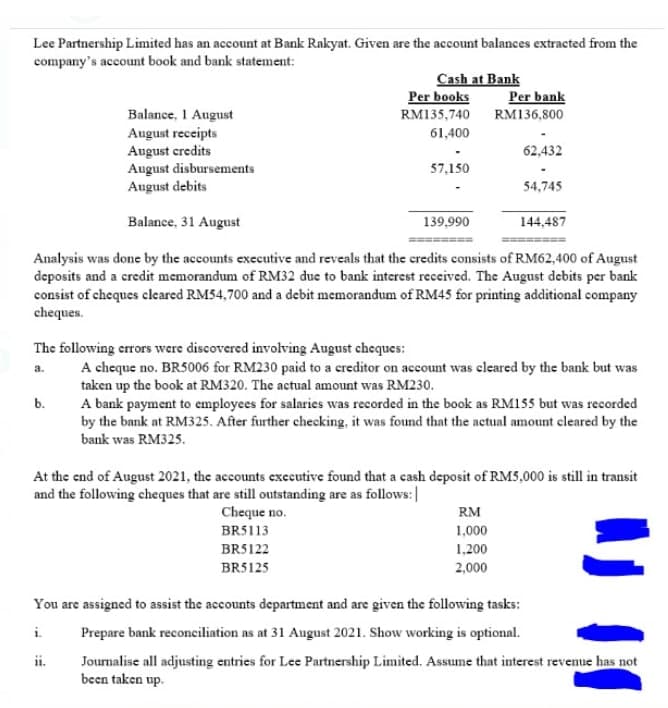

Lee Partnership Limited has an account at Bank Rakyat. Given are the account balances extracted from the company's account book and bank statement: Cash at Bank Per books RM135,740 RM136,800 Per bank Balance, 1 August August receipts August credits August disbursements August debits 61,400 62,432 57,150 54,745 Balance, 31 August 139,990 144,487

Lee Partnership Limited has an account at Bank Rakyat. Given are the account balances extracted from the company's account book and bank statement: Cash at Bank Per books RM135,740 RM136,800 Per bank Balance, 1 August August receipts August credits August disbursements August debits 61,400 62,432 57,150 54,745 Balance, 31 August 139,990 144,487

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 18E

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Lee Partnership Limited has an account at Bank Rakyat. Given are the account balances extracted from the

company's account book and bank statement:

Cash at Bank

Per books

Per bank

Balance, 1 August

August receipts

August credits

August disbursements

August debits

RM135,740

RM136,800

61,400

62,432

57,150

54,745

Balance, 31 August

139,990

144,487

Analysis was done by the accounts executive and reveals that the credits consists of RM62,400 of August

deposits and a credit memorandum of RM32 due to bank interest received. The August debits per bank

consist of cheques cleared RM54,700 and a debit memorandum of RM45 for printing additional company

cheques.

The following crrors were discovered involving August cheques:

A cheque no. BR5006 for RM230 paid to a creditor on account was cleared by the bank but was

taken up the book at RM320. The actual amount was RM230.

A bank payment to employees for salaries was recorded in the book as RM155 but was recorded

by the bank at RM325. After further checking, it was found that the actual amount cleared by the

bank was RM325.

a.

b.

At the end of August 2021, the accounts executive found that a cash deposit of RM5,000 is still in transit

and the following cheques that are still outstanding are as follows:|

Cheque no.

RM

BR5113

1,000

BR5122

1,200

BR5125

2,000

You are assigned to assist the accounts department and are given the following tasks:

i.

Prepare bank reconciliation as at 31 August 2021. Show working is optional.

Journalise all adjusting entries for Lee Partnership Limited. Assume that interest revenue has not

been taken up.

ii.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning