lease see the attached graph for questions below. What is the difference between the two companies on this ratio? What is a plausible explanation as to why they would differ? Is one company clearly different than the other? Are there economic or end-market influences that explain why the ratios differ? What might they be? Over time, is each company’s overall financial performance improving, declining, or is something strange going on? Do you think evaluating financial statements is a good idea? What do you regard as some of the shortcomings of financial ratio analysis?

lease see the attached graph for questions below. What is the difference between the two companies on this ratio? What is a plausible explanation as to why they would differ? Is one company clearly different than the other? Are there economic or end-market influences that explain why the ratios differ? What might they be? Over time, is each company’s overall financial performance improving, declining, or is something strange going on? Do you think evaluating financial statements is a good idea? What do you regard as some of the shortcomings of financial ratio analysis?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 10MCQ

Related questions

Question

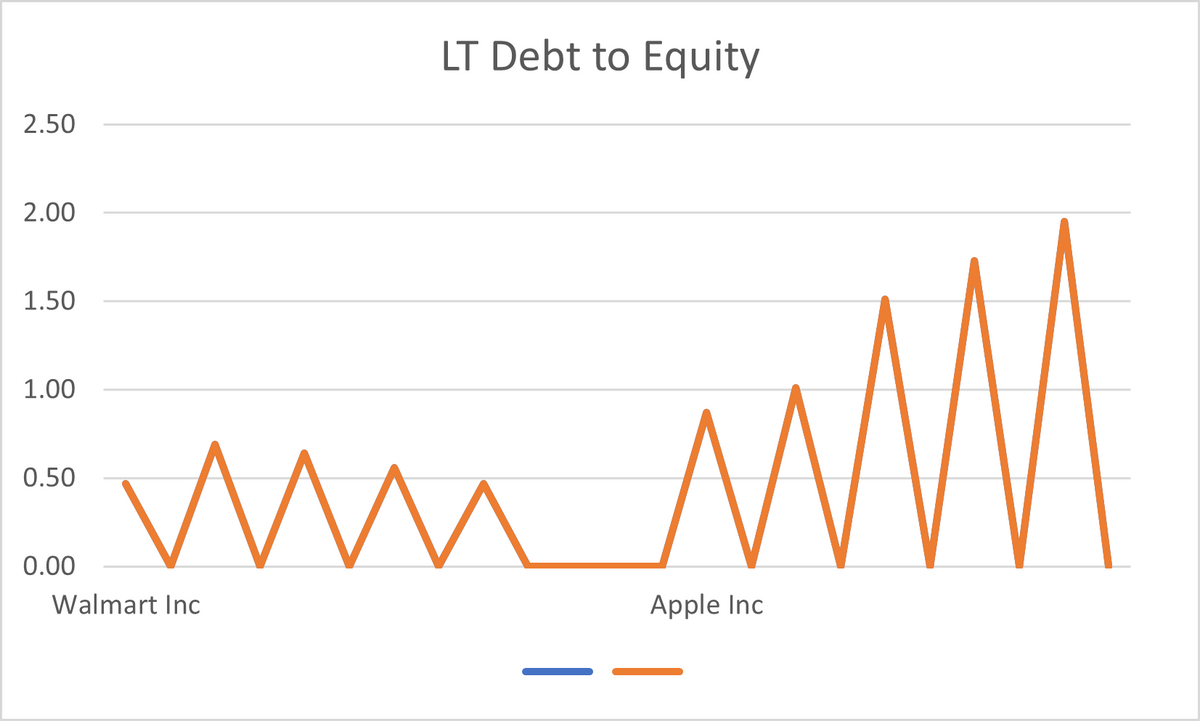

Please see the attached graph for questions below.

- What is the difference between the two companies on this ratio? What is a plausible explanation as to why they would differ? Is one company clearly different than the other?

- Are there economic or end-market influences that explain why the ratios differ? What might they be?

- Over time, is each company’s overall financial performance improving, declining, or is something strange going on?

- Do you think evaluating financial statements is a good idea? What do you regard as some of the shortcomings of financial ratio analysis?

Transcribed Image Text:2.50

2.00

1.50

1.00

0.50

0.00

LT Debt to Equity

ww

Walmart Inc

^

ww

Apple Inc.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT