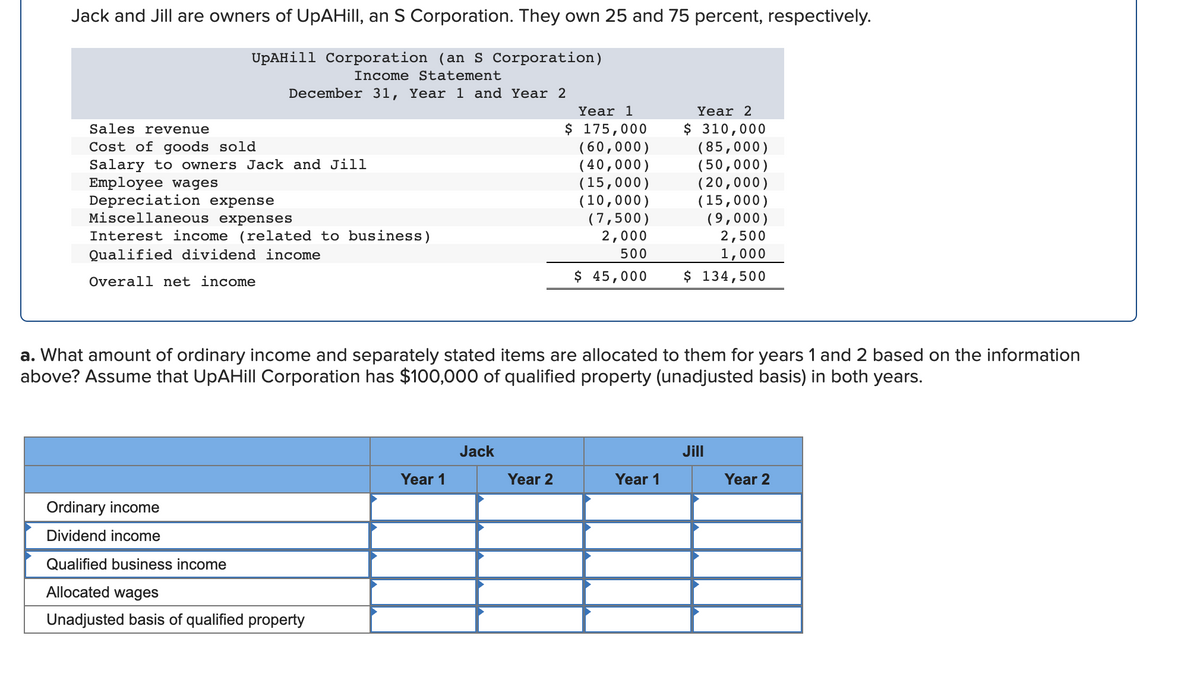

a. What amount of ordinary income and separately stated items are allocated to them for years 1 and 2 based on the information above? Assume that UpAHill Corporation has $100,000 of qualified property (unadjusted basis) in both years. Jack Jill Year 1 Year 2 Year 1 Year 2 Ordinary income Dividend income Qualified business income Allocated wages Unadjusted basis of qualified property

a. What amount of ordinary income and separately stated items are allocated to them for years 1 and 2 based on the information above? Assume that UpAHill Corporation has $100,000 of qualified property (unadjusted basis) in both years. Jack Jill Year 1 Year 2 Year 1 Year 2 Ordinary income Dividend income Qualified business income Allocated wages Unadjusted basis of qualified property

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 33P

Related questions

Question

Transcribed Image Text:Jack and Jill are owners of UpAHill, an S Corporation. They own 25 and 75 percent, respectively.

UpAHill Corporation (an S Corporation)

Income Statement

December 31, Year 1 and Year 2

Year 1

Year 2

$ 175,000

( 60,000)

( 40,000)

(15,000)

(10,000)

(7,500)

2,000

$ 310,000

(85,000)

( 50,000)

(20,000)

(15,000)

(9,000)

2,500

Sales revenue

Cost of goods sold

Salary to owners Jack and Jill

Employee wages

Depreciation expense

Miscellaneous expenses

Interest income (related to business)

Qualified dividend income

500

1,000

$ 134,500

Overall net income

$ 45,000

a. What amount of ordinary income and separately stated items are allocated to them for years 1 and 2 based on the information

above? Assume that UpAHill Corporation has $100,000 of qualified property (unadjusted basis) in both years.

Jack

Jill

Year 1

Year 2

Year 1

Year 2

Ordinary income

Dividend income

Qualified business income

Allocated wages

Unadjusted basis of qualified property

Expert Solution

Step 1

Solution:-

Given,

Jack and Jill are owners of Up A Hill, an S corporation.

Jack has = 25%

Jill = 75%

| Jack | Jill | |||

| Year-1 | Year-2 | Year-1 | Year-2 | |

| Ordinary Income | $11,125 | $33,375 | $33,375 | $100,125 |

| Qualified Business income | $11,125 | $33,375 | $33,375 | $100,125 |

| Dividend income | $125 | $250 | $375 | $750 |

| Allocated wages | $3,750 | $5,000 | $11,250 | $15,000 |

| Unadjusted basis of qualified property | $25,000 | $25,000 | $75,000 | $75,000 |

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you