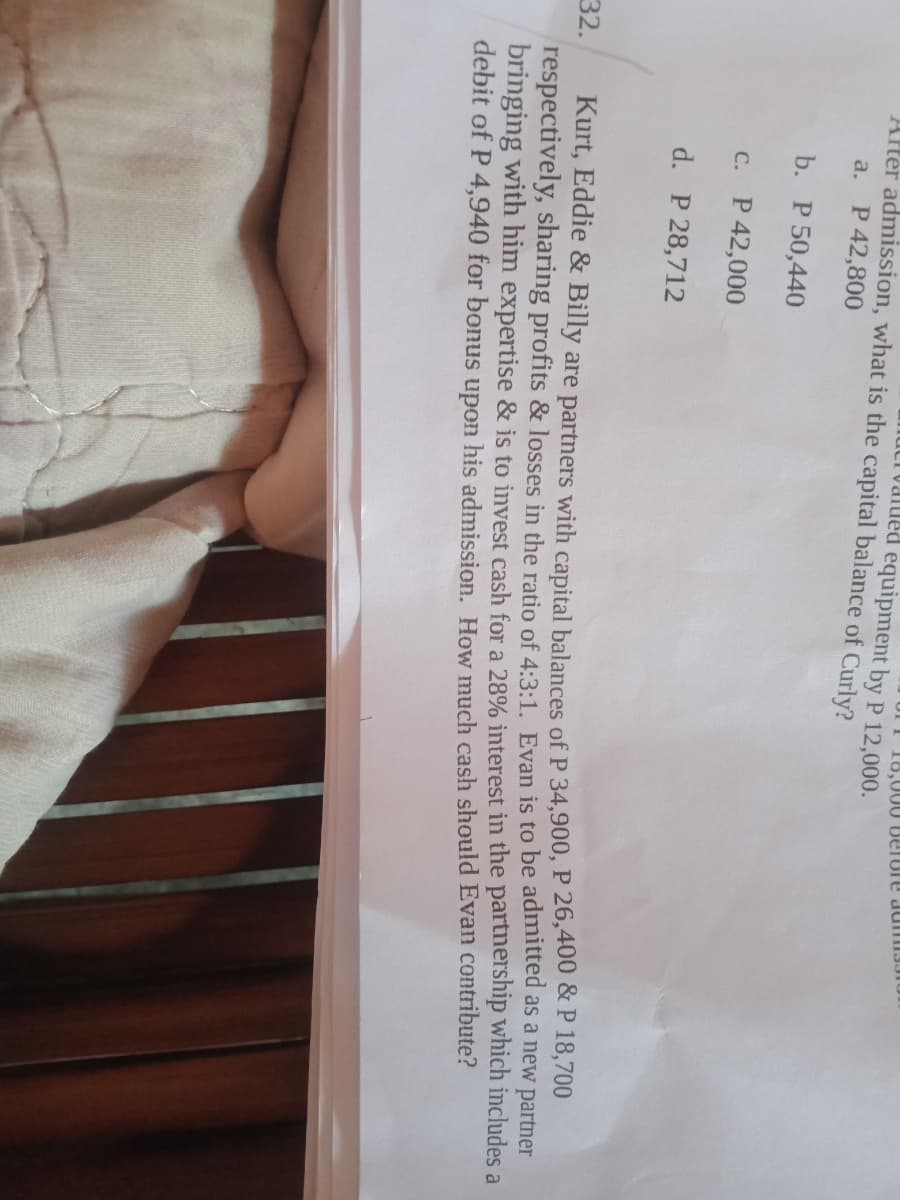

Kurt, Eddie & E respectively, sharing bringing with him e debit of P 4,940 for

Q: A firm buys merchandise at P20 per unit and sells them at P30 per unit Foxed costs are at P15,000.…

A: Answer:- 5 New break-even point is 1,154 units. Explanation:- Computation of break-even point:-…

Q: Required information Schedules of Expected Cash Collections and Disbursements; Income Statement;…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: Here is the condensed statement of financial performance of the three companies for the year ended…

A: A

Q: 5) Pertinent accounts gathered from the records of Heart Company for the year 2021 are given below:…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Halle’s Berry Farm establishes a $200 petty cash fund on September 4 to pay for minor cash…

A: Introduction Journal entries is the modern method of recording of a business transactions in a…

Q: Which one of the following statements is correct with respect to the creation of a partnership?

A: A partnership business is the business which has been started by the persons (persons are known as…

Q: n October 01, 2000, Mr Alberto opened a computer rental shop. The following transactions occurred…

A: The journal book is the first step to record the transactions of the business. Further T-accounts…

Q: Simphiwe, a student bought 50 memory sticks at R40 each for cash. All the memory sticks were marked…

A: The question is based on the concept of Cost Accounting. Gross profit is the difference between…

Q: Pit Coporation owns 75% of Stop Company's outstanding common stock. On 01/01/21, Pit sold sold a…

A: Date Company Particulars Debit Credit Jan-01 Pit Bank 2,36,000…

Q: The planned activity level for the assembly department of the Shields Company during the month of…

A: Variances represent the comparison of actual performance and the standard set by the company. If the…

Q: Using the following information: a. The bank statement balance is $2,622. b. The cash account…

A: Bank reconciliation statement is prepared by the management at a particular time period. It helps to…

Q: Here are comparative financial statement data for Bramble Company and Debra Company, two…

A: Answer 1) Bramble Company Return on Assets Return on Assets = Net Income/ Average Total Assets…

Q: The following data is given: December 31, 2021 2020 Cash $59,000 $49,500 Accounts receivable (net)…

A: I am answering the first 3 sub-parts of the question as per bartleby guidelines. Please re-submit…

Q: Misterio Company uses a standard costing system. During the past quarter, the following vari-ances…

A: Answer 1) Calculation of Standard Direct Labor hours allowed Variable Overhead Efficiency variance =…

Q: Which of the following is an effective internal control for cash payments? A.Payments should be…

A: Cash is one of the important current asset of the business. It's valuation and management is very…

Q: Required information [The following information applies to the questions displayed below.] Trey…

A: Specific Identification method of inventory valuation: in this method Every units of inventory is…

Q: When two (2) partners make no agreement as to how to share profits but agree to share losses 60-40,…

A: A partnership is an agreement between two or more persons who agree to work together for a common…

Q: basis is $1,000,000. The building is subject to a mortgage of $500,000. The mmercial office…

A: Partnership refers to the form of business under which two or more persons agreed to run a lawful…

Q: The charter of a corporation provides for the issuance of 118,000 shares of common stock. Assume…

A: Formula: Amount of cash dividends to be paid = No. of shares issued and outstanding x Dividend per…

Q: On December 31, 2019, Oriole Company leased machinery from Terminator Corporation for an agreed upon…

A: The lease liability is a total of the present value discounted at incremental borrowing rate, in…

Q: O Cambridge Businea ha O Cambridge Busilnes Module 11 I Finanoial Statement Forecasting LO2 MII-12.…

A: Income statement shows the net income / loss incurred by the company in a particular financial year.…

Q: 1-3. Are high turnover ratios good or bad?

A: As per the guidelines, only one question is allowed to be solved so I am answering question 1-3.…

Q: How do you figure out the balance of control and substantive testing? How does this link into…

A: Substantive testing can be defined as the process of auditing financial statements and obtaining…

Q: Prepare Trial Balance Account Insurance Expense Cash at Bank Supplies Accounts Payable Sales Revenue…

A: Introduction: Trial Balance: All the final ledger accounts balances are posted in Trial balance to…

Q: On May 8, they recognized an $8,900 short-term capital gain. On June 25, they recognized a $15,000…

A: As per federal laws on taxation, Can I deduct my capital losses? Yes, but there are limits. Losses…

Q: Following are transactions of Danica Company. Dec. 13 Accepted a $19, 000, 45-day, 7% note in…

A: interest expense = principal * time * rate

Q: Required: i) Čalculate the qualifying building expenditure and the industrial building allowance…

A:

Q: Alberto’s Computer Shop On October 01, 2000, Mr Alberto opened a computer rental shop. The…

A: The journal entries are prepared to record day to day transactions as debit one account and credit…

Q: Copy equipment was acquired at the beginning of the year at a cost of $73,020 that has an estimated…

A: Formula: Depreciation rate (units of output method) = Depreciable cost / Estimated output where,…

Q: Save-the-Earth Company reports the following income statement accounts for the year ended December…

A: Income Statement: It is the statement of Revenue earned and expenses incurred. This statement shows…

Q: Suppose that Dealer A owes Dealer B a swap contract with a market value of $5, whereas Dealer B owes…

A: There are two dealers with the contract. Contract B owes the money after the contract and bankruptcy…

Q: Gunnar Company gathered the following reconciling information in preparing its September bank…

A: Bank reconciliation statement is used to determine the differences between the bank statement…

Q: Which of these accounts is an asset? A. Common Stock B. Supplies C. Accounts Payable D. Fees Earned

A: Introduction: Assets: Asset means having Economic value to the resource. Assets are of two types: 1…

Q: The following information is available from Pusoko Company's accounting records for the current…

A: Formula: Cost of goods sold = Beginning inventory + Net Cost of goods purchased - ending inventory…

Q: Warehouse: On the 1 September 2020, FHL purchased a warehouse at the airport to store packages…

A: Revaluation is acknowledged as the method where the carrying value of an asset is revalued to a…

Q: Support your answer using at least two concrete examples.

A: Today we live in a smart world. The banking sector is also becoming smart. Earlier people use to go…

Q: Prince company had bought $5,400,000, and additional realtor's fee of $50,000 an office building and…

A: When the assets are acquired in lump sum amount, then the same is apportionment in the ratio of…

Q: Carla Vista Manufacturing Company accumulates the following summary data for the year ending…

A: The variance is said to be favorable when actual revenue is more than the budgeted revenue or actual…

Q: Toronto Corporation wants to raise $1,210,000 via a rights offering. The company currently has…

A: a) Right shares offered : 1: 5 Therefore: Total shares : 220,000* 1/5 = 44,000 rights shares Ex…

Q: Taylor Company has two products: A and B. The anual production and sales level of Product A is 9,094…

A: A flexible budget is prepared on the basis of the budgeted rate and on the basis of different…

Q: hen purchase costs regularly rise, the inventory costing method that yields the highest reported net…

A: The inventory can be valued using various methods as LIFO, FIFO, average and specific identification…

Q: For the following accounts please indicate whether the normal balance is a debit or a credit. A.…

A: Introduction: Each and business every transactions effects minimum two entries. 1 ) Debit 2 )…

Q: evenue and production budgets

A: Disclaimer : “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Discuss and explain how a revenue account for one taxpayer may be of a capital nature for another…

A: Taxable Income- Taxable income is a specific portion of the revenue earned by an organization or an…

Q: Which of the following requires periodic shareholder approval of executive compensation? Multiple…

A: Dodd-Frank Wall Street Reform and Consumer Protection Act proposed Regulations 14a-21(a) would…

Q: liability

A: As Given in the question On August 1st, the Anderson Company opened its business. It paid salaries…

Q: A movie production studio incurred the following costs related to its current movie: Purchased…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: Lee Gon Corporation has the following revenue and cost characteristics on their only product:…

A: If 5% increase in selling price P6.00 + P6.00 *5% = 6.3 Variable cost = P4.20 Contribution = selling…

Q: Setting Standards, Materials and Labor Variances Tom Belford and Tony Sorrentino own a small…

A:

Q: Ralston Consulting, Inc., has a $48,000 overdue debt with Supplier No. 1. The company is low on…

A: In the given case both alternatives will be compared and the alternative that involves lower present…

Step by step

Solved in 2 steps

- 57 On December 31, 20x20, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 6:1:3 of partners A, B and C respectively, revealed the following data: Cash P1,000,000 Other liabilities P2,000,000 Receivable from A 500,000 Payable to B 1,000,000 Other noncash assets 2,000,000 Payable to C 100,000 A, Capital 700,000 B, Capital (650,000) C, Capital 350,000 On January 1, 20x21, the partners decided to liquidate the partnership. All partners are legally declared to be personally insolvent. The other noncash assets are sold for P1,500,000. Liquidation expenses amounting to P100,000 were incurred. How much cash was received by C at the end of partnership liquidation?2. Rene, Michael, and Kevin are partners in an accounting firm. Their capital accountbalance at year-end were Rene, P90,000; Michael, P120,000; and Kevin,P160,000. They share profit and losses on a 4:4:2 ratio after considering thefollowing terms: a. Kevin is to receive a bonus of 10% of net income. b. Interest of 5% shall be paid on partner’s capital. c. Salaries of P8,000 and P10,000 shall be paid to partners Rene and Kevinrespectively. Assuming a net income of P84,000 for the year. REQUIRED: Prepare the following:A. Profit or Loss Distribution TableB. Corresponding JOURNAL ENTRY to distribute profit or lossThe partners of Dan and Ken are engaged in trading. Dan’s original capital was P40,000 and Ken ‘s was P60,000. They agreed to share profits and losses as follows: Dan Ken Salaries Php28,000 Php40,000 Interest on original capital 10% 10% Balance 30% 70% _______ If the losses for the year were P20,000, what share of the loss would Ken receive? a.P2,600 c. ( P2,600) b.(P22,600) d. P5,200

- A, and B are partners sharing profits in the ratio of 2:3. Their balance sheet shows machineryat ₹2,00,000; stock ₹80,000, and debtors at ₹1,60,000. C is admitted and the new profitsharing ratio is 6:9:5. Machinery is revalued at ₹1,40,000 and a provision is made fordoubtful debts @5%. A’s share in loss on revaluation amount to ₹20,000. Revalued value ofstock will be:(a) ₹62,000 (b) ₹1,00,000 (c) ₹60,000 (d) ₹98,000Abe, Ben, and Cain are partners in the ratio of 3:4:2. Abe, Ben and Cain has a capital balance prior to the retirement of P50,000, 60,000 and 70,000. Ben is retiring from the firm. The profit on revaluation of asset on that date of retirement was P36,000. The new ratio of A and C is 5:3 after the retirement. Profit on revaluation will be distributed as P16,000, B P12,000, C P8,000 P12,000, B P16,000, C P8,000 P22,500, C P13,500 P23,625, C P12,375 Abe, Ben, and Cain are partners in the ratio of 3:4:2. Abe, Ben and Cain has a capital balance prior to the retirement of P50,000, 60,000 and 70,000. Ben is retiring from the firm. The profit on revaluation of asset on that date of retirement was P36,000. The new ratio of A and C is 5:3 after the retirement. If Ben is to receive an amount equal to the book value of his capital balance, the amount he should get is 50,000 72,000 70,000 Abe, Ben, and Cain are partners in the ratio of 3:4:2. Abe, Ben and Cain has a capital balance prior to…Demarco Lee invested $60,000 in the Camden and Sayler partnership for ownership equity of $60,000. Prior to the investment, equipment was revalued to a market value of $39,000 froma book value of $30,000. Kevin Camden and Chloe Sayler share net income in a 2:1 ratio.a. Provide the journal entry for the revaluation of equipment.b. Provide the journal entry to admit Lee.

- John and Peter are in partnership sharing profits and losses in the ratio 3/5: 2/5, respectively.The following is their trial balance as of 31 December 2007.Dr Cr$ $Buildings (cost $105,000) 80,000Fixtures at cost 4,100Provision for depreciation: Fixtures 2,100Debtors 30,700Creditors 13,295Cash at bank 3,065Stock at 01 January 2008 31,370Sales 181,555.50Purchases 105,000Carriage outwards 1,705Discounts allowed 310Loan interest: M. Money 1,950Office expenses 2,380Salaries and wages 28,904.50Bad debts 816Provision for doubtful debts 700Loan from M. Money 32,500Capitals: Shoes 50,000Socks 37,500Current accounts: Shoes 2,050Socks 600Drawings: Shoes 15900Book 14,100320,300.5 320,300.5i. Stock, 31 December 2008, $35,105ii. Expenses to be accrued: Office Expenses $107.50; Wages $360iii. Depreciate fixtures 15 percent on reducing balance basis, buildings $2,500iv. Reduce provision for doubtful debts to $625v. Partnership salary: $15,000 to Shoes. Not yet enteredvi. Interest on drawings:…12. Following are the capital account balances and profit and loss percentages (indicated parenthetically) for the William, Jennings, and Bryan partnership: William (40%) $ 280,000 Jennings (40%) 230,000 Bryan (20%) 210,000 Darrow invests $325,000 in cash for a 30 percent ownership interest. The money goes to the business. No goodwill or other revaluation is to be recorded. After the transaction, what is Jennings’s capital balance? Multiple Choice $234,600 $230,000 $327,500 $233,450Doy, Rey, May, and Fay are partners with capitals of P 22,000, P 20,600, P 27,400, and P 18,000 respectively. Doy has a loan balance of P 4,000. Profits and losses are shared 40%; 30%; 20%; 10% by Doy, Rey, May, and Fay respectively. Assuming assets were sold and liabilities paid and the balance of cash showed P 24,000. Prepare a schedule showing how the P 24,000 will be distributed to the partners.

- Moose, Booze and Goose are partners with capital balances of P 320,000, P 450,000 and P 520,000 respectively with profit and loss sharing ratio of 2:3:5 respectively. The firm owes Booze P 20,000. Upon liquidation, P 390,000 is available for distribution to the partners. What amount of cash will Moose receive? a. P78,000 b. P136,000 c. P258,000 d. P320,000 Please provide a good accounting form for the solution. Thank you!Show Your Solutions 1) The following condensed Balance Sheet was prepared for Bi, Na, Ta partnership on March 31,200B: Cash P 30,000 Liabilities P 60,000 Other Assets P 190,000 Bi, Capital P 44,000 Na, Capital P 66,000 Ta, Capital P 50,000 P 220,000 P 220,000 The other assets were sold for P50,000. Profits are shared 4;4;2, for Bi, Na, and Ta, respectively. Bi is insolvent . The amount of cash received by Na was: 2) After the realization of non-cash assets, the following account balances appeared in the genera ledger of the partnership of See, Chap, and Pooh. Cash P 10,000 Liabilities 30,000 Pooh,Loan 5,000 See,Capital 15,000 Chap,Capital 10,000 Pooh,Capital 10,000 Profits are shared 2:4:4 for See, Chapand Pooh, respectively. Pooh is insolvent. How much was the loss on realization? 3) After realization…. X and Y are partners in a company with a capital of ₹1,80,000 and ₹2,00,000. Z was admitted for 1/3rd share in profits and brings ₹3,40,000 as capital. Calculate the amount of goodwill.