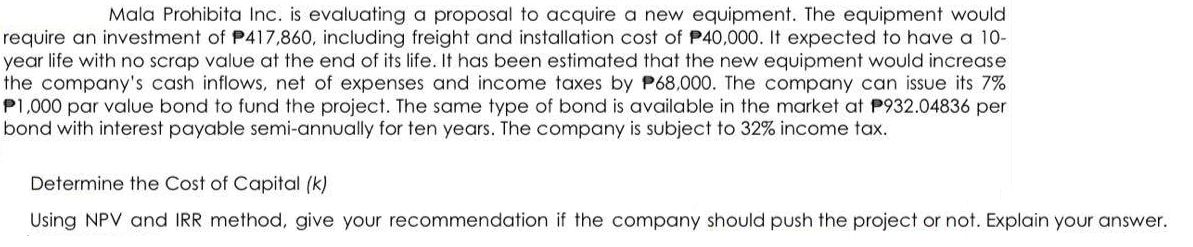

Mala Prohibita Inc. is evaluating a proposal to acquire a new equipment. The equipment would quire an investment of P417,860, including freight and installation cost of P40,000. It expected to have a 10- ar life with no scrap value at the end of its life. It has been estimated that the new equipment would increase e company's cash inflows, net of expenses and income taxes by P68,000. The company can issue its 7% ,000 par value bond to fund the project. The same type of bond is available in the market at P932.04836 per ond with interest payable semi-annually for ten years. The company is subject to 32% income tax. Determine the Cost of Capital (k) Using NPV and IRR method, give your recommendation if the company should push the project or not. Explain your answe

Mala Prohibita Inc. is evaluating a proposal to acquire a new equipment. The equipment would quire an investment of P417,860, including freight and installation cost of P40,000. It expected to have a 10- ar life with no scrap value at the end of its life. It has been estimated that the new equipment would increase e company's cash inflows, net of expenses and income taxes by P68,000. The company can issue its 7% ,000 par value bond to fund the project. The same type of bond is available in the market at P932.04836 per ond with interest payable semi-annually for ten years. The company is subject to 32% income tax. Determine the Cost of Capital (k) Using NPV and IRR method, give your recommendation if the company should push the project or not. Explain your answe

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:Mala Prohibita Inc. is evaluating a proposal to acquire a new equipment. The equipment would

require an investment of P417,860, including freight and installation cost of P40,000. It expected to have a 10-

year life with no scrap value at the end of its life. It has been estimated that the new equipment would increase

the company's cash inflows, net of expenses and income taxes by P68,000. The company can issue its 7%

P1,000 par value bond to fund the project. The same type of bond is available in the market at P932.04836 per

bond with interest payable semi-annually for ten years. The company is subject to 32% income tax.

Determine the Cost of Capital (k)

Using NPV and IRR method, give your recommendation if the company should push the project or not. Explain your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College