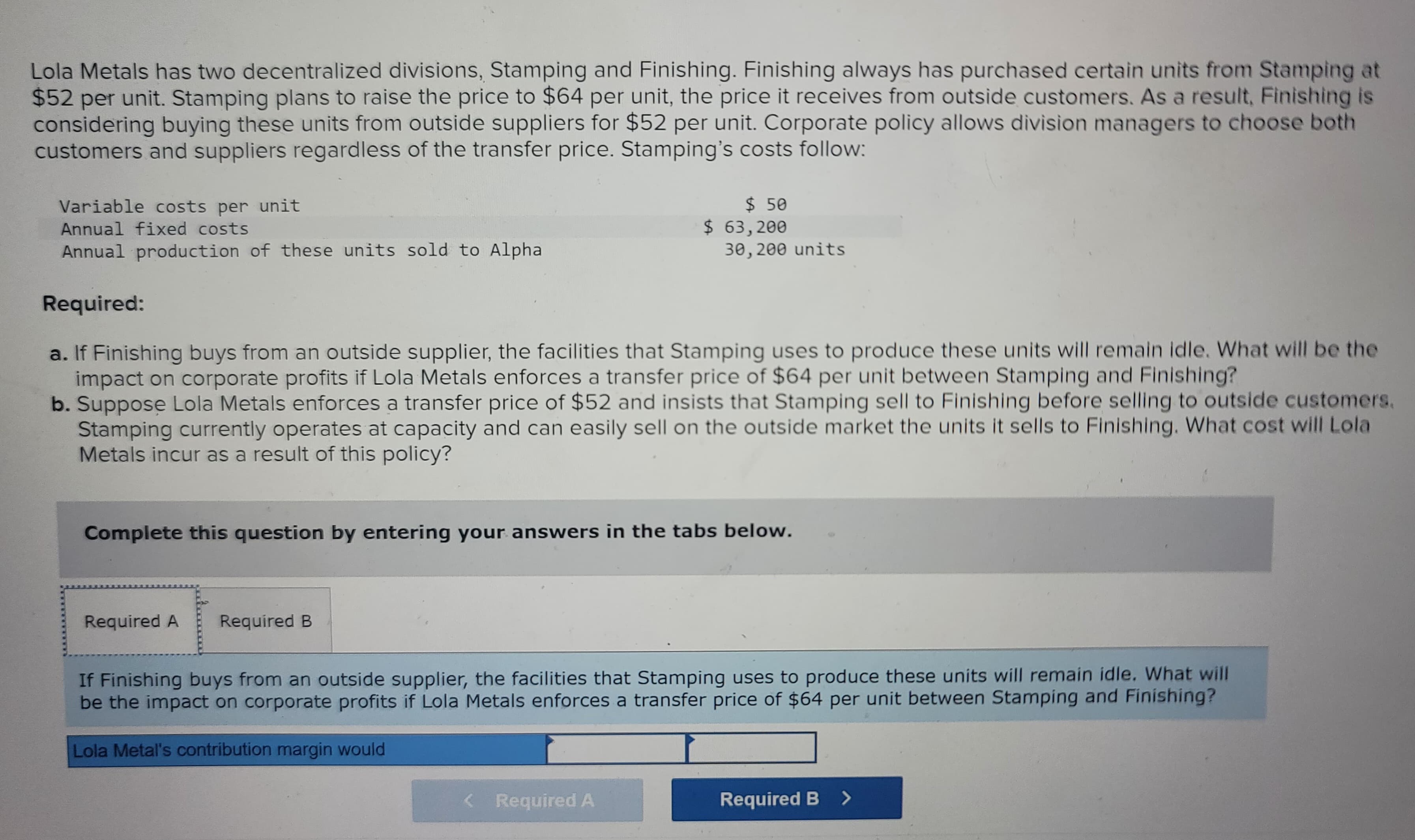

Lola Metals has two decentralized divisions, Stamping and Finishing. Finishing always has purchased certain units from Stamping at $52 per unit. Stamping plans to raise the price to $64 per unit, the price it receives from outside customers. As a result, Finishing is considering buying these units from outside suppliers for $52 per unit. Corporate policy allows division managers to choose both customers and suppliers regardless of the transfer price. Stamping's costs follow: Variable costs per unit Annual fixed costs Annual production of these units sold to Alpha $ 50 $ 63,200 30, 200 units Required: a. If Finishing buys from an outside supplier, the facilities that Stamping uses to produce these units will remain idle. What will be the impact on corporate profits if Lola Metals enforces a transfer price of $64 per unit between Stamping and Finishing? b. Suppose Lola Metals enforces a transfer price of $52 and insists that Stamping sell to Finishing before selling to outside customers. Stamping currently operates at capacity and can easily sell on the outside market the units it sells to Finishing. What cost will Lola Metals incur as a result of this policy?

Lola Metals has two decentralized divisions, Stamping and Finishing. Finishing always has purchased certain units from Stamping at $52 per unit. Stamping plans to raise the price to $64 per unit, the price it receives from outside customers. As a result, Finishing is considering buying these units from outside suppliers for $52 per unit. Corporate policy allows division managers to choose both customers and suppliers regardless of the transfer price. Stamping's costs follow: Variable costs per unit Annual fixed costs Annual production of these units sold to Alpha $ 50 $ 63,200 30, 200 units Required: a. If Finishing buys from an outside supplier, the facilities that Stamping uses to produce these units will remain idle. What will be the impact on corporate profits if Lola Metals enforces a transfer price of $64 per unit between Stamping and Finishing? b. Suppose Lola Metals enforces a transfer price of $52 and insists that Stamping sell to Finishing before selling to outside customers. Stamping currently operates at capacity and can easily sell on the outside market the units it sells to Finishing. What cost will Lola Metals incur as a result of this policy?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 17E: Materials used by the Instrument Division of Ziegler Inc. are currently purchased from outside...

Related questions

Question

100%

Transcribed Image Text:Lola Metals has two decentralized divisions, Stamping and Finishing. Finishing always has purchased certain units from Stamping at

$52 per unit. Stamping plans to raise the price to $64 per unit, the price it receives from outside customers. As a result, Finishing is

considering buying these units from outside suppliers for $52 per unit. Corporate policy allows division managers to choose both

customers and suppliers regardless of the transfer price. Stamping's costs follow:

Variable costs per unit

Annual fixed costs

Annual production of these units sold to Alpha

Required:

a. If Finishing buys from an outside supplier, the facilities that Stamping uses to produce these units will remain idle. What will be the

impact on corporate profits if Lola Metals enforces a transfer price of $64 per unit between Stamping and Finishing?

b. Suppose Lola Metals enforces a transfer price of $52 and insists that Stamping sell to Finishing before selling to outside customers.

Stamping currently operates at capacity and can easily sell on the outside market the units it sells to Finishing. What cost will Lola

Metals incur as a result of this policy?

Complete this question by entering your answers in the tabs below.

Required A

Required B

$ 50

$63,200

30,200 units

If Finishing buys from an outside supplier, the facilities that Stamping uses to produce these units will remain idle. What will

be the impact on corporate profits if Lola Metals enforces a transfer price of $64 per unit between Stamping and Finishing?

Lola Metal's contribution margin would

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning