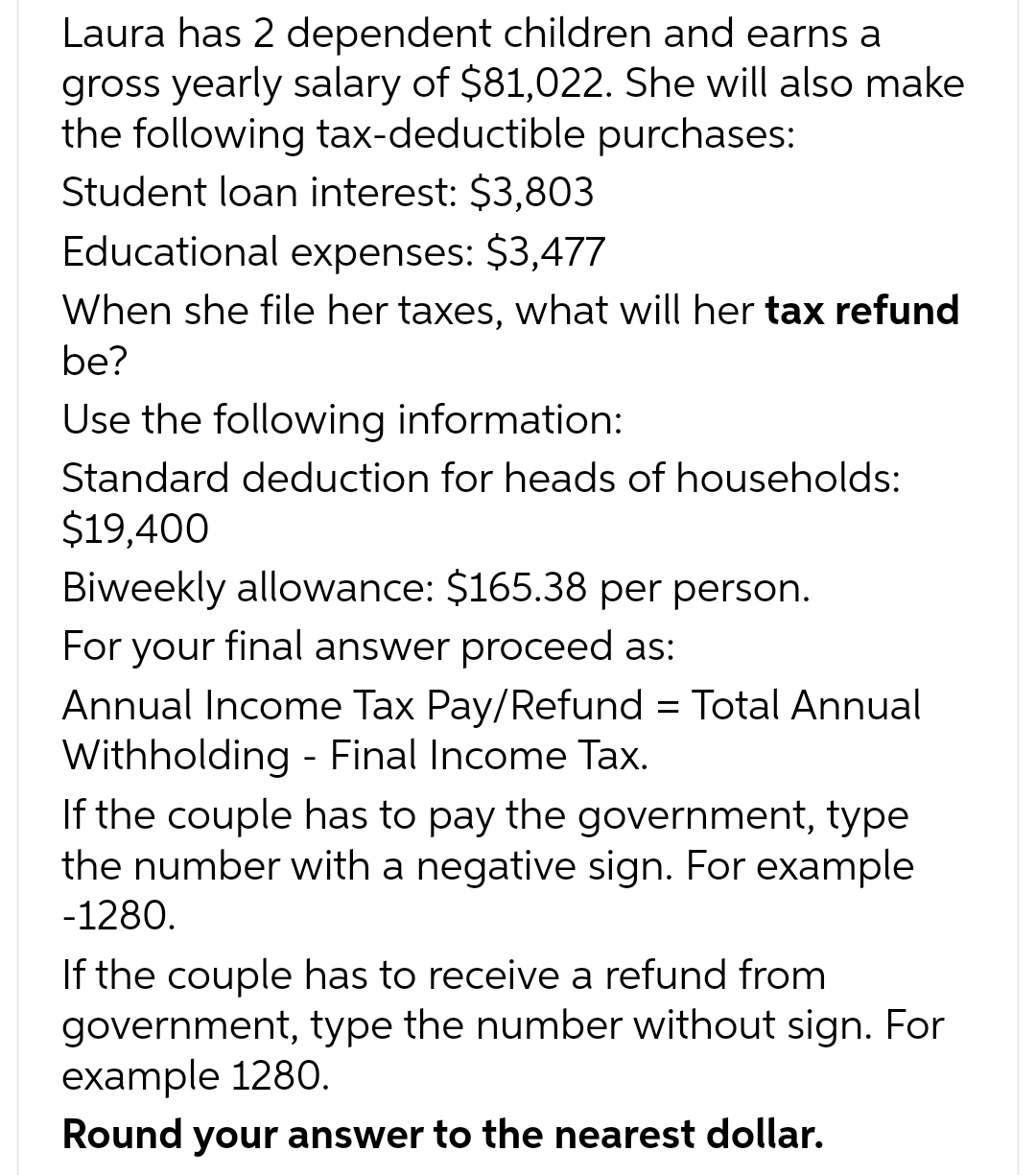

Laura has 2 dependent children and earns a gross yearly salary of $81,022. She will also make the following tax-deductible purchases: Student loan interest: $3,803 Educational expenses: $3,477 When she file her taxes, what will her tax refund be? Use the following information: Standard deduction for heads of households: $19,400 Biweekly allowance: $165.38 per person. For your final answer proceed as: Annual Income Tax Pay/Refund = Total Annual Withholding - Final Income Tax. If the couple has to pay the government, type the number with a negative sign. For example -1280. If the couple has to receive a refund from government, type the number without sign. For example 1280. Round your answer to the nearest dollar.

Laura has 2 dependent children and earns a gross yearly salary of $81,022. She will also make the following tax-deductible purchases: Student loan interest: $3,803 Educational expenses: $3,477 When she file her taxes, what will her tax refund be? Use the following information: Standard deduction for heads of households: $19,400 Biweekly allowance: $165.38 per person. For your final answer proceed as: Annual Income Tax Pay/Refund = Total Annual Withholding - Final Income Tax. If the couple has to pay the government, type the number with a negative sign. For example -1280. If the couple has to receive a refund from government, type the number without sign. For example 1280. Round your answer to the nearest dollar.

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 64P: Leroy and Amanda are married and have three dependent children. During the current year, they have...

Related questions

Question

Aa.61.

Transcribed Image Text:Laura has 2 dependent children and earns a

gross yearly salary of $81,022. She will also make

the following tax-deductible purchases:

Student loan interest: $3,803

Educational expenses: $3,477

When she file her taxes, what will her tax refund

be?

Use the following information:

Standard deduction for heads of households:

$19,400

Biweekly allowance: $165.38 per person.

For your final answer proceed as:

Annual Income Tax Pay/Refund = Total Annual

Withholding - Final Income Tax.

If the couple has to pay the government, type

the number with a negative sign. For example

-1280.

If the couple has to receive a refund from

government, type the number without sign. For

example 1280.

Round your answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT