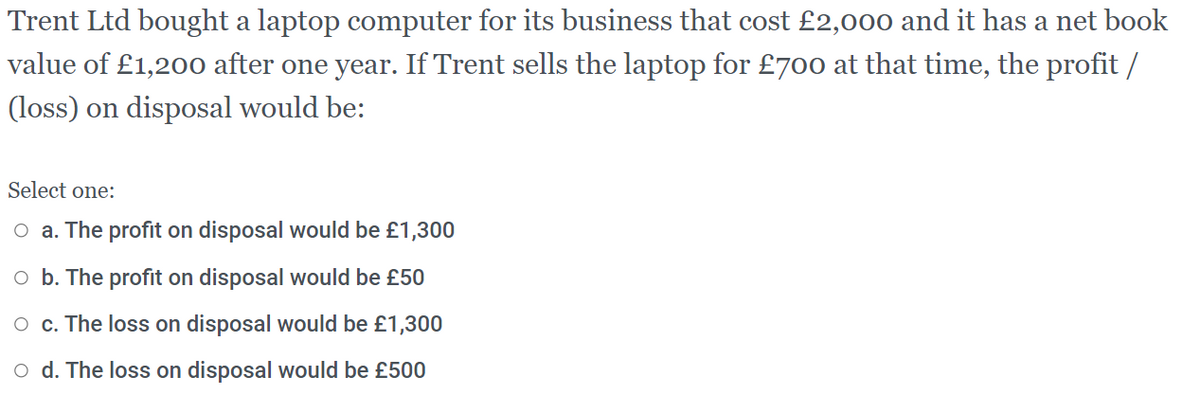

Ltd bought a laptop computer for its business that cost £2,000 and it has a net book value of £1,200 after one year. If Trent sells the laptop for £700 at that time, the profit / (loss) on disposal would be: Select one: O a. The profit on disposal would be £1,300 o b. The profit on disposal would be £50 O c. The loss on disposal would be £1,300 o d. The loss on disposal would be £500

Q: Paula bought a new flotation tank for $8,000. She must pay 5% sales tax and 7% excise tax. The…

A: Computation:Hence, the total purchase price of the flotation tank is $8,975.Answer: Option C

Q: Annie bought one dozen smartphones for 200,000.00 with a discount of 5%.she sold half a dozen at a…

A: The profit on a trade depends on the selling price and purchase price. If the overall sales of the…

Q: Bryan and Geena had purchased a house 10 years ago. They insured the house for RM650,000 with the…

A: Replacement cost coverage clause- It is a property insurance clause that is defined in the insurance…

Q: Molly purchased a franchise agreement to distribute electronic gadgets for 8 years. The agreement…

A: IRR is the rate at which the NPV of a project will become 0. A project can be accepted if the IRR is…

Q: 3

A: Introduction:- The Capital Cost Allowance (CCA) is a yearly deduction available under the Income Tax…

Q: Dan bought a hotel for $2,600,000 in January 2011. In May 2015, he died andleft the hotel to Ed.…

A: The estate tax is tax payable on the estates i.e. property owned by an individual. When a person…

Q: Mr Moosa has took a laptop (Which costs OMR 350) for lease from Mr Fahad for 11 months period. As Mr…

A: As per standard, Lessees will be required to recognize the right of use of asset and the lease…

Q: To purchase s11,700 worth of lab equipment for her business, Jenny made a down payment of s1600 and…

A: This is the case of an amortized loan. An amortized loan is that loan in which the periodic payments…

Q: Hayden Inc. has a number of copiers that were bought four years ago for $26,000. Currently…

A:

Q: Lee, a programmer, earned P350,000 in 2010, but in 2011, he began to manufacture computer monitors.…

A: Explicit costs are those that are plainly declared on the balance sheet of the company, whereas…

Q: Theresa is considering starting a small business. She plans to purchase equipment costing $149,000.…

A: Answer- Working Note- Calculation of Annual Net Cashflow generated by the business-…

Q: 4. Helmut gives Golda a house worth $700,000 in which Helmut has a basis of $650,000. The house has…

A: Property, Plant, and Equipment or PP&E is a classification shown on a balance sheet. It normally…

Q: Maria is a wedding planner. She purchases a laserjet printer for invitations, save-the-date…

A: Fixed assets: These are the assets which were used in the business for more than one year. These…

Q: Shannon purchased a franchise agreement to distribute electronic gadgets for 7 years. The agreement…

A: Given: Initial investment = $1,800,000 Cash inflow = $975,000 Year 1 and 2 cost = $800,000 Year 7…

Q: Ali, Ahmad and Sam shared and bought a Play Station III for RM1500. Each of them took turns to keep…

A: In partnership each partner have equal rights and equal responsibility and shared equally among all…

Q: X sold her principal residence for 5M when the market value was 6M. The house was purchased 4 years…

A: Capital gains arise when it is an appreciation in the value of capital assets. The gain realized on…

Q: Scrooge is thinking of selling his money lending business. He has been the sole owner for 6 years…

A: Howey test was given by Supreme court whether transactions qualified as security.There were…

Q: Chris purchased a new John Deere tractor for his farming business on 15 May 2018. He paid $45 000…

A: Depreciation is the value of asset, which has been used and we can find annual depreciation on fixed…

Q: Marigold Corp. has several outdated computers that cost a total of $17800 and could be sold as scrap…

A: It is pertinent to note that book value of outdated equipment is nothing but residual value or scrap…

Q: The firm paid $2,200,000 for the warehouse at that time. The owner, " Jack," (as the locals call…

A: Capital expenditure is the expense which is incurred for a long period of time. These expenses are…

Q: After Oliver Queen lost ownership of his company at Queen's consolidated, Mr. Queen no longer has…

A: Model A will take 12 years to surpass the cost of Model B that is 1 year of purchase cost and…

Q: Lee, a programmer, earned P350,000 in 2010, but in 2011, he began to manufacture computer monitors.…

A: An economic profit or loss seems to be the gap between the money earned from the selling of the…

Q: Lee, a programmer, earned P350,000 in 2010, but in 2011, he began to manufacture computer monitors.…

A: Implicit Cost: In economics, an implicit cost, also called an imputed cost and payment is not…

Q: A man formerly employed as chief mechanic of an automobile repair shop has saved P1,000,000.00 which…

A: Introduction:- A man who worked as the primary mechanic at an auto repair shop accumulated…

Q: This year, Barney and Betty sold their home (sales price $750,000; cost $200,000). All closing costs…

A: Capital gain on sales of home=Sale proceeds from the sale of the house-Cost of the home sold

Q: Hayden Inc. has a number of copiers that were bought four years ago for $25,000. Currently…

A: After tax salvage value After tax salvage value is calculated as shown below. After tax…

Q: In 2021 I bought 1/3 of ACO's Sushi House at BAM for 550,000TL. After 3 years I sold half of my…

A: Every investment is made for profit motive. Net benefit arise from the investment is called rate of…

Q: You have an opportunity to acquire a property from First Capital Bank. The bank recently obtained…

A: Property Costs $ 2,00,000.00 Acquisition related expenses $ 10,500.00 Repair…

Q: To purchase $11,500 worth of lab equipment for his business, Deon made a down payment of $1500 and…

A: The loan is the sum of money borrowed by the borrower from the lender, where the borrower agrees to…

Q: Maria is a wedding planner. She purchases a laserjet printer for invitations, save-the-date…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period. Example:…

Q: Aji Fatou is thinking about opening a hardware store. She estimates that it would cost $525,000 per…

A: Total revenue minus explicit and implicit (opportunity) costs equals economic profit. Accounting…

Q: A. Nenita Mendoza, who plans to go abroad, is selling her mini-donut business. Her friend Benita…

A: Net worth of the business means fair market value of assets of the business after deducting all…

Q: Lileth Adriano, who plans to go abroad, is selling her mini-donut business. Her friend, Benita…

A: The net worth of an business depends on the assets and liabilities the firm is having at a…

Q: You own a house that you rent for $1,700 per month. The maintenance expenses on the house average…

A:

Q: Valley Pizza’s owner bought his current pizza oven two years ago for $9,000, and it has one more…

A: Decision analysis: It can be defined as a process that is used by the decision-maker in selecting…

Q: Donna has Php35,000. She decided to buy a new gadget at Php30,000 and invested her remaining Php…

A: Given information: Investment is made to buy a gadget of Php 30,000 Remaining investment in an…

Q: The Tomlinsons decide to sell their home for $345,000. They are charged a real estate commission of…

A: Commission is charged on sale price

Q: Caleb buys a new laptop and decides to depreciate the value of the laptop by the reducing balance…

A: In this method depreciation rate is calculated at the beginning and depreciation will charge at each…

Q: Lee, a programmer, earned P350,000 in 2010, but in 2011, he began to manufacture computer monitors.…

A: Explicit costs are those that are plainly declared on the balance sheet of the company, whereas…

Q: (a) Find the payback period for this venture. (b) Calculate the net present value using a discount…

A: Information Provided: Discount rate = 8% Salvage = 40,000 Cost = 100,000

Q: You are considering opening your own restaurant. To do so, you will have to quit your current job,…

A: Direct cost (or explicit cost) is the cost that is incurred in monetary terms i.e. it actually…

Q: Lileth Adriano, who plans to go abroad, is selling her mini-donut business. Her friend, Benita…

A: Buying of the other business means to purchase a running business from the owner of the business who…

Q: Brandon buys a piece of equipment for $15,000. He pays $5,000 for upgrades in year 1 and the…

A: Capital budgeting refers to the evaluation of the profitability of potential investment and a set of…

Q: Mary sells her passive activity in 2020 for $450,000. She bought the activity in 2018 for $600,000.…

A: Passive activities are those activities from which income is earned by an individual but he was not…

Q: You own a house that costs $200,000 to build. You buy a compensate you for damage to the house. The…

A: The call seller, The insured person can use the insured service but has no obligation to use the…

How to do this? 9

Step by step

Solved in 2 steps

- Mr Adam wants to sell his car, which he purchased at RM 85,000 after using it for threeyears. The car is estimated to last for 8 years with a scrap value of RM 20,000. MrSalman has approached two used car dealers who are offering to sell his car based on thebook value. Both dealers use different method to calculate the depreciation. a)Dealer A is using the declining balance method. Construct the depreciation schedule for dealer A. b) Dealer B is using the sum of the year digits method. Construct the depreciation schedule for dealer B c) Comparing the book value for dealer A and dealer B, which dealer is offering abetter deal? Explain your answerUnited Ltd purchases a company car for £198,000 plus VAT at 17.5%. The car is expected to have a life of three years and a residual value of £90,000. Payment is made partly in cash and partly by trading in an old car with a net book value of £70,560 and a trade-in value of £54,000. The company uses the straight-line basis to depreciate its cars. What is the net book value of the car after one year? A £150,000 B £156,000 C £162,000 D £185,100The directors of Madura limited are contemplating the purchase of new machine to replace a machine which has been in operation in the factory for the last 5 years. Ignoring interest but considering tax at 50% of net earnings, suggest which of the two alternatives should be preferred. The following are the details: Details Old machine New machine Purchase price R40 000 R60 000 Useful life 10 years 10 years Running hours per year 2 000 2 000 Units per hour 24 36 Wages per running hour R3 R5.25 Power per annum R2 000 R4 500 Consumables per month R500 R625 All other charges per month R666.67 R750 Material cost per unit R0.50 R0.50 Selling price per unit R1.25 R1.25 Depreciation is charged on a straight line basis. Required: Compare accounting profits for both old and new machine. Assess the returns on i) original investment, ii) average investment method and return on incremental…

- A company buys a £300 computer in Year 1 and capitalizes the expenditure. Th e computer has a useful life of three years and an expected salvage value of £0, so the annualdepreciation expense using the straight-line method is £100 per year. Compared to expensing the entire £300 immediately, the company’s pretax profit in Year1 is £200 greater.1. Assume that the company continues to buy an identical computer each year at thesame price. If the company uses the same accounting treatment for each of the computers, when does the profit-enhancing eff ect of capitalizing versus expensing end?2. If the company buys another identical computer in Year 4, using the same accounting treatment as the prior years, what is the eff ect on Year 4 profits of capitalizingversus expensing these expenditures?Pebble Co. recently sold a used machine for P40,000. The machine had a book value of P60,000 at the time of the sale. What is the after-tax cash flow from the sale, assuming the company's marginal tax rate is 20 percent?An automobile purchases for use by the manager of a firm at a price of 24000 euros is to be depreciated using the straight-line method over 5 years. What will be the book value of the automobile at the end of 3 years (assume the scrap value is 0)? How can I solve something like that?

- Mr Adam wants to sell his car, which he purchased at RM 85,000 after using it for three years. The car is estimated to last for 8 years with a scrap value of RM 20,000. Mr Salman has approached two used car dealers who are offering to sell his car based on the book value. Both dealers use different method to calculate the depreciation a) Dealer A is using the declining balance method. Construct the depreciation schedule for dealer A.A company buys a machine for $180,000 that has an expected life of nine years and no salvage value. The company expects an annual net income (after taxes of 30%) of $8,550. What is the accounting rate of return? a. 4.75% c. 2.85% e. 6.65% b. 42.75% d. 9.50%Mr. Garcia sold his machine for P20,000 after using it for 6 years. He bought a new machine worth 75,000 with an expected life of 12 years and a salvage value of 2,000. The operating cost is P5,500 per year. The old machine which he bought for P50,000 when new will be useful for 10 years and a junk value of 1,000 but because of appropriate maintenance, it will be useful for another 5 years, no salvage value, with an annual operating cost of twice the new one. If money is worth 12%, was the engineer justified in selling the old machine? Use the ROR method.

- Kenzie Company purchased a 3-D printer for $318,000. Although this printer is expected to last for ten years, Kenzie knows the technology will become old quickly and so she plans to replace this printer in three years. Kenzie Company will be able to sell the printer for $30,000. Using the double-declining-balance method, what amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded? Round final answers to nearest whole dollar amount. DepreciationExpense BookValue Year 1 Year 2 Year 3Kenzie Company purchased a 3-D printer for $597,000. Although this printer is expected to last for ten years, Kenzie knows the technology will become old quickly and so she plans to replace this printer in three years. Kenzie Company will be able to sell the printer for $30,000. Using the double-declining-balance method, what amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded? Round final answers to nearest whole dollar amount. DepreciationExpense BookValue Year 1 $fill in the blank 1 $fill in the blank 2 Year 2 $fill in the blank 3 $fill in the blank 4 Year 3Kenzie Company purchased a 3-D printer for $597,000. Although this printer is expected to last for ten years, Kenzie knows the technology will become old quickly and so she plans to replace this printer in three years. Kenzie Company will be able to sell the printer for $30,000. Using the double-declining-balance method, what amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded? Round final answers to nearest whole dollar amount. DepreciationExpense BookValue Year 1 $fill in the blank 1 $fill in the blank 2 Year 2 $fill in the blank 3 $fill in the blank 4 Year 3 $fill in the blank 5 $fill in the blank 6