Last year Minden Company Introduced a new product and sold 25,100 units of It at a price of $95 per unit. The product's varlable expenses are $65 per unit and its fixed expenses are $835,500 per year. Required: 1. What was this product's net operating Income (loss) last year? 2 What Is the product's break-even polnt in unit sales and dollar sales? 3. Assume the company has conducted a marketing study that estimates It can Increase annual sales of this product by 5.000 units for each $2 reduction In Its selling price. If the company will only consider price reductions in Increments of $2 (e.g. $68. $6, etc.). what is the maximum annual profit that It can earn on this product? What sales volume and selling price per unit generate the maximum profit? 4. What would be the break-even polnt In unit sales and In dollar sales using the selling price that you determined In requirement 3? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What was this product's net operating income (loss) last year? Required 1 Required 2 >

Last year Minden Company Introduced a new product and sold 25,100 units of It at a price of $95 per unit. The product's varlable expenses are $65 per unit and its fixed expenses are $835,500 per year. Required: 1. What was this product's net operating Income (loss) last year? 2 What Is the product's break-even polnt in unit sales and dollar sales? 3. Assume the company has conducted a marketing study that estimates It can Increase annual sales of this product by 5.000 units for each $2 reduction In Its selling price. If the company will only consider price reductions in Increments of $2 (e.g. $68. $6, etc.). what is the maximum annual profit that It can earn on this product? What sales volume and selling price per unit generate the maximum profit? 4. What would be the break-even polnt In unit sales and In dollar sales using the selling price that you determined In requirement 3? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What was this product's net operating income (loss) last year? Required 1 Required 2 >

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 5EB: Cadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90....

Related questions

Question

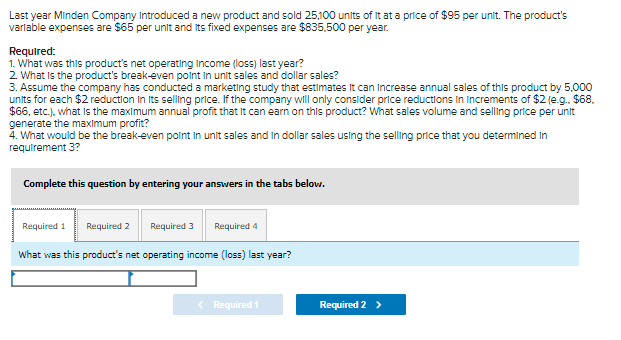

Transcribed Image Text:Last year Minden Company Introduced a new product and sold 25,100 units of It at a price of $95 per unit. The product's

varlable expenses are $65 per unit and its fixed expenses are $835,500 per year.

Required:

1. What was this product's net operating Income (loss) last year?

2 What Is the product's break-even polnt in unit sales and dollar sales?

3. Assume the company has conducted a marketing study that estimates It can Increase annual sales of this product by 5.000

units for each $2 reduction In Its selling price. If the company will only consider price reductions in Increments of $2 (e.g. $68.

$6, etc.). what is the maximum annual profit that It can earn on this product? What sales volume and selling price per unit

generate the maximum profit?

4. What would be the break-even polnt In unit sales and In dollar sales using the selling price that you determined In

requirement 3?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

What was this product's net operating income (loss) last year?

< Required 1

Required 2 >

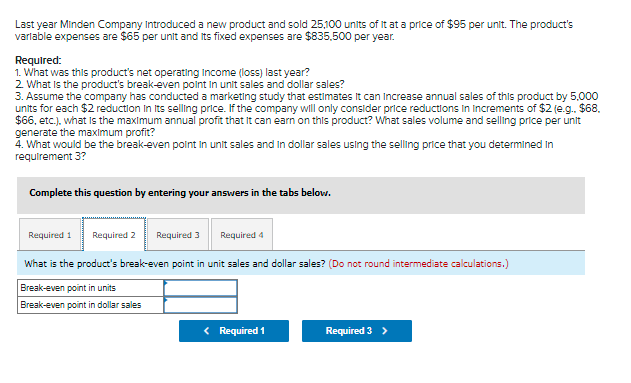

Transcribed Image Text:Last year Minden Company Introduced a new product and sold 25,100 units of it at a price of $95 per unit. The product's

varlable expenses are $65 per unit and Its fixed expenses are $835.500 per year.

Required:

1. What was this product's net operating Income (loss) last year?

2 What Is the product's break-even point in unit sales and dollar sales?

3. Assume the company has conducted a marketing study that estimates It can Increase annual sales of this product by 5.000

units for each $2 reduction In Its selling price. If the company will only consider price reductions in Increments of $2 (e.g. $68.

$6, etc.). what is the maximum annual profit that It can earn on this product? What sales volume and selling price per unit

generate the maximum profit?

4. What would be the break-even polnt in unit sales and In dollar sales using the selling price that you determined In

requirement 3?

Complete this question by entering your answers in the tabs belovw.

Required 1

Required 2

Required 3

Required 4

What is the product's break-even point in unit sales and dollar sales? (Do not round intermediate calculations.)

Break-even point in units

Break-even point in dollar sales

< Required 1

Required 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning