Losses Based or Lewis Company uses th al credit sales which were $1,500,000 during the year. On December had a credit balance of $60,200 before adjustment.

Losses Based or Lewis Company uses th al credit sales which were $1,500,000 during the year. On December had a credit balance of $60,200 before adjustment.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 9SPA: UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the completion of the...

Related questions

Question

I can not figure out the last part of this question.

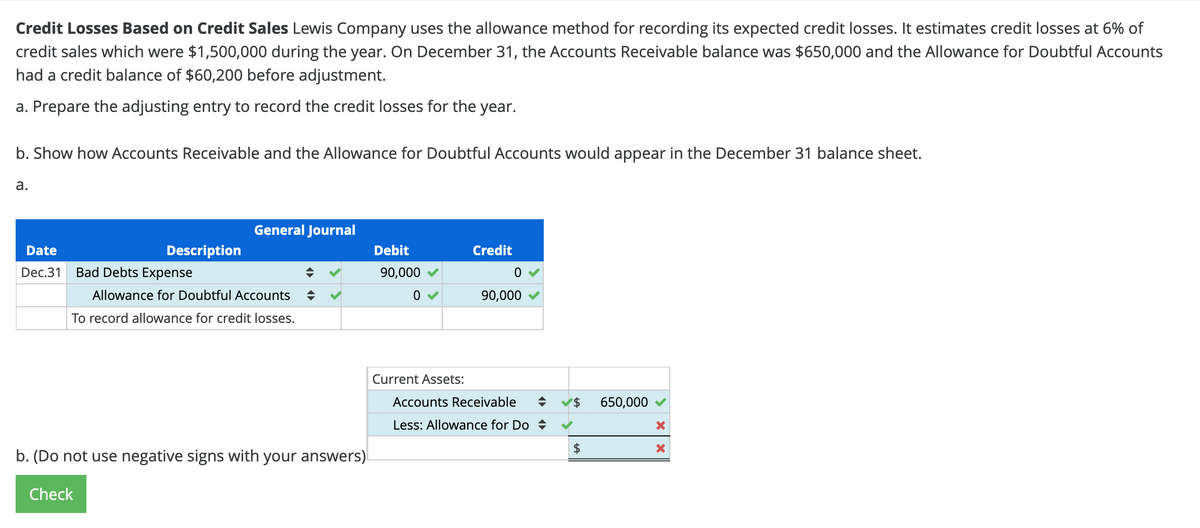

Transcribed Image Text:Credit Losses Based on Credit Sales Lewis Company uses the allowance method for recording its expected credit losses. It estimates credit losses at 6% of

credit sales which were $1,500,000 during the year. On December 31, the Accounts Receivable balance was $650,000 and the Allowance for Doubtful Accounts

had a credit balance of $60,200 before adjustment.

a. Prepare the adjusting entry to record the credit losses for the year.

b. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear in the December 31 balance sheet.

а.

General Journal

Date

Description

Debit

Credit

Dec.31

Bad Debts Expense

90,000

Allowance for Doubtful Accounts

90,000

To record allowance for credit losses.

Current Assets:

Accounts Receivable

650,000

Less: Allowance for Do +

b. (Do not use negative signs with your answers)

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,