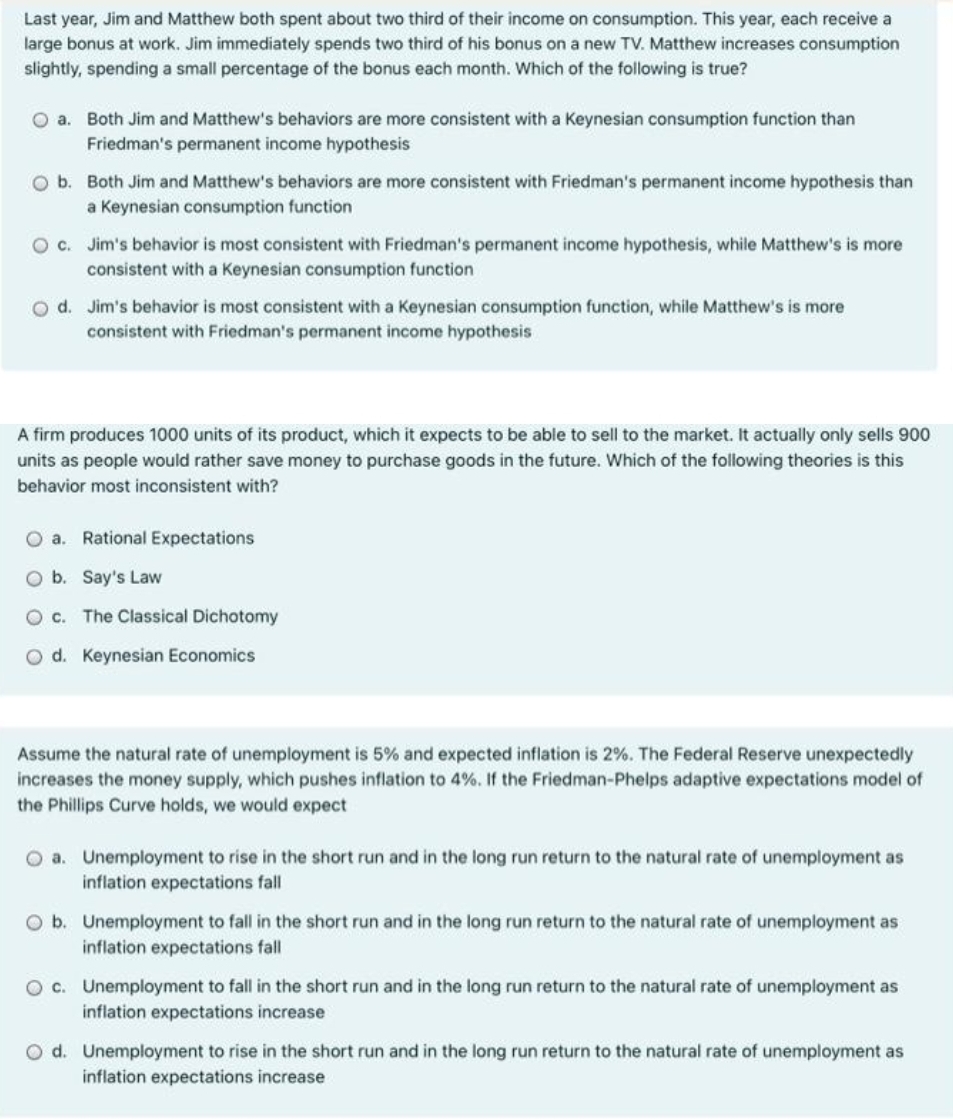

Last year, Jim and Matthew both spent about two third of their income on consumption. This year, each receive a large bonus at work. Jim immediately spends two third of his bonus on a new TV. Matthew increases consumption slightly, spending a small percentage of the bonus each month. Which of the following is true? a. Both Jim and Matthew's behaviors are more consistent with a Keynesian consumption function than Friedman's permanent income hypothesis b. Both Jim and Matthew's behaviors are more consistent with Friedman's permanent income hypothesis than a Keynesian consumption function c. Jim's behavior is most consistent with Friedman's permanent income hypothesis, while Matthew's is more consistent with a Keynesian consumption function d. Jim's behavior is most consistent with a Keynesian consumption function, while Matthew's is more consistent with Friedman's permanent income hypothesis

Last year, Jim and Matthew both spent about two third of their income on consumption. This year, each receive a large bonus at work. Jim immediately spends two third of his bonus on a new TV. Matthew increases consumption slightly, spending a small percentage of the bonus each month. Which of the following is true? a. Both Jim and Matthew's behaviors are more consistent with a Keynesian consumption function than Friedman's permanent income hypothesis b. Both Jim and Matthew's behaviors are more consistent with Friedman's permanent income hypothesis than a Keynesian consumption function c. Jim's behavior is most consistent with Friedman's permanent income hypothesis, while Matthew's is more consistent with a Keynesian consumption function d. Jim's behavior is most consistent with a Keynesian consumption function, while Matthew's is more consistent with Friedman's permanent income hypothesis

Chapter11: Managing Aggregate Demand: Fiscal Policy

Section: Chapter Questions

Problem 2TY

Related questions

Question

Transcribed Image Text:Last year, Jim and Matthew both spent about two third of their income on consumption. This year, each receive a

large bonus at work. Jim immediately spends two third of his bonus on a new TV. Matthew increases consumption

slightly, spending a small percentage of the bonus each month. Which of the following is true?

O a. Both Jim and Matthew's behaviors are more consistent with a Keynesian consumption function than

Friedman's permanent income hypothesis

O b. Both Jim and Matthew's behaviors are more consistent with Friedman's permanent income hypothesis than

a Keynesian consumption function

O c. Jim's behavior is most consistent with Friedman's permanent income hypothesis, while Matthew's is more

consistent with a Keynesian consumption function

d. Jim's behavior is most consistent with a Keynesian consumption function, while Matthew's is more

consistent with Friedman's permanent income hypothesis

A firm produces 1000 units of its product, which it expects to be able to sell to the market. It actually only sells 900

units as people would rather save money to purchase goods in the future. Which of the following theories is this

behavior most inconsistent with?

O a. Rational Expectations

O b. Say's Law

O c. The Classical Dichotomy

O d. Keynesian Economics

Assume the natural rate of unemployment is 5% and expected inflation is 2%. The Federal Reserve unexpectedly

increases the money supply, which pushes inflation to 4%. If the Friedman-Phelps adaptive expectations model of

the Phillips Curve holds, we would expect

O a. Unemployment to rise in the short run and in the long run return to the natural rate of unemployment as

inflation expectations fall

O b. Unemployment to fall in the short run and in the long run return to the natural rate of unemployment as

inflation expectations fall

O c. Unemployment to fall in the short run and in the long run return to the natural rate of unemployment as

inflation expectations increase

O d. Unemployment to rise in the short run and in the long run return to the natural rate of unemployment as

inflation expectations increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning