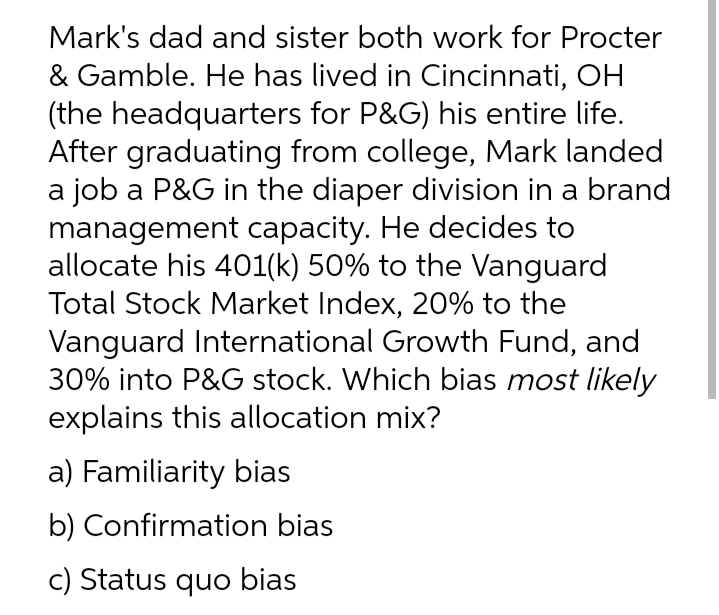

Mark's dad and sister both work for Procter & Gamble. He has lived in Cincinnati, OH (the headquarters for P&G) his entire life. After graduating from college, Mark landed a job a P&G in the diaper division in a brand management capacity. He decides to allocate his 401(k) 50% to the Vanguard Total Stock Market Index, 20% to the Vanguard International Growth Fund, and 30% into P&G stock. Which bias most likely explains this allocation mix? a) Familiarity bias b) Confirmation bias c) Status quo bias

Q: King Solomon is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns over…

A: Call Provision A contingent provision included in a bond indenture. It leads a bond issuer to a…

Q: King Solomon is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns…

A: The question is based on the calculation of present value of future cash flow to meet required…

Q: Lucas Mendes graduated from college six years ago with a finance bachelors (undergraduate) degree.…

A: Given, The appropriate discount rate is 5.5%

Q: If King Solomon is planning to make the first of 5 deposits one year from now, how large must each…

A: If the equal deposits are made by the investor for a specified period of time after a regular…

Q: purchased 2,000 units in a Canadian mutual fund company for $13,000. On April 29, 2021, he sold…

A: Capital loss will be offseted by capital gains and net gains will taxed.

Q: King Solomon is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns over…

A: Bond’s value is the present value of the all future cash flows from the bond. By discounting the…

Q: King Solomon is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns over…

A: The question is based on the calculation of future value, present value and concept of bond.

Q: Mable is a wealthy widow who has come to you for tax advice. She is in the 35 percent tax bracket.…

A: After-tax return=Tax-free interest rate1 - the taxpayer's tax rate=3.5%1-0.35=5.38%

Q: Allen Young has always been proud of his personal investment strategies and has done very well over…

A: A)- Decision table is given below- State of market Good Fair Bad Amount of…

Q: King Solomon is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Your grandfather is retired and living on his Social Security benefits and the interest he gets from…

A: A bond is a financial security that is sold by governments or big corporations to get borrowing…

Q: Diana sold mutual fund shares she had owned 4 years so that she could use to the proceeds to travel…

A: Given : Capital gain = $ 75258 Marginal tax bracket = 35% And , Capital gain tax rate = 15%

Q: Advise Sasha whether, and if so how, her interest in the restaurant company can be held through the…

A: The answer for the practical question is discussed hereunder :

Q: Three years ago, Kenesha purchased $10,000 worth of stock in major U.S. corporations. She spent…

A: Capital gains or losses arise when an investment is sold by the investor. If the investment is sold…

Q: tom is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns over 100,000…

A: Call provision: A call provision is a stipulation on the contract for a bond—or other fixed-income…

Q: Your clients, Adam and Amy Accrual, have a 21-year-old daughter named April. April is single and is…

A: In the above question we have asked about to sign declaration form for return or not which the help…

Q: Your uncle is ready to retire and head for the hills, so he says to you: “Look, I own 500 shares of…

A: QSBS or Qualified small business stock refers to shares of qualified small businesses whose gross…

Q: How could Samuel have received better tax consequences?

A: IRA stands for individual retirement account used by the financial bodies in the USA. The main…

Q: Sasha and Emi are two friends who met when they worked together as chefs at a famous restaurant in…

A: Sasha and Emi are two friends and decided to set up own restaurant in Adelaide. Each of them invest…

Q: Kenneth, 32 years old, is a business development manager working for a 2-year-old start-up company…

A: All amounts are in dollars ($). Note: It is assumed that financial ratios are:

Q: Adam Fleeman, a skilled carpenter, started a home improvement business with Tom Collins, a master…

A: Social Security tax refers to the tax which is implied on both employees and employers in order to…

Q: JoJo is a doctor by day but her favorite evening activity is her stock portfolio. She usually spends…

A: Income Tax is a tax imposed by the Government authorities on the incomes earned by individual and…

Q: Determine Abby's total AGI under both options for the current year and next year.

A: AGI the Adjusted Gross Income can be defined as the result of the deduction of specific deductions…

Q: Your long time client John is considering starting JMP, Corporation with his two colleagues, Mary…

A: A tax is a charge which a taxpayer has to give to the government as per pre defined tax slabs by the…

Q: Cara wants to make sure that her stock portfolio will not have to go through probate when she dies.…

A: Given, In this question, there are some substitutes for Cara to use and we have to choose the better…

Q: King Solomon is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns…

A: Retirement planning means deciding the amount which will be required for the retirement period and…

Q: e. Mac and Alana are in the 32 and 12 percent marginal tax brackets for ordinary income and in the…

A: Taxpayers are allowed for deductions of investment expenses and miscellaneous itemized deductions…

Q: Ms. Jones owns all of the shares of Jones Co. She has had the company valued and 50% of the shares…

A: In the given case, the 50% of the shares are worth $100,000 that means the worth of total shares : =…

Q: George is 22 years old and has recently completed a Bachelor of Commerce at A University. He has…

A:

Q: Peter, Brian and Marc, three brothers, were co-owners of Bug-Zappers Inc. They each owned 1,000…

A: Here discuss about the details of the capital gain taxable for the agreement between the cross…

Q: Harvey quit his job at State University where he earned $45,000 a year. He Figures his…

A: Cost of capital is amount you paid using the money.

Q: Mustafa Kurtulmuş has always been proud of his personal investment strategies and has done very well…

A: Given: The expected return on Certificate of deposit would always remain 9%, no matter whta is the…

Q: King Solomon is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns over…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Old Alfred Road, who is well-known to drivers on the Maine Turnpike, has reached his 70th birthday…

A: No, he cannot spend all the interest. If he spends all the interest, the value of his portfolio will…

Q: Lana, a single individual, was looking for an investment that would give some diversity to her stock…

A: Shares: Shares are the number of units held by a company as its stock. It is segregated into two…

Q: While studying, Miriam worked as student-assistant in their department. She graduated with honor and…

A: Capital is the amount of cash or liquid assets that are kept and held by a business in order to…

Q: Sam owns 1,500 shares of Eagle, Inc. stock that he purchased over 10 years ago for $80,000. Although…

A: Sam owns 1,500 shares of Eagle, Inc.Cost of share = $80,000.Current Market Value = $52,000

Q: Donna currently owns a large position in Facebook. She originally purchased the stock at $39.50 per…

A: A limit order is a tool in which an investor can specify the price at which the sell order would be…

Q: King Solomon is a rich farmer in Tetebia, a town in the Asou Municipal Assembly. He owns over…

A: The financial market is similar to any other market expect it only trades financial securities…

Q: Kate and Mark, a married couple, own a limited liability company. Although Kate and Mark are not yet…

A: C)A cross-purchase buy-sell agreement between Kate, Mark, and the children

Q: Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of…

A: >Net Present value or NPV analysis takes into account the present value of future cash flows to…

Q: bby, a single taxpayer, purchased 10,000 shares of § 1244 stock several years ago at a cost of $20…

A: As per section 1244, ordinary loss is allowed up to $50,000 for individual returns and up to…

Q: Kenneth, 32 years old, is a business development manager working for a 2-year-old start-up company…

A: Required: ⇔Personal Balance Sheet ⇔Income and Expenditure Statement

Q: Alec inherited ₱1,000,000 from his grandparents. He planned to invest it for his future. He was…

A: Introduction: In financial accounting, ownership interest refers to the extent to which one company…

Q: Tom and Harry are friends. Tom was injured in an accident and received a settlement. He is living…

A: Tom want money for his livelihood due to meeting an accident. Harry wants to purchase an asset, so…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Christopher regularly invests in internet company stocks, hoping to become wealthy by making an early investment in the next high-tech phenomenon. In 2012, Christopher purchased 3,000 shares of FlicksNet, a film rental company, for 15 per share shortly after the company went public. Because Christopher purchased the shares in their initial offering, the shares are qualified small business stock. In 2019, Christopher sold 800 of the shares (at 325 per share) so that he could purchase a reservation for a seat on 1-lon Musks first human mission to Mars. What regular income tax consequences and AMT consequences arise for Christopher as a result of the sale of these shares?Sarah Mix is a single 30-year-old business owner who has $500 a month toinvest. This money is in excess of the contribution to her company pensionplan. Sarah hears that many of her friends are investing in mutual funds. Hergrandfather, Grandpa Russ, invested in the stock market and lost everything.He advises her to invest only in bonds. Her uncle, Sam, thinks thatshe should invest in stock mutual funds, but only in conservatively managedfunds that invest in U.S. blue-chip stocks. Sarah notes that her Grandpais 70 years old and her uncle is 55 years old. Her friend Jane, who is also30 years old, said she only invests in small capital growth funds.a. What should you advise Sarah to invest in?b. Why do you think these people have different investment strategies?Allison and Leslie, who are twins, just received $35,000 each for their 26th birthday. They both have aspirations to become millionaires. Each plans to make a $5,000 annual contribution to her "early retirement fund" on her birthday, beginning a year from today. Allison opened an account with the Safety First Bond Fund, a mutual fund that invests in high-quality bonds whose investors have earned 8% per year in the past. Leslie invested in the New Issue Bio-Tech Fund, which invests in small, newly issued bio-tech stocks and whose investors have earned an average of 14% per year in the fund's relatively short history. If the two women’s funds earn the same returns in the future as in the past, how old will each be when she becomes a millionaire? Do not round intermediate calculations. Round your answers to two decimal places.Allison: yearsLeslie: years How large would Allison's annual contributions have to be for her to become a millionaire at the same age as Leslie, assuming…

- Allison and Leslie, who are twins, just received $20,000 each for their 27th birthdays. They both have aspirations to become millionaires. Each plans to make a $5,000 annual contribution to her "early retirement fund" on her birthday, beginning a year from today. Allison opened an account with the Safety First Bond Fund, a mutual fund that invests in high-quality bonds whose investors have earned 7% per year in the past. Leslie invested in the New Issue Bio-Tech Fund, which invests in small, newly issued bio-tech stocks and whose investors have earned an average of 17% per year in the fund's relatively short history. A. If Allison's fund earns the same returns in the future as in the past, how old will she be when she becomes a millionaire? Do not round intermediate calculations. Round your answer to two decimal places. B. If Leslie's fund earns the same returns in the future as in the past, how old will she be when she becomes a millionaire? Do not round intermediate calculations.…Allison and Leslie, who are twins, just received $20,000 each for their 24th birthday. They both have aspirations to become millionaires. Each plans to make a $5,000 annual contribution to her "early retirement fund" on her birthday, beginning a year from today. Allison opened an account with the Safety First Bond Fund, a mutual fund that invests in high-quality bonds whose investors have earned 8% per year in the past. Leslie invested in the New Issue Bio-Tech Fund, which invests in small, newly issued bio-tech stocks and whose investors have earned an average of 19% per year in the fund's relatively short history. If the two women’s funds earn the same returns in the future as in the past, how old will each be when she becomes a millionaire? Do not round intermediate calculations. Round your answers to two decimal places. Allison: years Leslie: years How large would Allison's annual contributions have to be for her to become a millionaire at the same age as Leslie,…Erika and Kitty, who are twins, just received $30,000 each for their 20th birthday. Theyboth have aspirations to become millionaires. Each plans to make a $5,000 annualcontribution to her “early retirement fund” on her birthday, beginning a year from today.Erika opened an account with the Safety First Bond Fund, a mutual fund that invests inhigh-quality bonds whose investors have earned 7% per year in the past. Kitty investedin the New Issue Bio-Tech Fund, which invests in small, newly issued bio-tech stocks andwhose investors have earned an average of 20% per year in the fund’s relatively shorthistory.a. If the two women’s funds earn the same returns in the future as in the past,how old will each be when she becomes a millionaire?b. How large would Erika’s annual contributions have to be for her to becomemillionaire at the same age as Kitty, assuming their expected returns arerealized?c. Is it rational or irrational for Erika to invest in the bond fund rather than instocks?

- JoJo is a doctor by day but her favorite evening activity is her stock portfolio. She usually spends at least a couple of hours every evening – sometimes a few hours on weekends, too – studying the market and deciding what stocks to buy, hold, or sell. JoJo started with $10,000 five years ago and is justifiably proud that she has grown her portfolio to more than $25,000 as of today. JoJo is your new tax return client. She clearly isn’t a “dealer,” so it’s up to you to analyze her portfolio-related activity and classify her for FIT purposes as either – an investor, or a trader. Which category do you conclude is the correct one for JoJo, and why?Raj Shah, aged 36 years, is employed with a MNC. His wife Pooja, aged 34 years, is also working part - time. The couple has two children - daughter Rima aged 7 years and son Ansh aged 4 years. Raj and Pooja require your help to make a few financial decisions. (You can make any assumptions to further build up your case)a. Raj and Pooja want to invest for their children’s higher education for the long term (over 12 to 15 years). Develop a plan so that they can accumulate a sufficient education corpus. b. Raj wants to take a Life Insurance cover of Rs 1.5 crore. Advise him whether he should go for a ULIP or a term insurance.Sarah and Mae, who are twins, just received P30,000 each for their 25th birthday. They both have aspirations to become millionaires. Each plan to make a P5,000 annual contribution to her “early retirement fund” on her birthday, beginning a year from today. Sarah opened an account with the First Bond Fund, a mutual fund that invests in high-quality bonds whose investors have earned 6% per year in the past. Mae invested in the New Issue Bio-Tech Fund, which invests in small, newly issued biotech stocks and whose investors have earned an average of 20% per year in the fund’s relatively short history. Post your Excel file here to answer the questions below: a. Draw a timeline of the cash flows. b. If the two women’s funds earn the same returns in the future as in the past, how old will each be when she becomes a millionaire? c. How large would Sarah’s annual contributions have to be for her to become a millionaire at the same age as Mae, assuming their expected returns are realized?

- Allison and Leslie, who are twins, just received $10,000 each for their 25th birthday. They both have aspirations to become millionaires. Each plans to make a $5,000 annual contribution to her “early retirement fund” on her birthday, beginning a year from today. Allison opened an account with the Safety First Bond Fund, a mutual fund that invests in high-quality bonds whose investors have earned 8% per year in the past. Leslie invested in the New Issue Bio-Tech Fund, which invests in small, newly issued bio-tech stocks and whose investors have earned an average of 13% per year in the fund’s relatively short history. If the two women’s funds earn the same returns in the future as in the past, how old will each be when she becomes a millionaire? How large would Allison’s annual contributions have to be for her to become a millionaire at the same age as Leslie, assuming their expected returns are realized? Is it rational or irrational for Allison to invest in the bond fund rather than in…Kelly is a diligent mother who has just finished supporting her two children, Susan, aged 23, and Randy, aged 25, through their university education. Both Susan and Randy have embarked on their careers and have moved out. Kelly wants to continue supporting them by providing financial assistance for their future endeavors, such as purchasing their first home or pursuing further education. She aims to give each of them an equal amount of money when they reach the age of 30. Currently, Kelly has $15,000 in savings, which she plans to allocate to Randy, as she will reach 30 first. She intends to provide Randy with $35,000. Kelly's investments generate a 6% return before tax, and her marginal tax rate is 35%. The inflation rate is estimated to be 3%.All savings are deposited at the end of the year.Required:(a) Calculate the annual savings Kelly needs to make to accumulate $35,000 to give to Randy when she turns 30.(b) Determine the fair amount Kelly should give to Susan when she reaches 30,…Kelly is a diligent mother who has just finished supporting her two children, Susan, aged 23, and Randy, aged 25, through their university education. Both Susan and Randy have embarked on their careers and have moved out. Kelly wants to continue supporting them by providing financial assistance for their future endeavors, such as purchasing their first home or pursuing further education. She aims to give each of them an equal amount of money when they reach the age of 30. Currently, Kelly has $15,000 in savings, which she plans to allocate to Randy, as she will reach 30 first. She intends to provide Randy with $35,000. Kelly's investments generate a 6% return before tax, and her marginal tax rate is 35%. The inflation rate is estimated to be 3%.All savings are deposited at the end of the year.Required:(a) Calculate the annual savings Kelly needs to make to accumulate $35,000 to give to Randy when she turns 30.(b) Determine the fair amount Inaaya should give to Susan when he reaches 30,…