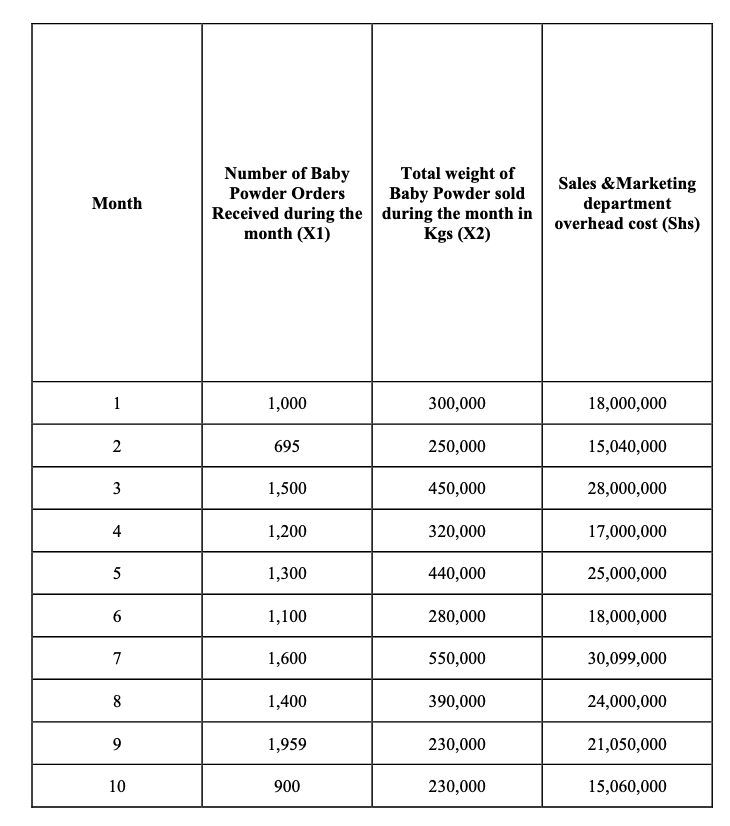

(a) The following information is extracted from the cost accounting records for Johnson & Johnson Ltd. To be able to control the Sales & Marketing department overhead cost the cost accounting department has been given the task of coming up with a cost function that can be used to estimate the Sales & Marketing department overhead cost. The cost accounting department identified two activity levels that can be used for prediction of the Sales & Marketing department overhead cost. The information was extracted from the cost accounting information system database for the last 10 months. The Sales & Marketing department overhead cost function can be derived using two activity levels; Number of Baby Powder Orders Received during the month (X1) and Total weight of Baby Powder sold during the month in Kgs (X2). Month 1 2 3 4 5 6 7 8 9 10 Number of Baby Powder Orders Received during the month (X1) 1,000 695 1,500 1,200 1,300 1,100 1,600 1,400 1,959 900 Total weight of Baby Powder sold during the month in Kgs (X2) 300,000 250,000 450,000 320,000 440,000 280,000 550,000 390,000 230,000 230,000 Sales & Marketing department overhead cost (Shs) 18,000,000 15,040,000 28,000,000 17,000,000 25,000,000 18,000,000 30,099,000 24,000,000 21,050,000 15,060,000

Hello! I posted this question and only the 3 subparts were solved kindly solve the remaining 2 parts

i) Using the high-low method derive the cost function that can be used to predict the Sales

&Marketing department

Received during the month (X1) as the activity level.

ii) Using the high-low method derive the cost function that can be used to predict the Sales

&Marketing department overhead cost using the Total weight of Baby Powder sold during

the month in Kgs (X2)as the activity level

iii) Using the cost function derived in (i) above using the Number of Baby Powder Orders

Received during the month (X1) as the activity level estimate the Sales &Marketing

department overhead cost for the month of September 2021 where the Number of Baby

Powder Orders Received is expected to be 1,800 orders

iv) Using the cost function derived in (ii) above using the Total weight of Baby Powder sold

during the month in Kgs (X2) as the activity level estimate the Sales &Marketing

departmentoverhead cost for the month of September 2021 where Total weight of Baby

Powder sold during the month in Kgs) expected to be 505,000 Kgs.

v) If the actual Sales and Marketing department overhead cost that was incurred during the

month of September 2021 was Shs 23,550,000 explain which of the two cost functions

derived in (i) using Number of Baby Powder Orders Received during the month (X1) as

the activity level and (ii) using the Total weight of Baby Powder sold during the month in

Kgs (X2) as the activity level is more accurate in predicting the Sales &Marketing

department overhead cost.

Step by step

Solved in 2 steps with 2 images