Economics Today and Tomorrow, Student Edition

1st Edition

ISBN:9780078747663

Author:McGraw-Hill

Publisher:McGraw-Hill

Chapter4: Going Into Debt

Section4.1: Americans And Credit

Problem 1R

Related questions

Question

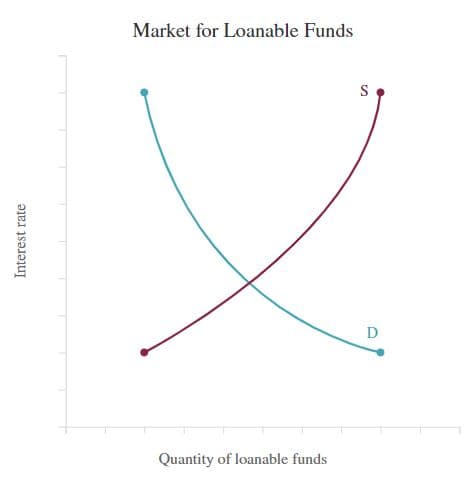

Collaboration with Congress during the Clinton Administration allowed for an aggressive deficit-cutting plan to pass. As a result, the government was able to reach a balanced budget at the end of the 90's.

Move the supply and/or

As a result, private investment should have

a) decreased as the cost of borrowing increased.

b) increased as the cost of borrowing increased.

c) increased because the cost of borrowing decreased.

d) decreased as the cost of borrowing decreased.

Transcribed Image Text:Market for Loanable Funds

S

D

Quantity of loanable funds

Interest rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co