Krueger Corporation in Washington, D.C., U.S., recently implemented a standard cost system. The company's cost accountant has gathered the following information needed to perform a variance analysis at the end of the month:+ Standard Cost Informatione Direct materials Quantity allowed per unit Direct labor rate Hours allowed per unit Fixed overhead budgeted. Normal level of production. Variable overhead application rate Fixed overhead application rate ($12,000 _ 1,200 units). Total overhead application rate. $5 per pounde 100 pounds per unit $20.00 per hour 2 hours per unite $12,000 per month 1,200 unitse $ 2.00 unit per 10.00 per unit $12.00 per unite Actual Cost Information Cost of materials purchased and used. Pounds of materials purchased and used Cost of direct labor Hours of direct labor. Cost of variable overhead Cost of fixed overhead $468,000 104,000 pounds- $46,480 2,240 hours+ $2,352 $12,850 1,000 units Volume of production. InstructionsH 1. Compute the direct materials price variance, given an actual price of $4.50 per pound ($468,000 104,000 pounds). (10%)e 2. Compute the materials quantity variance, given a standard quantity of 100,000 pounds allowed to produce 1,000 units (1,000 units x 100 pounds per unit). (10%)

Krueger Corporation in Washington, D.C., U.S., recently implemented a standard cost system. The company's cost accountant has gathered the following information needed to perform a variance analysis at the end of the month:+ Standard Cost Informatione Direct materials Quantity allowed per unit Direct labor rate Hours allowed per unit Fixed overhead budgeted. Normal level of production. Variable overhead application rate Fixed overhead application rate ($12,000 _ 1,200 units). Total overhead application rate. $5 per pounde 100 pounds per unit $20.00 per hour 2 hours per unite $12,000 per month 1,200 unitse $ 2.00 unit per 10.00 per unit $12.00 per unite Actual Cost Information Cost of materials purchased and used. Pounds of materials purchased and used Cost of direct labor Hours of direct labor. Cost of variable overhead Cost of fixed overhead $468,000 104,000 pounds- $46,480 2,240 hours+ $2,352 $12,850 1,000 units Volume of production. InstructionsH 1. Compute the direct materials price variance, given an actual price of $4.50 per pound ($468,000 104,000 pounds). (10%)e 2. Compute the materials quantity variance, given a standard quantity of 100,000 pounds allowed to produce 1,000 units (1,000 units x 100 pounds per unit). (10%)

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 1PB: Direct materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

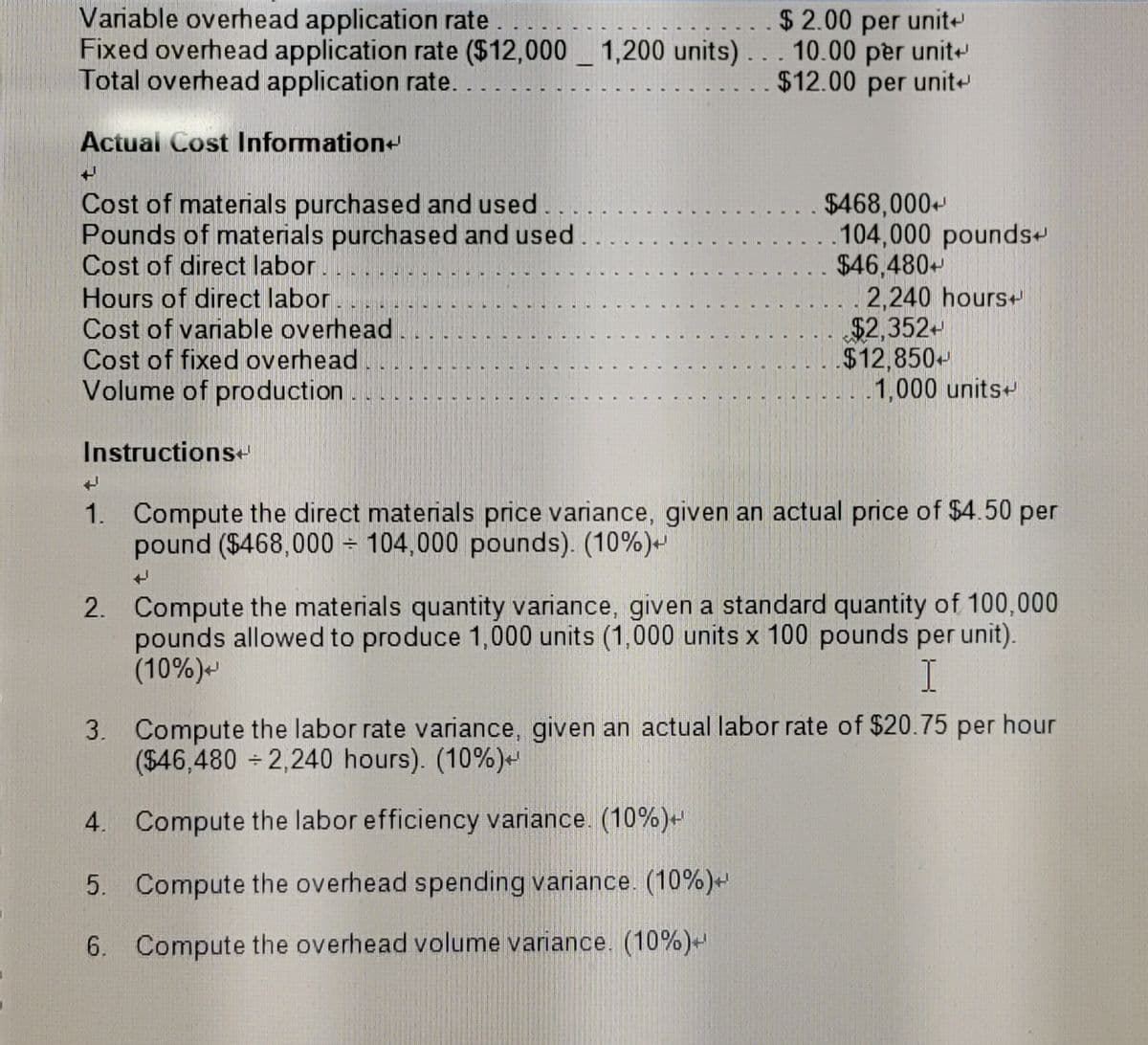

Transcribed Image Text:Variable overhead application rate

Fixed overhead application rate ($12,000 1,200 units). . . 10.00 per unit

Total overhead application rate.

$ 2.00 per unit

. $12.00 per unite

Actual Cost Information+

Cost of materials purchased and used.

Pounds of materials purchased and used

Cost of direct labor.

Hours of direct labor.

Cost of variable overhead

Cost of fixed overhead...

Volume of production .

$468,000

..104,000 pounds+

$46,480+

2,240 hours+

$2,352+

$12,850

-1,000 units

Instructions+

1. Compute the direct materials price variance, given an actual price of $4.50 per

pound ($468,000 - 104,000 pounds). (10%)

2. Compute the materials quantity variance, given a standard quantity of 100,000

pounds allowed to produce 1,000 units (1,000 units x 100 pounds per unit).

(10%)

I

3. Compute the labor rate variance, given an actual labor rate of $20.75 per hour

($46,480 2,240 hours). (10%)+

Compute the labor efficiency variance. (10%)+

5. Compute the overhead spending variance. (10%)

6. Compute the overhead volume variance. (10%)

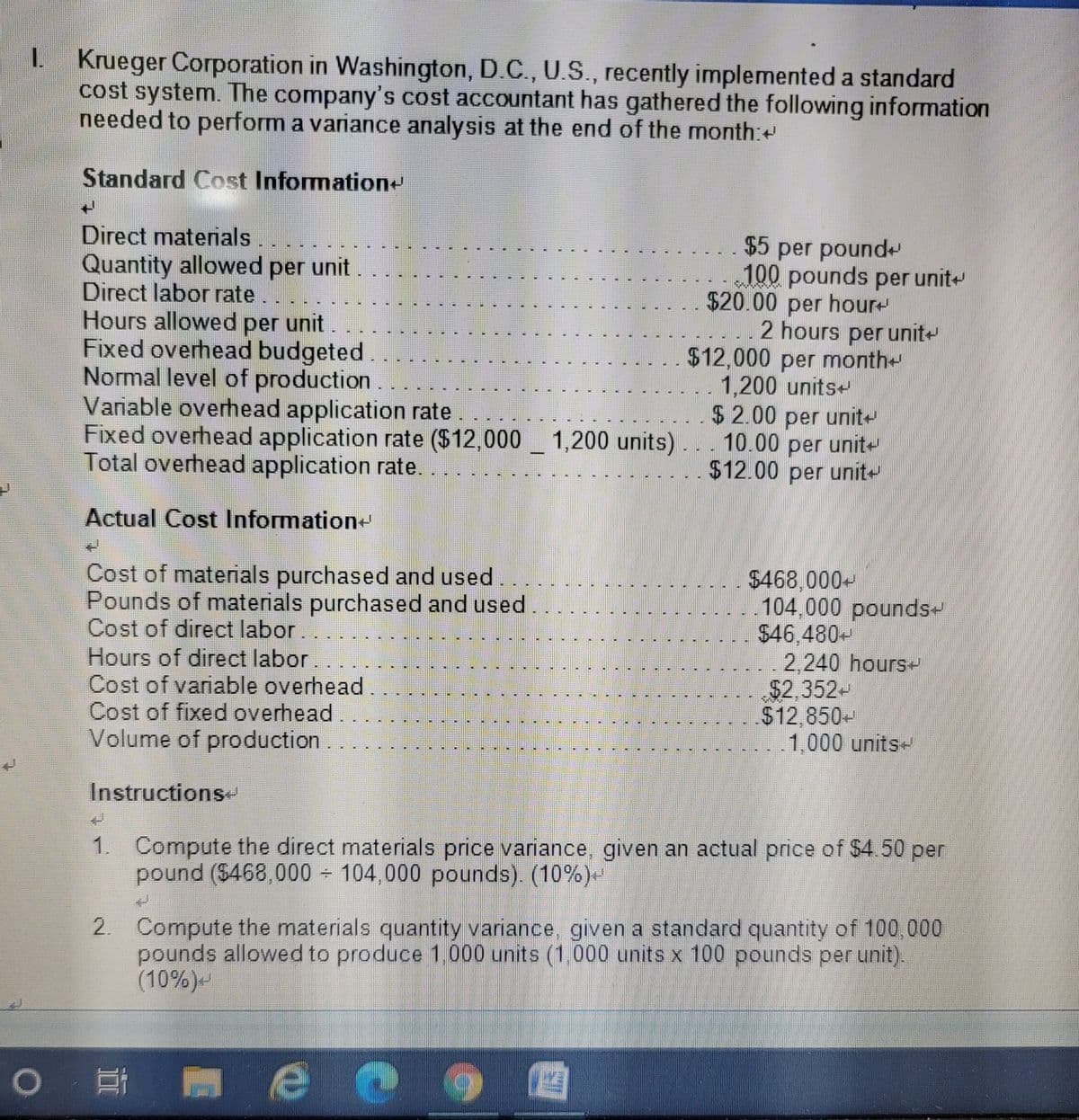

Transcribed Image Text:Krueger Corporation in Washington, D.C., U.S., recently implemented a standard

cost system. The company's cost accountant has gathered the following information

needed to perform a variance analysis at the end of the month:

Standard Cost Information+

Direct materials

Quantity allowed per unit

Direct labor rate..

Hours allowed per unit.

Fixed overhead budgeted

Normal level of production.

Variable overhead application rate

Fixed overhead application rate ($12,000 _ 1,200 units)... 10.00 per unit-

Total overhead application rate.

$5 per pound

100 pounds per unit

$20.00 per hour

..2 hours per unit-

$12,000 per month

1,200 units+

$2.00 per unit

$12.00 per unit

Actual Cost Information+

Cost of materials purchased and used.

Pounds of materials purchased and used

Cost of direct labor.

Hours of direct labor

Cost of variable overhead

Cost of fixed overhead.

Volume of production.

$468,000-

..104,000 pounds-

$46,480-

..2,240 hours-

$2,352-

$12,850-

1,000 units-

Instructions

Compute the direct materials price variance, given an actual price of $4.50 per

pound ($468,000 104,000 pounds). (10%)-

2. Compute the materials quantity variance, given a standard quantity of 100,000

pounds allowed to produce 1,000 units (1,000 units x 100 pounds per unit).

(10%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning