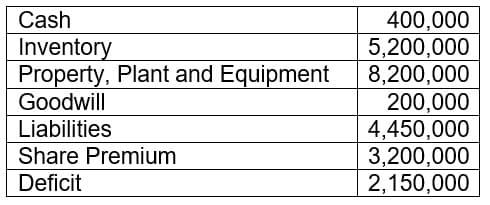

Mario Company has been incurring losses for several years. On December 31, 2019, the SEC permitted Mario to implement a quasi-reorganization after due approval from its shareholders and creditors. Its balance sheet before quasi-reorganization is as follows. [Refer to the figure] The quasi-reorganization plan provides the following: • The PPE shall be revalued at an appraised amount of P8,500,000. • Goodwill shall be written off in full. • Par value shall be reduced by forty percent. • The deficit shall be wiped out firstly from Revaluation Surplus and any unabsorbed amount from Share Premium. 1. How much is the total assets after the quasi-reorganization? 2. How much is the Share Premium after the quasi-reorganization? 3. How much is the Retained Earnings after the quasi-reorganization?

Mario Company has been incurring losses for several years. On December 31, 2019, the SEC permitted Mario to implement a quasi-reorganization after due approval from its shareholders and creditors. Its

The quasi-reorganization plan provides the following:

• The PPE shall be revalued at an appraised amount of P8,500,000.

•

• Par value shall be reduced by forty percent.

• The deficit shall be wiped out firstly from Revaluation Surplus and any unabsorbed amount from Share Premium.

1. How much is the total assets after the quasi-reorganization?

2. How much is the Share Premium after the quasi-reorganization?

3. How much is the

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images