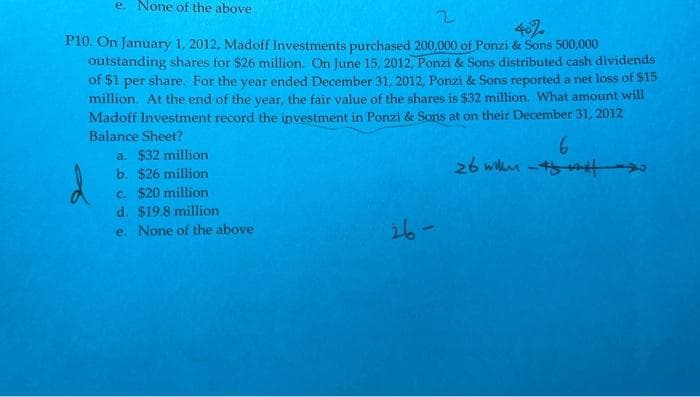

e. None of the above 2 40% P10. On January 1, 2012, Madoff Investments purchased 200,000 of Ponzi & Sons 500,000 outstanding shares for $26 million. On June 15, 2012, Ponzi & Sons distributed cash dividends of $1 per share. For the year ended December 31, 2012, Ponzi & Sons reported a net loss of $15 million. At the end of the year, the fair value of the shares is $32 million. What amount will Madoff Investment record the investment in Ponzi & Sons at on their December 31, 2012 Balance Sheet? 6 26 w5 a. $32 million b. $26 million c. $20 million d. $19.8 million e. None of the above 26-

e. None of the above 2 40% P10. On January 1, 2012, Madoff Investments purchased 200,000 of Ponzi & Sons 500,000 outstanding shares for $26 million. On June 15, 2012, Ponzi & Sons distributed cash dividends of $1 per share. For the year ended December 31, 2012, Ponzi & Sons reported a net loss of $15 million. At the end of the year, the fair value of the shares is $32 million. What amount will Madoff Investment record the investment in Ponzi & Sons at on their December 31, 2012 Balance Sheet? 6 26 w5 a. $32 million b. $26 million c. $20 million d. $19.8 million e. None of the above 26-

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 6MCQ: Ames Corporation repurchases 10,000 shares of its common stock for $12 per share. The shares were...

Related questions

Question

do not ive answer images formet

Transcribed Image Text:e. None of the above

2

40%

P10. On January 1, 2012, Madoff Investments purchased 200,000 of Ponzi & Sons 500,000

outstanding shares for $26 million. On June 15, 2012, Ponzi & Sons distributed cash dividends

of $1 per share. For the year ended December 31, 2012, Ponzi & Sons reported a net loss of $15

million. At the end of the year, the fair value of the shares is $32 million. What amount will

Madoff Investment record the investment in Ponzi & Sons at on their December 31, 2012

Balance Sheet?

a. $32 million

b. $26 million

c. $20 million

d. $19.8 million

e. None of the above

26-

6

26 win-wi

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning