Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend $5.3 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $8.6 million this year and $6.6 million next year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other products are expected to rise by $1.7 million each year. Kokomochi's gross profit margin for the Mini Mochi Munch is 31%, and its gross profit margin averages 24% for all other products. The company's marginal corporate tax rate is 21% both this year and next year. What are the incremental earnings associated with the advertising campaign? (Please write out all of the zeros. No integers or  abbreviations. Round to the nearest dollar.)

Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend $5.3 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $8.6 million this year and $6.6 million next year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other products are expected to rise by $1.7 million each year. Kokomochi's gross profit margin for the Mini Mochi Munch is 31%, and its gross profit margin averages 24% for all other products. The company's marginal corporate tax rate is 21% both this year and next year. What are the incremental earnings associated with the advertising campaign? (Please write out all of the zeros. No integers or  abbreviations. Round to the nearest dollar.)

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1mM

Related questions

Question

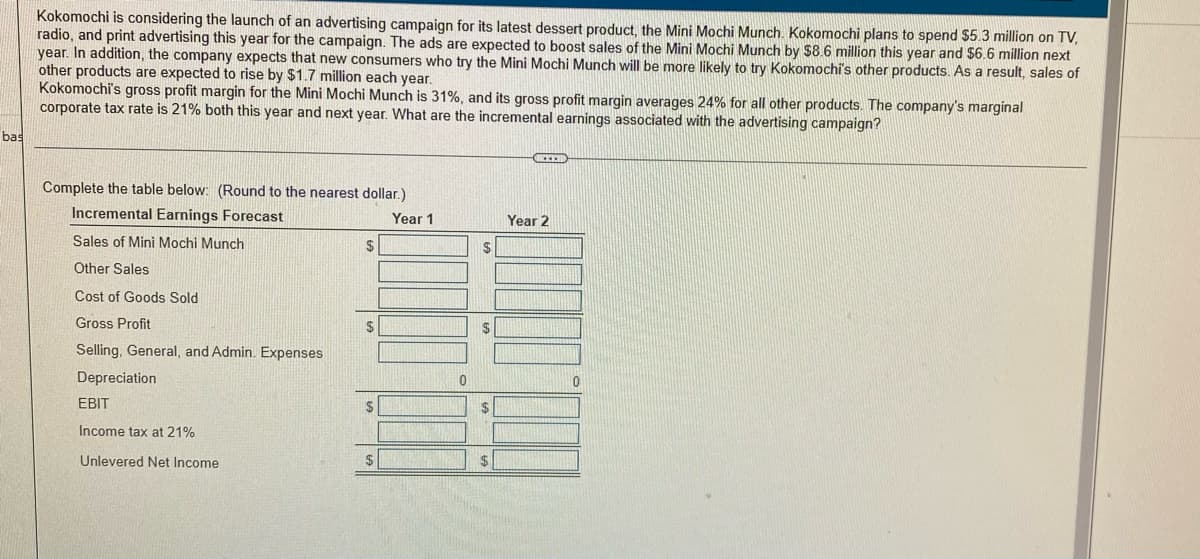

Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend $5.3 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $8.6 million this year and $6.6 million next year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other products are expected to rise by $1.7 million each year.

Kokomochi's gross profit margin for the Mini Mochi Munch is 31%, and its gross profit margin averages 24% for all other products. The company's marginal corporate tax rate is 21% both this year and next year. What are the incremental earnings associated with the advertising campaign?

(Please write out all of the zeros. No integers or  abbreviations. Round to the nearest dollar.)

Transcribed Image Text:Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend $5.3 million on TV,

radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $8.6 million this year and $6.6 million next

year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of

other products are expected to rise by $1.7 million each year.

Kokomochi's gross profit margin for the Mini Mochi Munch is 31%, and its gross profit margin averages 24% for all other products. The company's marginal

corporate tax rate is 21% both this year and next year. What are the incremental earnings associated with the advertising campaign?

bas

Complete the table below: (Round to the nearest dollar.)

Incremental Earnings Forecast

Year 1

Year 2

Sales of Mini Mochi Munch

24

2$

Other Sales

Cost of Goods Sold

Gross Profit

2$

2$

Selling, General, and Admin. Expenses

Depreciation

EBIT

24

Income tax at 21%

Unlevered Net

%24

$4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning