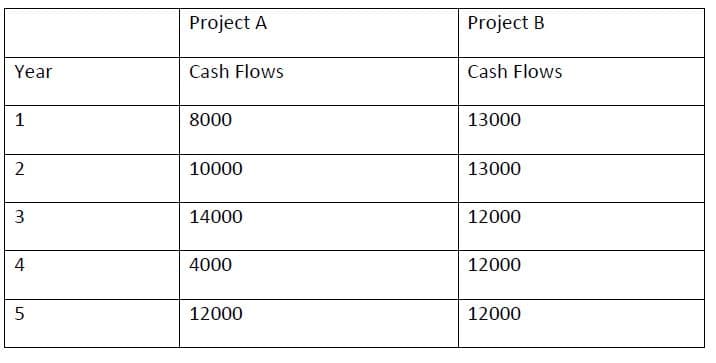

Majan Company considers to appraise two projects. The cost of capital is 8%. The Initial investment in Project A is OMR 42,000 and in Project B is OMR 36,000. The cash flows for the projects are as follows: You are required to: 1. Explain which project should be considered if the Majan Company want to recover the initial investment in less than 4 years’ time. 2. If Majan Company wants to appraise projects according to the current value of cash explain which project should be considered by Majan LLC in terms of current value.

Majan Company considers to appraise two projects. The cost of capital is 8%. The Initial investment in Project A is OMR 42,000 and in Project B is OMR 36,000. The cash flows for the projects are as follows: You are required to: 1. Explain which project should be considered if the Majan Company want to recover the initial investment in less than 4 years’ time. 2. If Majan Company wants to appraise projects according to the current value of cash explain which project should be considered by Majan LLC in terms of current value.

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter13: The Accounts Payable/cash Disbursements (ap/cd) Process

Section: Chapter Questions

Problem 10RQ: What is EIPP? How does it improve the efficiency and effectiveness of the AP/CD process?

Related questions

Question

100%

Majan Company considers to appraise two projects. The cost of capital is 8%. The Initial investment in Project A is OMR 42,000 and in Project B is OMR 36,000. The cash flows for the projects are as follows:

You are required to:

1. Explain which project should be considered if the Majan Company want to recover the initial investment in less than 4 years’ time.

2. If Majan Company wants to appraise projects according to the current value of cash explain which project should be considered by Majan LLC in terms of current value.

Transcribed Image Text:Project A

Project B

Year

Cash Flows

Cash Flows

8000

13000

2

10000

13000

14000

12000

4000

12000

12000

12000

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning