Finished goods. Other... Total inventories. 791 369 $3,266 851 348 $3,379 Required a. Identify the method Coca-Cola uses to report its inventories. Identify the method used for its cost basis. b. Is its method for the cost basis permitted under GAAP? Is it allowed for IRS income tax reporting?

Finished goods. Other... Total inventories. 791 369 $3,266 851 348 $3,379 Required a. Identify the method Coca-Cola uses to report its inventories. Identify the method used for its cost basis. b. Is its method for the cost basis permitted under GAAP? Is it allowed for IRS income tax reporting?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 2MAD: Analyzing process cost elements across product types Mystic Bottling Company bottles popular...

Related questions

Question

Dd2.

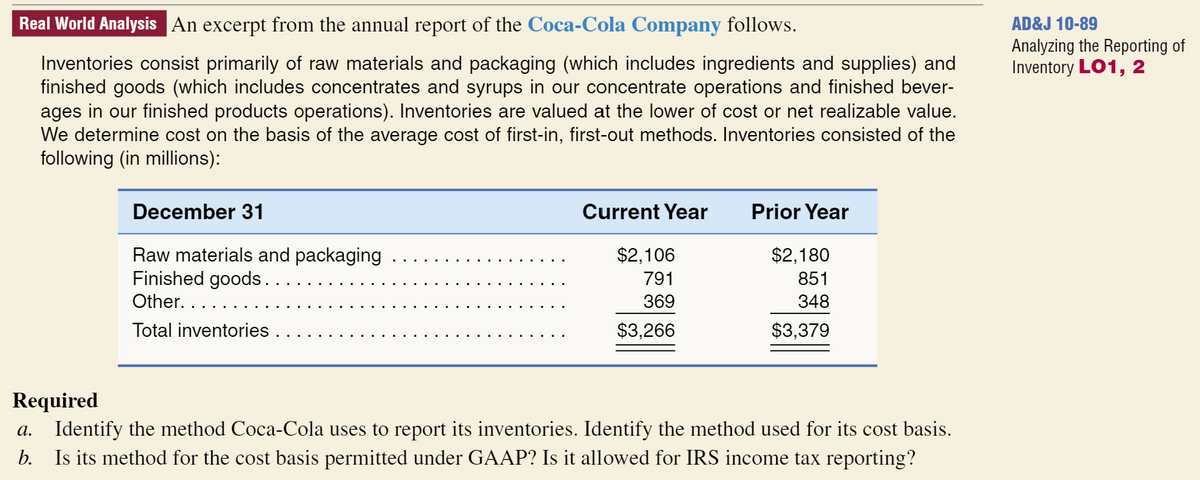

Transcribed Image Text:Real World Analysis An excerpt from the annual report of the Coca-Cola Company follows.

Inventories consist primarily of raw materials and packaging (which includes ingredients and supplies) and

finished goods (which includes concentrates and syrups in our concentrate operations and finished bever-

ages in our finished products operations). Inventories are valued at the lower of cost or net realizable value.

We determine cost on the basis of the average cost of first-in, first-out methods. Inventories consisted of the

following (in millions):

December 31

Raw materials and packaging

Finished goods.

Other.

Total inventories

Current Year

$2,106

791

369

$3,266

Prior Year

$2,180

851

348

$3,379

Required

a.

Identify the method Coca-Cola uses to report its inventories. Identify the method used for its cost basis.

b. Is its method for the cost basis permitted under GAAP? Is it allowed for IRS income tax reporting?

AD&J 10-89

Analyzing the Reporting of

Inventory LO1, 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College