LEQUIRED: ) Determine the amount assigned to equity on January 1,2020. ) Compute the amount charged to Compensation Expense during the years 2020, 2021,2022 and 2023 as a result of the foregoing. -) Prepare all the entries relating to the above during the years 2020 through 2023,inclusive.

LEQUIRED: ) Determine the amount assigned to equity on January 1,2020. ) Compute the amount charged to Compensation Expense during the years 2020, 2021,2022 and 2023 as a result of the foregoing. -) Prepare all the entries relating to the above during the years 2020 through 2023,inclusive.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 8RE: On January 2, 2019, Brust Corporation grants its new CFO 2,000 restricted share units. Each of the...

Related questions

Question

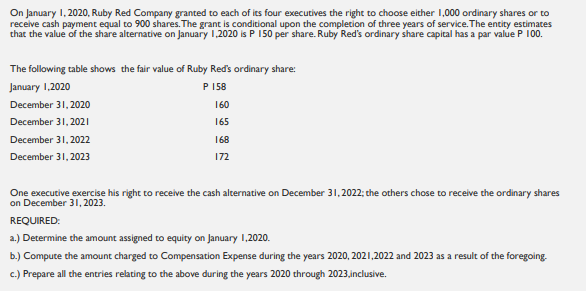

Transcribed Image Text:On January 1, 2020, Ruby Red Company granted to each of its four executives the right to choose either 1,000 ordinary shares or to

receive cash payment equal to 900 shares. The grant is conditional upon the complecion of three years of service. The entity estimates

that the value of the share alternative on January 1,2020 is P 150 per share. Ruby Red's ordinary share capital has a par value P 100.

The following table shows the fair value of Ruby Red's ordinary share:

January 1,2020

P

P 158

December 31, 2020

160

December 31, 2021

165

December 31, 2022

168

December 31, 2023

172

One executive exercise his right to receive the cash alternative on December 31, 2022; the others chose to receive the ordinary shares

on December 31, 2023.

REQUIRED:

a.) Determine the amount assigned to equity on January 1,2020.

b.) Compute the amount charged to Compensation Expense during the years 2020, 2021,2022 and 2023 as a result of the foregoing.

c.) Prepare all the entries relating to the above during the years 2020 through 2023,inclusive.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning