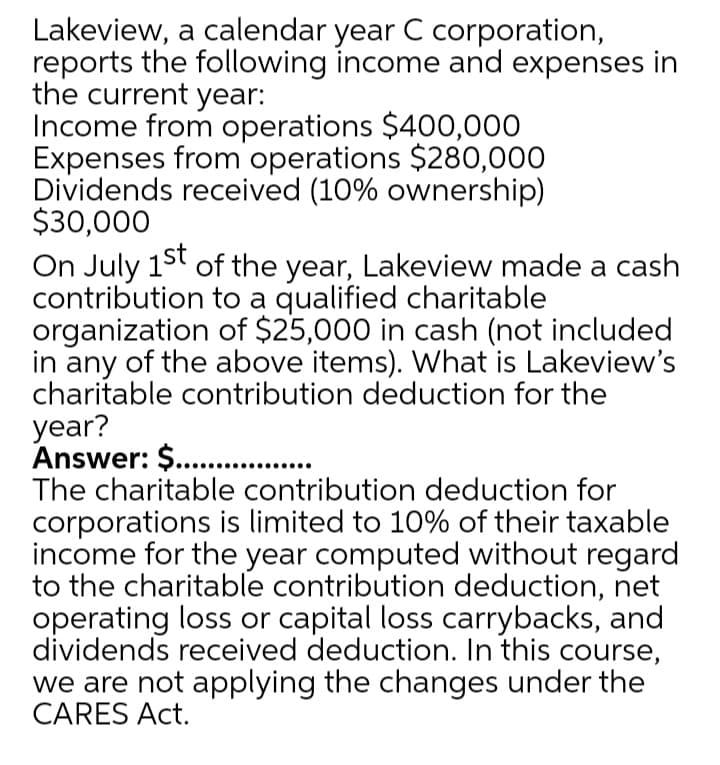

Lakeview, a calendar year C corporation, reports the following income and expenses in the current year: Income from operations $400,000 Expenses from operations $280,000 Dividends received (10% ownership) $30,000 On July 15t of the year, Lakeview made a cash contribution to a qualified charitable organization of $25,000 in cash (not included in any of the above items). What is Lakeview's charitable contribution deduction for the year? Answer: $ . The charitable contribution deduction for corporations is limited to 10% of their taxable income for the year computed without regard to the charitable contribution deduction, net operating loss or capital loss carrybacks, and dividends received deduction. In this course, we are not applying the changes under the CARES Act.

Lakeview, a calendar year C corporation, reports the following income and expenses in the current year: Income from operations $400,000 Expenses from operations $280,000 Dividends received (10% ownership) $30,000 On July 15t of the year, Lakeview made a cash contribution to a qualified charitable organization of $25,000 in cash (not included in any of the above items). What is Lakeview's charitable contribution deduction for the year? Answer: $ . The charitable contribution deduction for corporations is limited to 10% of their taxable income for the year computed without regard to the charitable contribution deduction, net operating loss or capital loss carrybacks, and dividends received deduction. In this course, we are not applying the changes under the CARES Act.

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:Lakeview, a calendar year C corporation,

reports the following income and expenses in

the current year:

Income from operations $400,000

Expenses from operations $280,000

Dividends received (10% ownership)

$30,000

On July 15t of the year, Lakeview made a cash

contribution to a qualified charitable

organization of $25,000 in cash (not included

in any of the above items). What is Lakeview's

charitable contribution deduction for the

year?

Answer: $ .

The charitable contribution deduction for

corporations is limited to 10% of their taxable

income for the year computed without regard

to the charitable contribution deduction, net

operating loss or capital loss carrybacks, and

dividends received deduction. In this course,

we are not applying the changes under the

CARES Act.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you