You are provided with information relating to Umdoni Stores. The following information appeared in the Bank Reconciliation Statement of Umdoni Stores on 30 September 20.19: R5 000 Debit An EFT payment made by a receivable for R4 300 on 31 October 20.19 appeared in the bank statement but not in the Balance per bank statement 7. Balance per Cash Book RG 500 credit October Cash Book. Outstanding deposit dated 30 September 20.19 R20 500 On comparing the September bank Reconciliation statement, the October bank statement and the Cash Book for October, the following was noted:

You are provided with information relating to Umdoni Stores. The following information appeared in the Bank Reconciliation Statement of Umdoni Stores on 30 September 20.19: R5 000 Debit An EFT payment made by a receivable for R4 300 on 31 October 20.19 appeared in the bank statement but not in the Balance per bank statement 7. Balance per Cash Book RG 500 credit October Cash Book. Outstanding deposit dated 30 September 20.19 R20 500 On comparing the September bank Reconciliation statement, the October bank statement and the Cash Book for October, the following was noted:

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:QUESTION 8

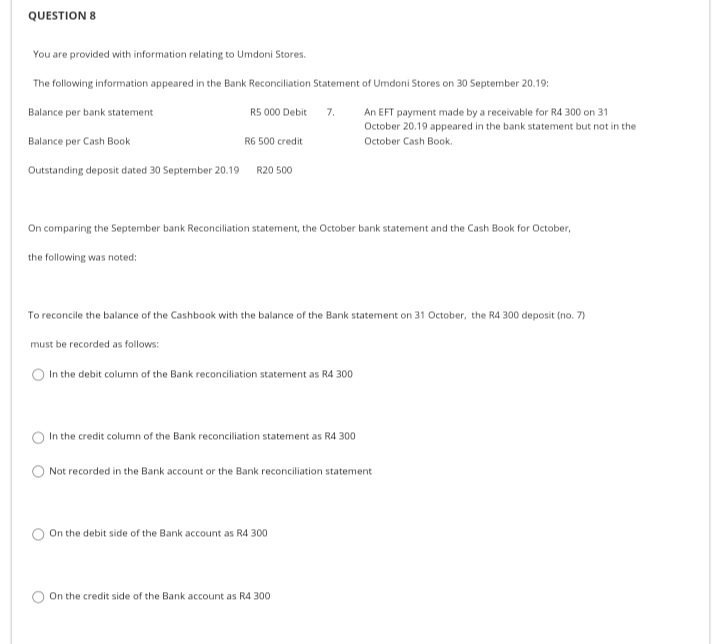

You are provided with information relating to Umdoni Stores.

The following information appeared in the Bank Reconciliation Statement of Umdoni Stores on 30 September 20.19:

Balance per bank statement

R5 000 Debit

7.

An EFT payment made by a receivable for R4 300 on 31

October 20.19 appeared in the bank statement but not in the

Balance per Cash Book

R6 500 credit

October Cash Book.

Outstanding deposit dated 30 September 20.19

R20 500

On comparing the September bank Reconciliation statement, the October bank statement and the Cash Book for October,

the following was noted:

To reconcile the balance of the Cashbook with the balance of the Bank statement on 31 October, the R4 300 deposit (no. 7)

must be recorded as follows:

In the debit column of the Bank reconciliation statement as R4 300

O In the credit column of the Bank reconciliation statement as R4 300

Not recorded in the Bank account or the Bank reconciliation statement

On the debit side of the Bank account as R4 300

On the credit side of the Bank account as R4 300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning