LoneStar Co. is a manufacturing company that produces only one product, cowboy boots, has provided the following data concerning its operations in 2019 and 2020: 2019 was the company's first year of operations. In 2019 the company produced 1,000 pairs of cowboy boots and sold 900 pairs. The company sold boots at $250 a pair. The company incurred the following costs in 2019: direct materials of $70 a pair, direct labor costs of $20 a pair, variable selling and administrative of $5 a pair, variable manufacturing overhead of $10 a pair, and fixed manufacturing overhead of $20,000. Lastly, they paid $50,000 for fixed selling and administrative expenses. In 2020 selling price and all costs remained the same except that direct material costs went up by $5 a pair The company

LoneStar Co. is a manufacturing company that produces only one product, cowboy boots, has provided the following data concerning its operations in 2019 and 2020: 2019 was the company's first year of operations. In 2019 the company produced 1,000 pairs of cowboy boots and sold 900 pairs. The company sold boots at $250 a pair. The company incurred the following costs in 2019: direct materials of $70 a pair, direct labor costs of $20 a pair, variable selling and administrative of $5 a pair, variable manufacturing overhead of $10 a pair, and fixed manufacturing overhead of $20,000. Lastly, they paid $50,000 for fixed selling and administrative expenses. In 2020 selling price and all costs remained the same except that direct material costs went up by $5 a pair The company

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 4EB: Roper Furniture manufactures office furniture and tracks cost data across their process. The...

Related questions

Question

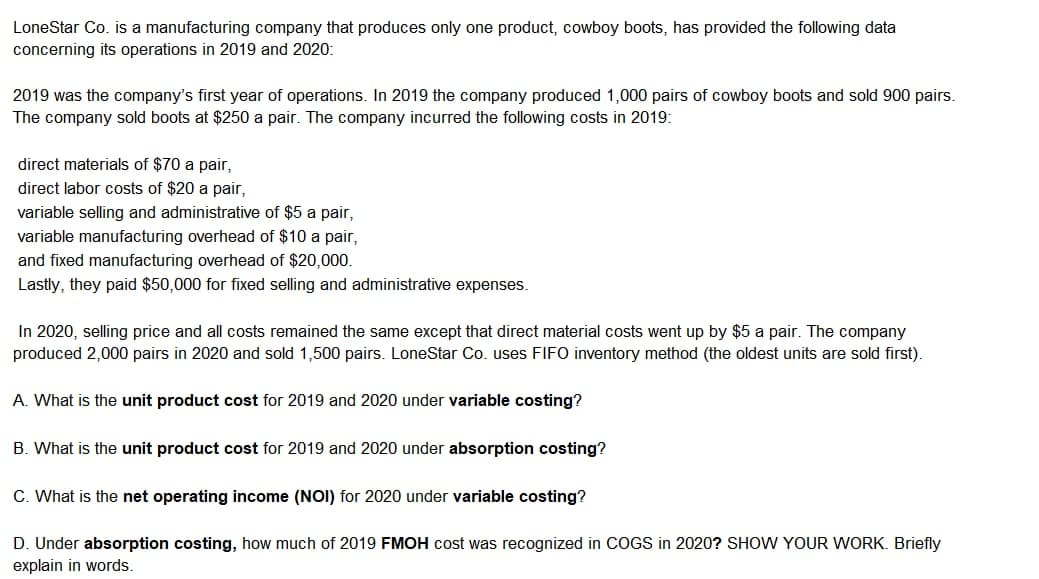

Transcribed Image Text:LoneStar Co. is a manufacturing company that produces only one product, cowboy boots, has provided the following data

concerning its operations in 2019 and 2020:

2019 was the company's first year of operations. In 2019 the company produced 1,000 pairs of cowboy boots and sold 900 pairs.

The company sold boots at $250 a pair. The company incurred the following costs in 2019:

direct materials of $70 a pair,

direct labor costs of $20 a pair,

variable selling and administrative of $5 a pair,

variable manufacturing overhead of $10 a pair,

and fixed manufacturing overhead of $20,000.

Lastly, they paid $50,000 for fixed selling and administrative expenses.

In 2020, selling price and all costs remained the same except that direct material costs went up by $5 a pair. The company

produced 2,000 pairs in 2020 and sold 1,500 pairs. LoneStar Co. uses FIFO inventory method (the oldest units are sold first).

A. What is the unit product cost for 2019 and 2020 under variable costing?

B. What is the unit product cost for 2019 and 2020 under absorption costing?

C. What is the net operating income (NOI) for 2020 under variable costing?

D. Under absorption costing, how much of 2019 FMOH cost was recognized in COGS in 2020? SHOW YOUR WORK. Briefly

explain in words.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,