loss carryovers or carrybacks). -,000) ▪,000) 6,750 2,000 ,500) 0,000 1 taxable income after the NOL deduction (assume it elects to carryback any NOLs it is all fter the NOL deduction S

loss carryovers or carrybacks). -,000) ▪,000) 6,750 2,000 ,500) 0,000 1 taxable income after the NOL deduction (assume it elects to carryback any NOLs it is all fter the NOL deduction S

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 62P

Related questions

Question

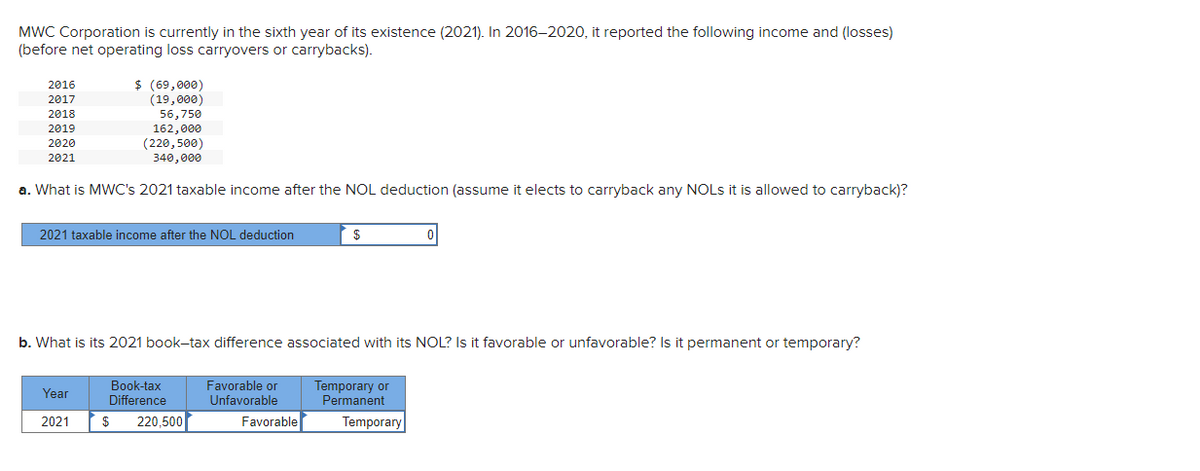

Transcribed Image Text:MWC Corporation is currently in the sixth year of its existence (2021). In 2016-2020, it reported the following income and (losses)

(before net operating loss carryovers or carrybacks).

2016

2017

2018

2019

2020

2021

$ (69,000)

(19,000)

56,750

162,000

(220, 500)

340,000

a. What is MWC's 2021 taxable income after the NOL deduction (assume it elects to carryback any NOLs it is allowed to carryback)?

2021 taxable income after the NOL deduction

Year

2021

b. What is its 2021 book-tax difference associated with its NOL? Is it favorable or unfavorable? Is it permanent or temporary?

Book-tax

Difference

$ 220,500

Favorable or

Unfavorable

$

Favorable

Temporary or

Permanent

0

Temporary

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you