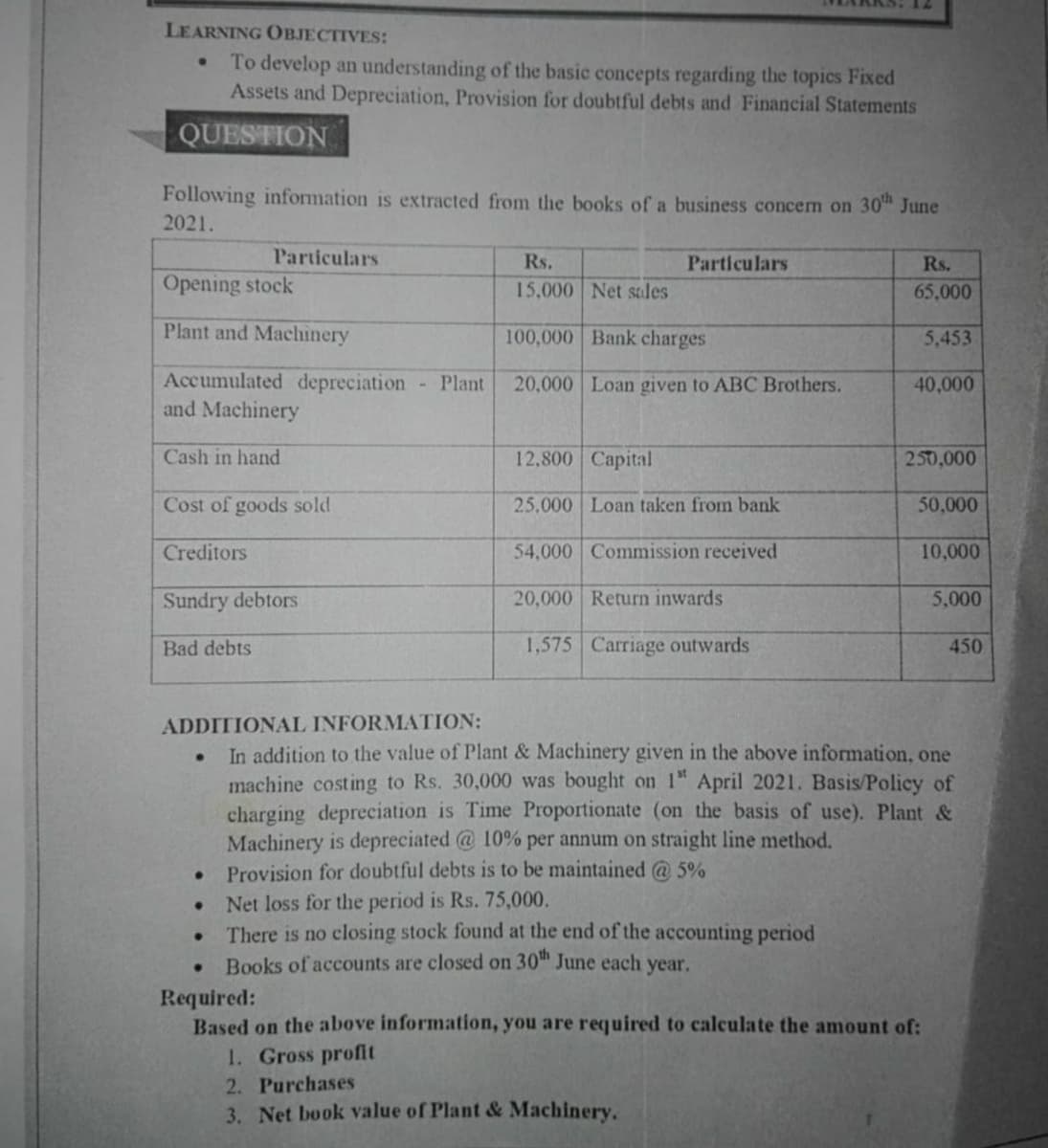

LEARNING OBJECTIVES: To develop an understanding of the basic concepts regarding the topics Fixed Assets and Depreciation, Provision for doubtful debts and Financial Statements QUESTION Following information is extracted from the books of a business concem on 30 June 2021. Particulars Rs. Particulars Rs. Opening stock 15,000 Net sades 65,000 Plant and Machinery 100,000 Bank charges 5,453 Accumulated depreciation and Machinery - Plant 20,000 Loan given to ABC Brothers. 40,000 Cash in hand 12,800 Capital 250,000 Cost of goods sold 2.5,000 Loan taken from bank 50,000 Creditors 54,000 Commission received 10,000 Sundry debtors 20,000 Return inwards 5,000 Bad debts 1,575 Carriage outwards 450 ADDITIONAL INFORMATION: In addition to the value of Plant & Machinery given in the above information, one machine costing to Rs. 30,000 was bought on 1" April 2021. Basis/Policy of charging depreciation is Time Proportionate (on the basis of use). Plant & Machinery is depreciated @ 10% per annum on straight line method. Provision for doubtful debts is to be maintained @ 5% Net loss for the period is Rs. 75,000. There is no closing stock found at the end of the accounting period Books of accounts are closed on 30" June each year. Required: Based on the above information, you are required to calculate the amount of: 1. Gross profit 2. Purchases 3. Net book value of Plant & Machinery.

LEARNING OBJECTIVES: To develop an understanding of the basic concepts regarding the topics Fixed Assets and Depreciation, Provision for doubtful debts and Financial Statements QUESTION Following information is extracted from the books of a business concem on 30 June 2021. Particulars Rs. Particulars Rs. Opening stock 15,000 Net sades 65,000 Plant and Machinery 100,000 Bank charges 5,453 Accumulated depreciation and Machinery - Plant 20,000 Loan given to ABC Brothers. 40,000 Cash in hand 12,800 Capital 250,000 Cost of goods sold 2.5,000 Loan taken from bank 50,000 Creditors 54,000 Commission received 10,000 Sundry debtors 20,000 Return inwards 5,000 Bad debts 1,575 Carriage outwards 450 ADDITIONAL INFORMATION: In addition to the value of Plant & Machinery given in the above information, one machine costing to Rs. 30,000 was bought on 1" April 2021. Basis/Policy of charging depreciation is Time Proportionate (on the basis of use). Plant & Machinery is depreciated @ 10% per annum on straight line method. Provision for doubtful debts is to be maintained @ 5% Net loss for the period is Rs. 75,000. There is no closing stock found at the end of the accounting period Books of accounts are closed on 30" June each year. Required: Based on the above information, you are required to calculate the amount of: 1. Gross profit 2. Purchases 3. Net book value of Plant & Machinery.

Chapter6: Investing And Financing Activities

Section: Chapter Questions

Problem 1M

Related questions

Question

Solve these question?

Transcribed Image Text:LEARNING OBJECTIVES:

To develop an understanding of the basic concepts regarding the topics Fixed

Assets and Depreciation, Provision for doubtful debts and Financial Statements

QUESTION

Following information is extracted from the books of a business concem on 30" June

2021.

Particulars

Rs.

Particulars

Rs.

Opening stock

15,000 Net sles

65,000

Plant and Machinery

100,000 Bank charges

5,453

Accumulated depreciation

and Machinery

Plant

20,000 Loan given to ABC Brothers.

40,000

Cash in hand

12,800 Capital

250,000

Cost of goods sold

25,000 Loan taken from bank

50,000

Creditors

54,000 Commission received

10,000

Sundry debtors

20,000 Return inwards

5,000

Bad debts

1,575 Carriage outwards

450

ADDITIONAL INFORMATION:

In addition to the value of Plant & Machinery given in the above information, one

machine costing to Rs. 30,000 was bought on 1" April 2021. Basis/Policy of

charging depreciation is Time Proportionate (on the basis of use). Plant &

Machinery is depreciated @ 10% per annum on straight line method.

Provision for doubtful debts is to be maintained @ 5%

• Net loss for the period is Rs. 75,000.

There is no closing stock found at the end of the accounting period

Books of accounts are closed on 30" June each year.

Required:

Based on the above information, you are required to calculate the amount of:

1. Gross profit

2. Purchases

3. Net book value of Plant & Machinery.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College