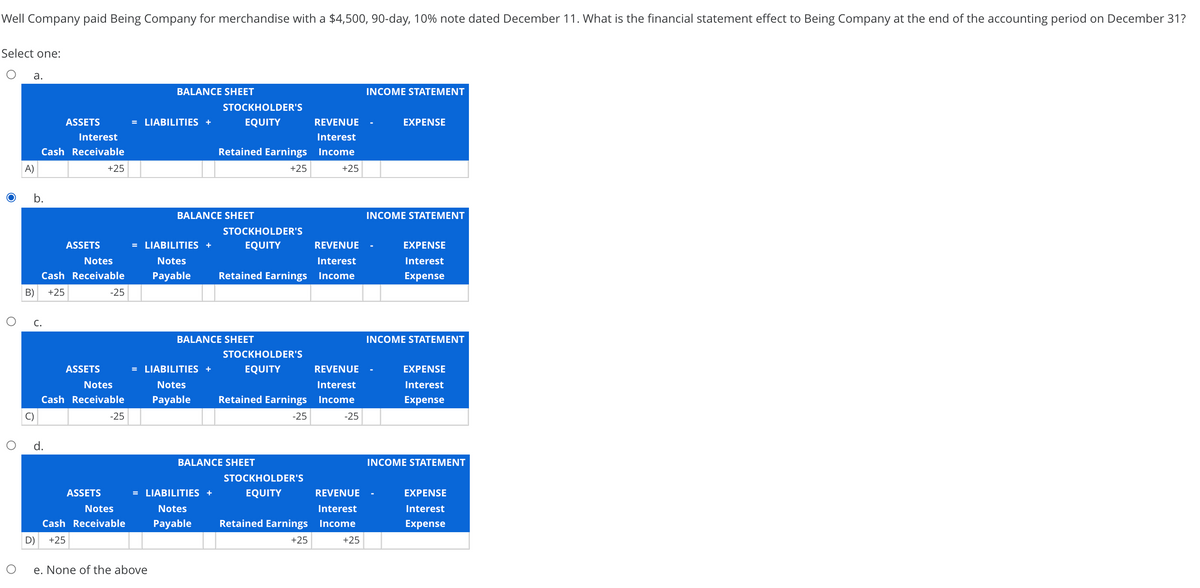

Well Company paid Being Company for merchandise with a $4500, 90-day, 10% note dated December 11. What is the financial statement effect to Being Company at the end of the accounting period on December 31? Select one: O a. BALANCE SHEET INCOME STATEMENT STOCKHOLDER'S ASSETS = LIABILITIES + EQUITY REVENUE - EXPENSE Interest Interest Cash Receivable Retained Earnings Income A) +25 +25 +25 b. BALANCE SHEET INCOME STATEMENT STOCKHOLDER'S ASSETS = LIABILITIES + EQUITY REVENUE - EXPENSE Notes Notes Interest Interest Cash Receivable Payable Retained Earnings Income Expense B) +25 -25 C. BALANCE SHEET INCOME STATEMENT STOCKHOLDER'S ASSETS - LIABILITIES + EQUITY REVENUE - EXPENSE Notes Notes Interest Interest Cash Receivable Payable Retained Earnings Income Expense C) -25 -25 -25 O d. BALANCE SHEET INCOME STATEMENT STOCKHOLDER'S ASSETS - LIABILITIES + EQUITY REVENUE - EXPENSE Notes Notes Interest Interest Cash Receivable Payable Retained Earnings Income Expense D) +25 +25 +25 e. None of the above

Well Company paid Being Company for merchandise with a $4500, 90-day, 10% note dated December 11. What is the financial statement effect to Being Company at the end of the accounting period on December 31? Select one: O a. BALANCE SHEET INCOME STATEMENT STOCKHOLDER'S ASSETS = LIABILITIES + EQUITY REVENUE - EXPENSE Interest Interest Cash Receivable Retained Earnings Income A) +25 +25 +25 b. BALANCE SHEET INCOME STATEMENT STOCKHOLDER'S ASSETS = LIABILITIES + EQUITY REVENUE - EXPENSE Notes Notes Interest Interest Cash Receivable Payable Retained Earnings Income Expense B) +25 -25 C. BALANCE SHEET INCOME STATEMENT STOCKHOLDER'S ASSETS - LIABILITIES + EQUITY REVENUE - EXPENSE Notes Notes Interest Interest Cash Receivable Payable Retained Earnings Income Expense C) -25 -25 -25 O d. BALANCE SHEET INCOME STATEMENT STOCKHOLDER'S ASSETS - LIABILITIES + EQUITY REVENUE - EXPENSE Notes Notes Interest Interest Cash Receivable Payable Retained Earnings Income Expense D) +25 +25 +25 e. None of the above

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 4SEB: FINANCIAL RATIOS Based on the financial statements, shown on pages 603604, for McDonald Carpeting...

Related questions

Question

How do I solve this?

Transcribed Image Text:Well Company paid Being Company for merchandise with a $4,500, 90-day, 10% note dated December 11. What is the financial statement effect to Being Company at the end of the accounting period on December 31?

Select one:

а.

BALANCE SHEET

INCOME STATEMENT

STOCKHOLDER'S

ASSETS

= LIABILITIES +

EQUITY

REVENUE

EXPENSE

Interest

Interest

Cash Receivable

Retained Earnings Income

A)

+25

+25

+25

b.

BALANCE SHEET

INCOME STATEMENT

STOCKHOLDER'S

ASSETS

= LIABILITIES +

EQUITY

REVENUE

EXPENSE

Notes

Notes

Interest

Interest

Cash Receivable

Payable

Retained Earnings Income

Expense

B)

+25

-25

С.

BALANCE SHEET

INCOME STATEMENT

STOCKHOLDER'S

ASSETS

= LIABILITIES +

EQUITY

REVENUE

ΕXPENSE

Notes

Notes

Interest

Interest

Cash Receivable

Payable

Retained Earnings Income

Expense

C)

-25

-25

-25

d.

BALANCE SHEET

INCOME STATEMENT

STOCKHOLDER'S

ASSETS

= LIABILITIES +

EQUITY

REVENUE

EXPENSE

Notes

Notes

Interest

Interest

Cash Receivable

Payable

Retained Earnings Income

Expense

D)

+25

+25

+25

e. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning