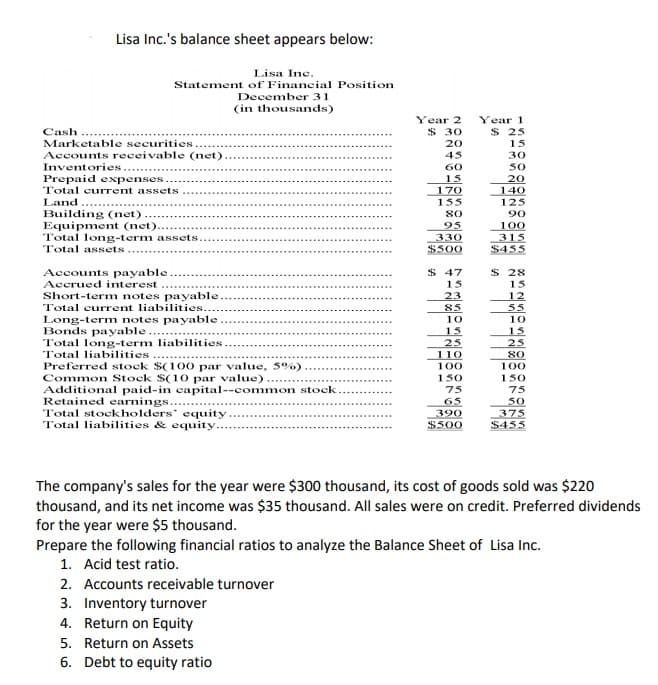

Lisa Inc.'s balance sheet appears below: Lisa Inc. Statement of Financial Position December 31 (in thousands) Year 2 Year 1 Cash $ 30 $ 25 Marketable securities. Accounts receivable (net) Inventories... Prepaid expenses Total current assets Land.. Building (net) Equipment (net). Total long-term assets. Total assets 20 15 45 30 30 20 140 125 60 15 170 155 80 90 95 330 $500 100 315 $455 Accounts payable Accrued interest Short-term notes payable. $ 47 15 23 85 $ 28 15 12 55 10 Total current liabilities... Long-term notes payable Bonds payable. Total long-term liabilities Total liabilities 10 15 25 110 100 15 25 80 100 Preferred stock $(100 par value, 5%) Common Stock S(10 par value) Additional paid-in capital--common stock. Retained earnings... Total stockholders equity Total liabilities & equity. 150 150 75 75 65 390 $500 50 375 $455 The company's sales for the year were $300 thousand, its cost of goods sold was $220 thousand, and its net income was $35 thousand. All sales were on credit. Preferred dividends for the year were $5 thousand. Prepare the following financial ratios to analyze the Balance Sheet of Lisa Inc. 1. Acid test ratio. 2. Accounts receivable turnover 3. Inventory turnover

Lisa Inc.'s balance sheet appears below: Lisa Inc. Statement of Financial Position December 31 (in thousands) Year 2 Year 1 Cash $ 30 $ 25 Marketable securities. Accounts receivable (net) Inventories... Prepaid expenses Total current assets Land.. Building (net) Equipment (net). Total long-term assets. Total assets 20 15 45 30 30 20 140 125 60 15 170 155 80 90 95 330 $500 100 315 $455 Accounts payable Accrued interest Short-term notes payable. $ 47 15 23 85 $ 28 15 12 55 10 Total current liabilities... Long-term notes payable Bonds payable. Total long-term liabilities Total liabilities 10 15 25 110 100 15 25 80 100 Preferred stock $(100 par value, 5%) Common Stock S(10 par value) Additional paid-in capital--common stock. Retained earnings... Total stockholders equity Total liabilities & equity. 150 150 75 75 65 390 $500 50 375 $455 The company's sales for the year were $300 thousand, its cost of goods sold was $220 thousand, and its net income was $35 thousand. All sales were on credit. Preferred dividends for the year were $5 thousand. Prepare the following financial ratios to analyze the Balance Sheet of Lisa Inc. 1. Acid test ratio. 2. Accounts receivable turnover 3. Inventory turnover

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13P: Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and...

Related questions

Question

I'm stuck with my assignment. It would be a big help if you could help me thank you so much!

Transcribed Image Text:Lisa Inc.'s balance sheet appears below:

Lisa Inc.

Statement of Financial Position

December 31

(in thousands)

Year 2

Year 1

Cash

$ 30

$ 25

Marketable securities

20

15

Accounts receivable (net)

45

30

Inventories....

Prepaid expenses

Total current assets

Land

Building (net)

Equipment (net)..

Total long-term assets

Total assets

50

20

140

125

60

15

170

155

80

90

95

330

$500

100

315

$455

$ 47

15

23

85

$ 28

Accounts payable

Accrued interest

Short-term notes payable

15

12

55

Total current liabilities.

Long-term notes payable

Bonds payable

Total long-term liabilities

Total liabilities

10

10

15

25

110

15

25

80

Preferred stock $(100 par value, 5%)

Common Stock S(10 par value)

Additional paid-in capital--common stock

Retained earnings....

Total stockholders' equity

Total liabilities & equity.

100

100

150

150

75

75

65

390

$500

50

375

$455

The company's sales for the year were $300 thousand, its cost of goods sold was $220

thousand, and its net income was $35 thousand. All sales were on credit. Preferred dividends

for the year were $5 thousand.

Prepare the following financial ratios to analyze the Balance Sheet of Lisa Inc.

1. Acid test ratio.

2. Accounts receivable turnover

3. Inventory turnover

4. Return on Equity

5. Return on Assets

6. Debt to equity ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning