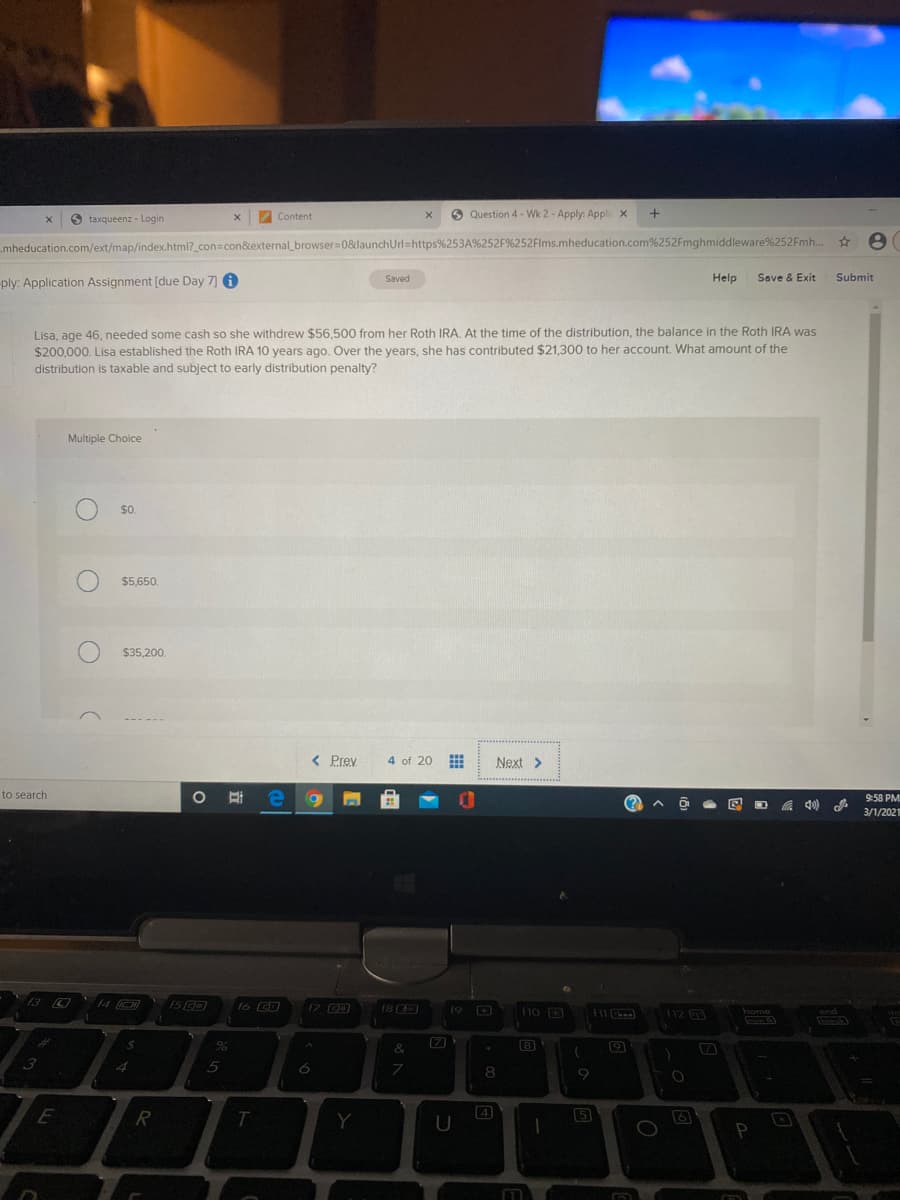

Lisa, age 46, needed some cash so she withdrew $56,500 from her Roth IRA At the time of the distribution, the balance in the Roth IRA was $200,000. Lisa established the Roth IRA 10 years ago. Over the years, she has contributed $21,300 to her account. What amount of the distribution is taxable and subject to early distribution penalty? Multiple Choice $0. $5,650 $35,200.

Lisa, age 46, needed some cash so she withdrew $56,500 from her Roth IRA At the time of the distribution, the balance in the Roth IRA was $200,000. Lisa established the Roth IRA 10 years ago. Over the years, she has contributed $21,300 to her account. What amount of the distribution is taxable and subject to early distribution penalty? Multiple Choice $0. $5,650 $35,200.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter15: Preparing Adjusting Entries And A Trial Balance

Section: Chapter Questions

Problem 4AP

Related questions

Question

Transcribed Image Text:O taxqueenz - Login

Content

O Question 4 - Wk 2 - Apply: Appli x

mheducation.com/ext/map/index.html?_con=con&external_browser=08&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fmh..

ply: Application Assignment [due Day 7 A

Saved

Help

Save & Exit

Submit

Lisa, age 46, needed some cash so she withdrew $56,500 from her Roth IRA, At the time of the distribution, the balance in the Roth IRA was

$200,000. Lisa established the Roth IRA 10 years ago. Over the years, she has contributed $21,300 to her account. What amount of the

distribution is taxable and subject to early distribution penalty?

Multiple Choice

$5,650.

$35,200.

< Prey

4 of 20

Next >

O # e 9

to search

9:58 PM

(?

3/1/2021

13 O

14 O

1S

17 C

18 C

19 D

f10 D

f11

home

end

[7

8

3

8

R

T.

4

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning