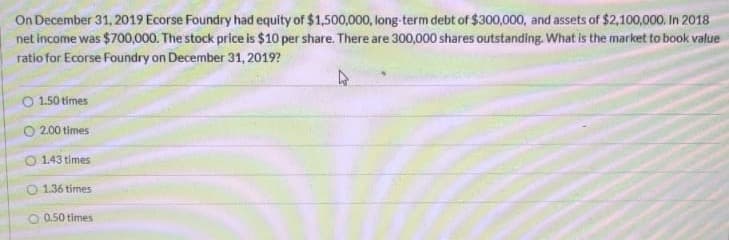

On December 31, 2019 Ecorse Foundry had equity of $1,500,000, long-term debt of $300,000, and assets of $2,100,000. In 2018 net income was $700,000. The stock price is $10 per share. There are 300,000 shares outstanding. What is the market to book value ratio for Ecorse Foundry on December 31, 2019? O 1.50 times O 2.00 times O 143 times O 1.36 times O 0.50 times

Q: During 2019, Minh Corporation had a net income of $144,000. Ordinary share capital was $200,000…

A: Cash flow statement is a statement which is prepared to find out the cash comes in and goes out , by…

Q: common stock was $30 last night. Calculate the following. (Round all answers to two decimal places…

A: 1) Current yield = (Dividend in year 1 / price) * 100 Current yield = (0.65 / 30) * 100 Current…

Q: LOCKDOWN Corp. has the ending balances as December 31, 2020: Cash - 110,000 Fixed Assets - 155. 000;…

A: "Since you have asked multiple questions, we will solve the first question for you". If you want any…

Q: a) Compute diluted earnings per share. (Round answer to 2 decimal places, e.g. $2.55.) Diluted…

A:

Q: Here is financial information for Glitter Inc. December 31, 2020 December 31, 2019 Current…

A: Horizontal analysis is the analysis made out of the comparison of financial statements for multiple…

Q: Cullumber Company had the following assets and liabilities on the dates indicated. December 31…

A: Stockholders’ equity is the measure of assets staying in a business after the sum total of the…

Q: The ledger of Sadaf Oman Company showed the following final balances at the end of the year 2020…

A: Accounts Debit Credit Share capital 4200 Accounts payable 4800 Reserve 63000 Expense…

Q: Here is financial information for Metlock, Inc.. Please explain as well :) December 31, 2020…

A: Lets understand the basics. There are two type of analysis are made by the management which are, (1)…

Q: Suppose that in April 2019, Nike Inc. had sales of $36,312 million, EBITDA of $5,217 million, excess…

A: a) Nike' share price can be calculated using the below formula, where Average EV to sales multiple =…

Q: Lansbury Inc. had the following balance sheet at December 31, 2019. Lansbury Inc.Balance…

A: a.

Q: Venzuela Company's net income for 2020 is $50,000. The only potentially dilutive securities…

A: Amount paid towards shares = Options issued * Exercise price per share = 1,000 * 6 = $ 6,000 Value…

Q: The market price of Jergan's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020,…

A: *As per bartleby guideline in case of interlinked question answer first 3 only 1) Calculation of…

Q: Use the following information in the table below to answer the question: Blanc Blanc Financial Year…

A: The accounting return on equity (ROE) is calculated as net income divided by average shareholder…

Q: Terry Company began operations on January 1, 2019, with an investment of $62,000 by each of its two…

A: companies ending stockholders equity = opening equity + additions to equity stock during the year +…

Q: For 2020, the annual earnings for Eveready Security Equipment were $6,800,000. The corporation has…

A: A ratio that provides information regarding the share price of a company by relating it to the…

Q: answer the questions

A: a) Formula:

Q: During 2021, your firm reported net income of $600 and paid a $120 cash dividend. The Dec 31, 2020…

A: Retained earnings Balance on December 31, 2021 = Retained Earnings Balance on December 31, 2020 +…

Q: Use the following information in the table below to answer the question: Blanc Blanc Financial Year…

A: Calculate the book value per share (BVPS) in Year 2019 by dividing the total shareholders' equity…

Q: At the end of the year 2020, the common equity was 490,000, and the dividends paid in the year 2021…

A: Free cash flow to equity = Common equity 2021- common equity 2020 - dividends paid

Q: Castleman Holdings, Inc. had the following equity investment portfolio at January 1, 2020. Evers…

A: Journalize the entries for the given transactions:

Q: The December 31, 2018, balance sheet of Whelan, Inc., showed long-term debt of $1,380,000, $136,000…

A: The question is based on the concept of Financial Management.

Q: operating

A: Formula to calculate operating cashflows: Cashflow from assets + Net capital spending + Net change…

Q: On January 1, 2019, the total assets of the Dexter Company were $270 million. The firm'spresent…

A: Note : Since you have posted a question with multiple sub-parts, we will solve first three sub-parts…

Q: Flounder Company's net income for 2020 is $672,000, and 91.000 shares of common stock were issued…

A: The diluted earning per share is used to measure a company's earning per share by assuming that all…

Q: Neptune Corporation is preparing its December 31, 2018, balance sheet. The following items may be…

A: Assets are the tangible and intangible resources of the company which the company owns. Liabilities…

Q: In 2020, analytics showed that the current assets increased by 25%, noncurrent assets increased by…

A: Computation of book value as of December 2019:- Particulars Amount Current assets 15,00,000…

Q: dividends

A: Formula to calculate net income is given by: Net income = Increase in retained earnings + dividends…

Q: In December 2019, Al Muntar Co. had a share price of $39.20. They had 81.33 million shares…

A: Market capitalization is calculated multiplying current market value of the share with number of…

Q: Oman Company has 1,500 shares of stock outstanding. The price-earnings ratio for 2018 is 21. If the…

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: Oriole, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company 960…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Ayayai Company’s net income for 2020 is $52,900. The only potentially dilutive securities…

A: Proceeds from issue of options = 1,040 options x 1 share x $6 per share = $6,240 Number of shares…

Q: Prepare a partial balance sheet showing the investment-related amounts to be reported at December…

A: Ivanhoe, Inc. Partial Balance Sheet Particulars Dec 31, 2020 Dec 31, 2021 Current Asset…

Q: At year-end 2019, Waqar Pharma’s total assets were $3.25 million and itsaccounts payable were…

A: The following calculations are done in the records of Waqar Pharma for the increase and decrease in…

Q: Casello Mowing & Landscaping's year-end 2018 balance sheet lists current assets of $435,200, fixed…

A: Total Stockholder equity = Total Assets - Total Liabilities

Q: In January 2021, Tesla Inc shares were priced at $860. The value of the company at that stock price…

A: Price earning ratio- It is used for valuing a company and it is calculated as Market price of share…

Q: he financial statements of Friendly Fashions include the following selected data (in millions):…

A: Dividend Yield = Dividend per share/ Stock price per share Price Earnings Ratio = Market price per…

Q: Here is the income statement for Tamarisk, Inc. TAMARISK, INC. Income Statement For the Year Ended…

A: a. Compute earnings per share for 2020 as shown below:

Q: Ayayai Company’s net income for 2020 is $52,900. The only potentially dilutive securities…

A: GIVEN Ayayai Company’s net income for 2020 is $52,900. The only potentially dilutive securities…

Q: a.)Pharoah Company’s net income for 2020 is $709,000, and 94,000 shares of common stock were issued…

A: A) 94,000 shares was outstanding for period 12 months Net Income for 2020 $709000 stock…

Q: Selected balance sheet accounts for Tibbetts Company on September 30, 2019, are as follows: $ 48,000…

A: Working capital means difference between total current assets and total current liabilities. It is…

Q: Ivanhoe, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company…

A: SOLUTION- WORKING NOTES-1 SECURITIES COST FAIR VALUE UNREALIZED GAIN /LOSS EVERS COMPANY…

Q: Here is financial information for Glitter Inc. December 31, 2020 December 31, 2019 Current…

A: Horizontal analysis of the balance sheet shows changes in balances over the period and also…

Q: Answer the questions based on the Data Table.

A: (1) Calculation of the EPS:EPS can be calculated by the following formula:EPS = (Net Income –…

Q: Hera Company reported the following balances at December 31, 2019 Current Assets P1,500,000.00…

A: The shareholders equity is the difference between the assets and liabilities.

Q: Brooks Sporting Inc. is prepared to report the following 2019 income statement (shown in thousands…

A: Given information :- Company outstanding share 333,000 Current market price(P0 ) $41…

Q: Oriole, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company 960…

A: The stock price at December 31 , 2020 : Evers $ 18, Rogers $ 19, and Chance $ 9 The stock price at…

Q: Triumph's has 40,000 common shares outstanding during 2018. Requirement 1. Compute earnings per…

A: The following computations are done for Triumph's Companies.

Q: In 2021, Jake's Jamming Music, Inc., announced an ROA of 8.65 percent, ROE of 15.40 percent, and…

A: ROA = Net income / Total assets = 8.65%ROE = Net income / Total Equity = 15.40%Profit margin = Net…

Q: In 2018, Jake's Jamming Music, Inc. announced an ROA of 8.46 percent, ROE of 13.50 percent, and…

A: Return on assets and return on equity are also known as profitability ratios. These ratios show the…

Q: Pharoah Company’s net income for 2020 is $709,000, and 94,000 shares of common stock were issued and…

A: 28000 dilutive stock options would increase shares outstanding by 28000 Proceeds= 28000*20= $ 560000…

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

answer the questions

Step by step

Solved in 3 steps with 2 images

- Balance Sheet Calculations Cornerstone Development Companys balance sheet information at the end of 2019 and 2020 is provided in random order, as follows: Additional information: At the end of 2019, (a) the amount of long-term liabilities is twice the amount of current liabilities and (b) there are 2,900 shares of common stock outstanding. During 2020, the company (a) issued 100 shares of common stock for 25 per share, (b) earned net income of 20,600, and (c) paid dividends of 1 per share on the common stock outstanding at year-end. Required: Next Level Fill in the blanks lettered (a) through (p). All of the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?DIVIDENDS Brooks Sporting Inc. is prepared to report the following 2019 income statement (shown in thousands of dollars). Prior to reporting this income statement, the company wants to determine its annual dividend. The company has 320,000 shares of common stock outstanding, and its stock trades at 37 per share. a. The company had a 25% dividend payout ratio in 2018. If Brooks wants to maintain this payout ratio in 2019, what will be its per-share dividend in 2019? b. If the company maintains this 25% payout ratio, what will be the current dividend yield on the companys stock? c. The company reported net income of 1.35 million in 2018. Assume that the number of shares outstanding has remained constant. What was the companys per-share dividend in 2018? d. As an alternative to maintaining the same dividend payout ratio. Brooks is considering maintaining the same per-share dividend in 2019 that it paid in 2018. If it chooses this policy, what will be the companys dividend payout ratio in 2019? e. Assume that the company is interested in dramatically expanding its operations and that this expansion will require significant amounts of capital. The company would like to avoid transactions costs involved in issuing new equity. Given this scenario, would it make more sense for the company to maintain a constant dividend payout ratio or to maintain the same per-share dividend? Explain.Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73

- Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2 convertible securities outstanding at the end of 2019. These are: 1. Convertible preferred stock: 1,000 shares of 9%, 100 par, preferred stock were issued in 2015 for 140 per share. Each share of preferred stock is convertible into 3.5 shares of common stock. The current dividends have been paid. To date, no preferred stock has been converted. 2. Convertible bonds: Bonds with a face value of 100,000 and an interest rate of 10% were issued at par on July 1, 2019. Each 1,000 bond is convertible into 35 shares of common stock. To date, no bonds have been converted. Percy earned net income of 54,000 during 2019. Its income tax rate is 30%. Required: Compute the 2019 diluted earnings per share. What earnings per share amount(s) would Percy report on its 2019 income statement?