Marigold Corp., organized in 2022, has the following transactions related to intangible assets. 1/2/22 Purchased patent (7-year life) $528,500 4/1/22 Goodwill purchased (indefinite life) 360,000 7/1/22 Acquired 10-year franchise; expiration date 7/1/2032 380,000 9/1/22 Incurred research and development costs 171,000 Prepare the necessary entries to record these transactions. All costs incurred were for cash. Make the adjusting entries as of December 31, 2022, recording any necessary amortization.

Marigold Corp., organized in 2022, has the following transactions related to intangible assets. 1/2/22 Purchased patent (7-year life) $528,500 4/1/22 Goodwill purchased (indefinite life) 360,000 7/1/22 Acquired 10-year franchise; expiration date 7/1/2032 380,000 9/1/22 Incurred research and development costs 171,000 Prepare the necessary entries to record these transactions. All costs incurred were for cash. Make the adjusting entries as of December 31, 2022, recording any necessary amortization.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.19E: Effects of errors on financial statements If the net income for the current year had been $2224600...

Related questions

Question

I could really use some help with the last part of this problem it's been giving me a lot of trouble.

Marigold Corp., organized in 2022, has the following transactions related to intangible assets.

| 1/2/22 | Purchased patent (7-year life) | $528,500 | ||

| 4/1/22 | 360,000 | |||

| 7/1/22 | Acquired 10-year franchise; expiration date 7/1/2032 | 380,000 | ||

| 9/1/22 | Incurred research and development costs | 171,000 |

Prepare the necessary entries to record these transactions. All costs incurred were for cash. Make the

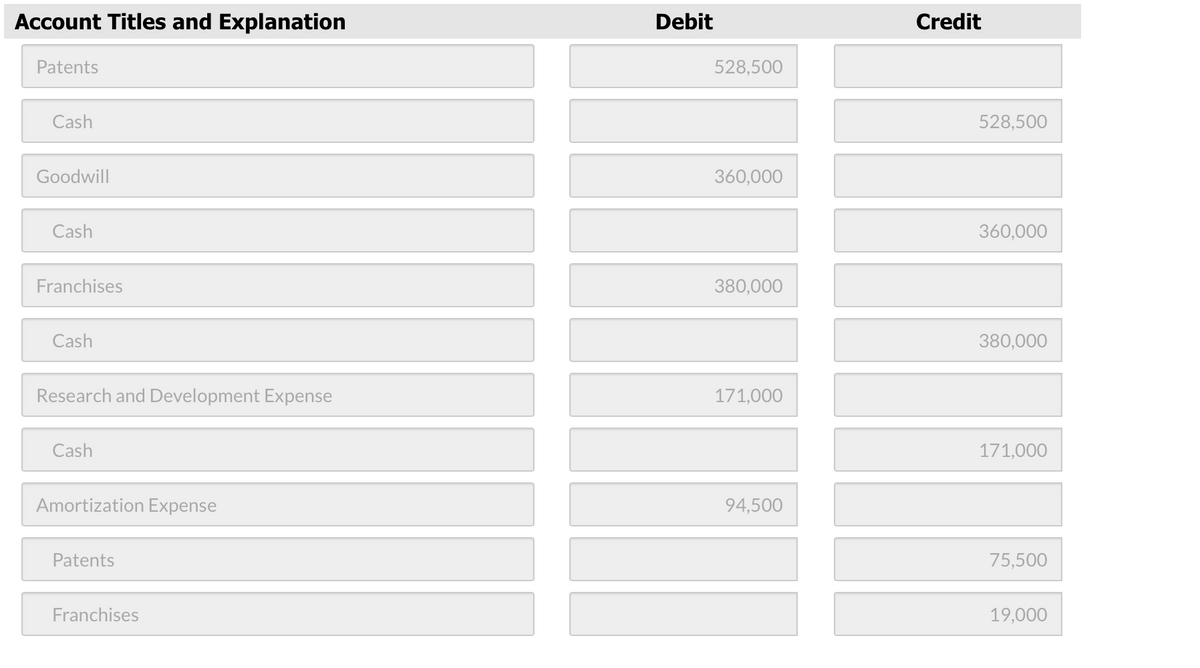

Transcribed Image Text:Account Titles and Explanation

Debit

Credit

Patents

528,500

Cash

528,500

Goodwill

360,000

Cash

360,000

Franchises

380,000

Cash

380,000

Research and Development Expense

171,000

Cash

171,000

Amortization Expense

94,500

Patents

75,500

Franchises

19,000

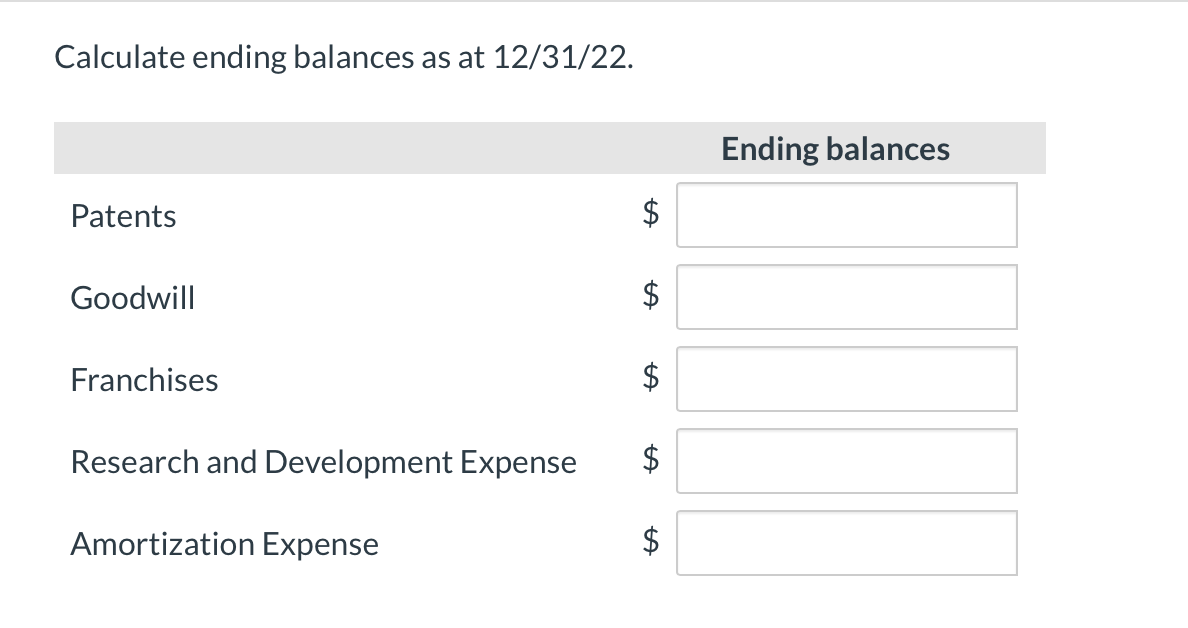

Transcribed Image Text:Calculate ending balances as at 12/31/22.

Ending balances

Patents

$

Goodwill

Franchises

Research and Development Expense

Amortization Expense

$

%24

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning