mcertain tax positi 21, the IRS challen impact does the ser Explain.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 20DQ

Related questions

Question

Please Solve in 30mins

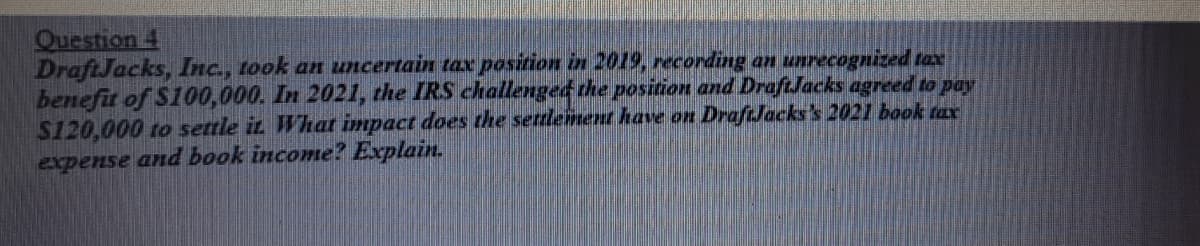

Transcribed Image Text:Question 4

DraftJacks, Inc., took an uncertain tax position in 2019, recording an unrecognized tax

benefit of S100,000. In 2021, the IRS challenged the position and DraftJacks agreed to pay

$120,000 to settle iz What impact does the settlement have on DraftJacks's 2021 book tax

expense and book income? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning