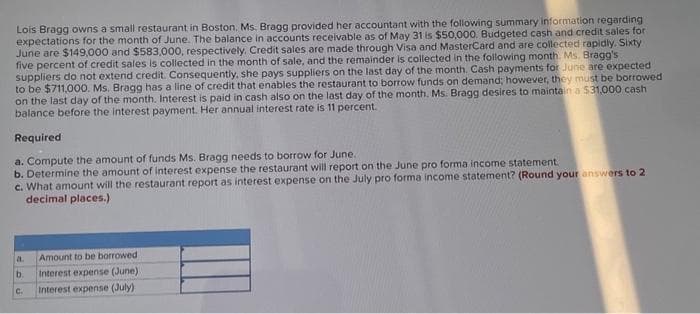

Lois Bragg owns a small restaurant in Boston. Ms. Bragg provided her accountant with the following summary information regarding expectations for the month of June. The balance in accounts receivable as of May 31 is $50,000. Budgeted cash and credit sales for June are $149,000 and $583,000, respectively. Credit sales are made through Visa and MasterCard and are collected rapidly. Sixty five percent of credit sales is collected in the month of sale, and the remainder is collected in the following month. Ms. Bragg's suppliers do not extend credit. Consequently, she pays suppliers on the last day of the month. Cash payments for June are expected to be $711,000. Ms. Bragg has a line of credit that enables the restaurant to borrow funds on demand; however, they must be borrowed on the last day of the month. Interest is paid in cash also on the last day of the month. Ms. Bragg desires to maintain a $31,000 cash balance before the interest payment. Her annual interest rate is 11 percent. Required a. Compute the amount of funds Ms. Bragg needs to borrow for June. b. Determine the amount of interest expense the restaurant will report on the June pro forma income statement. c. What amount will the restaurant report as interest expense on the July pro forma income statement? (Round your answers to 2. decimal places.) a. b C. Amount to be borrowed Interest expense (June). Interest expense (July).

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Subject - account

Please help me.

Thankyou.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images