)

Account Titles and Explanation

Debit

Credit

eTextbook and Media

List of Accounts

Transcribed Image Text:Kirson Holdings Ltd. purchased the net assets of Baker Ltd. in January 2020 for $6,082,000. Kirson had appraisals conducted that

indicated that the fair values of the assets purchased and liabilities assumed were as follows:

Inventory

$1,220,000

Patents

$517,000

Accounts receivable

722,000

Accounts payable

595,000

Equipment

2,199,000

Bank loan payable

932,000

The patent acquired has 18 years remaining in its useful life. Kirson's management determined that it would contribute to the

generation of revenues for five years, after which it would be obsolete.

Determine the amount of goodwill Kirson acquired in the purchase.

$4

Goodwill

eTextbook and Media

List of Accounts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning