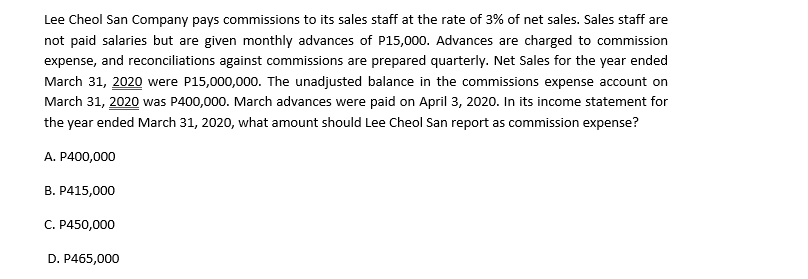

Lee Cheol San Company pays commissions to its sales staff at the rate of 3% of net sales. Sales staff are not paid salaries but are given monthly advances of P15,000. Advances are charged to commission expense, and reconciliations against commissions are prepared quarterly. Net Sales for the year ended March 31, 2020 were P15,000,000. The unadjusted balance in the commissions expense account on March 31, 2020 was P400,000. March advances were paid on April 3, 2020. In its income statement for the year ended March 31, 2020, what amount should Lee Cheol San report as commission expense? A. P400,000 B. P415,000 C. P450,000 D. P465,000

Lee Cheol San Company pays commissions to its sales staff at the rate of 3% of net sales. Sales staff are not paid salaries but are given monthly advances of P15,000. Advances are charged to commission expense, and reconciliations against commissions are prepared quarterly. Net Sales for the year ended March 31, 2020 were P15,000,000. The unadjusted balance in the commissions expense account on March 31, 2020 was P400,000. March advances were paid on April 3, 2020. In its income statement for the year ended March 31, 2020, what amount should Lee Cheol San report as commission expense? A. P400,000 B. P415,000 C. P450,000 D. P465,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 8RE: Borat Company gives annual bonuses after the end of the year. Borat computes the bonuses based on...

Related questions

Question

Transcribed Image Text:Lee Cheol San Company pays commissions to its sales staff at the rate of 3% of net sales. Sales staff are

not paid salaries but are given monthly advances of P15,000. Advances are charged to commission

expense, and reconciliations against commissions are prepared quarterly. Net Sales for the year ended

March 31, 2020 were P15,000,000. The unadjusted balance in the commissions expense account on

March 31, 2020 was P400,000. March advances were paid on April 3, 2020. In its income statement for

the year ended March 31, 2020, what amount should Lee Cheol San report as commission expense?

A. P400,000

B. P415,000

C. P450,000

D. P465,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT