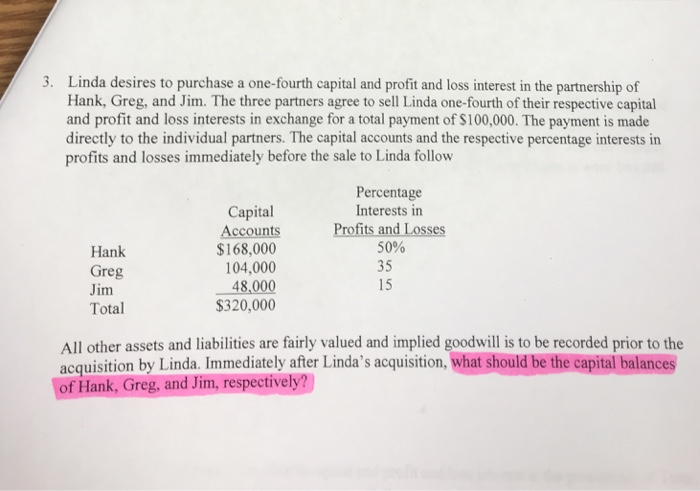

Linda desires to purchase a one-fourth capital and profit and loss interest in the partnership of Hank, Greg, and Jim. The three partners agree to sell Linda one-fourth of their respective capital and profit and loss interests in exchange for a total payment of $100,000. The payment is made directly to the individual partners. The capital accounts and the respective percentage interests in profits and losses immediately before the sale to Linda follow Capital Accounts $168,000 104,000 48,000 $320,000 Percentage Interests in Profits and Losses 50% 35 Hank Greg Jim Total 15

Linda desires to purchase a one-fourth capital and profit and loss interest in the partnership of Hank, Greg, and Jim. The three partners agree to sell Linda one-fourth of their respective capital and profit and loss interests in exchange for a total payment of $100,000. The payment is made directly to the individual partners. The capital accounts and the respective percentage interests in profits and losses immediately before the sale to Linda follow Capital Accounts $168,000 104,000 48,000 $320,000 Percentage Interests in Profits and Losses 50% 35 Hank Greg Jim Total 15

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 25P

Related questions

Question

100%

Give me answer within an hour please I will give upvotes ita very urgent ...thankyou...

Transcribed Image Text:3. Linda desires to purchase a one-fourth capital and profit and loss interest in the partnership of

Hank, Greg, and Jim. The three partners agree to sell Linda one-fourth of their respective capital

and profit and loss interests in exchange for a total payment of S100,000. The payment is made

directly to the individual partners. The capital accounts and the respective percentage interests in

profits and losses immediately before the sale to Linda follow

Capital

Accounts

$168,000

104,000

48,000

$320,000

Percentage

Interests in

Profits and Losses

50%

35

Hank

Greg

Jim

Total

15

All other assets and liabilities are fairly valued and implied goodwill is to be recorded prior to the

acquisition by Linda. Immediately after Linda's acquisition, what should be the capital balances

of Hank, Greg, and Jim, respectively?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you