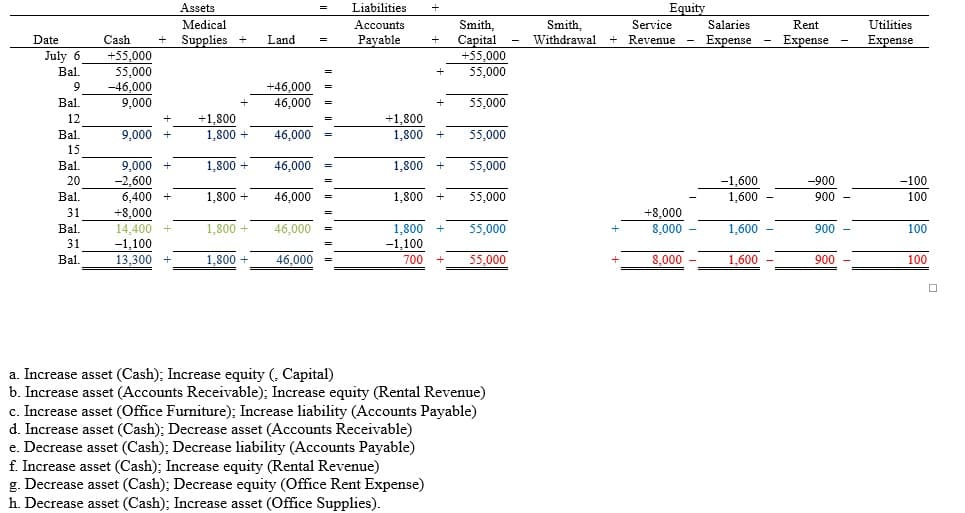

Medical Accounts Salaries Smith, Capital +55,000 55,000 Smith, Service Rent Utilities Date Cash + Supplies + Land Payable Withdrawal + Revenue - Expense - Expense Expense July 6 +55,000 55,000 -46,000 9,000 Bal. 9 +46,000 46,000 55,000 Bal. 12 9,000 + +1,800 1,800 + +1,800 1,800 + 55,000 46,000 Bal. 15 1,800 + 55,000 9,000 + -2,600 6,400 + 1,800 + Bal. 20 46,000 -1,600 1,600 -900 -100 Bal. 1,800 + 46,000 1,800 + 55,000 900 100 +8,000 14,400 + -1,100 13,300 + 31 +8,000 8,000 1,800 + -1,100 1,800 + Bal. 31 46,000 55,000 1,600 900 100 Bal. 1,800 + 46,000 700 55,000 8,000 1,600 900 100 a. Increase asset (Cash); Increase equity (, Capital) b. Increase asset (Accounts Receivable); Increase equity (Rental Revenue) c. Increase asset (Office Furniture); Increase liability (Accounts Payable) d. Increase asset (Cash); Decrease asset (Accounts Receivable) e. Decrease asset (Cash); Decrease liability (Accounts Payable) f. Increase asset (Cash); Increase equity (Rental Revenue) g. Decrease asset (Cash); Decrease equity (Office Rent Expense) h. Decrease asset (Cash); Increase asset (Office Supplies).

Medical Accounts Salaries Smith, Capital +55,000 55,000 Smith, Service Rent Utilities Date Cash + Supplies + Land Payable Withdrawal + Revenue - Expense - Expense Expense July 6 +55,000 55,000 -46,000 9,000 Bal. 9 +46,000 46,000 55,000 Bal. 12 9,000 + +1,800 1,800 + +1,800 1,800 + 55,000 46,000 Bal. 15 1,800 + 55,000 9,000 + -2,600 6,400 + 1,800 + Bal. 20 46,000 -1,600 1,600 -900 -100 Bal. 1,800 + 46,000 1,800 + 55,000 900 100 +8,000 14,400 + -1,100 13,300 + 31 +8,000 8,000 1,800 + -1,100 1,800 + Bal. 31 46,000 55,000 1,600 900 100 Bal. 1,800 + 46,000 700 55,000 8,000 1,600 900 100 a. Increase asset (Cash); Increase equity (, Capital) b. Increase asset (Accounts Receivable); Increase equity (Rental Revenue) c. Increase asset (Office Furniture); Increase liability (Accounts Payable) d. Increase asset (Cash); Decrease asset (Accounts Receivable) e. Decrease asset (Cash); Decrease liability (Accounts Payable) f. Increase asset (Cash); Increase equity (Rental Revenue) g. Decrease asset (Cash); Decrease equity (Office Rent Expense) h. Decrease asset (Cash); Increase asset (Office Supplies).

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter8: Specialized Audit Tools: Attributes Sampling, Monetary Unit Sampling, And Data Analytics Tools

Section: Chapter Questions

Problem 29CYBK

Related questions

Question

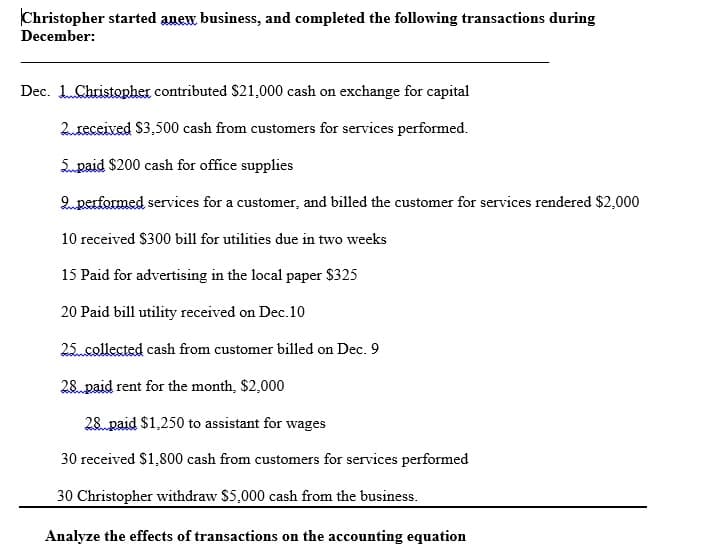

I have attached the table which is the sample howbto solve this problem. Als with increase asset and decrease asset

Transcribed Image Text:Medical

Accounts

Salaries

Smith,

Capital

+55,000

55,000

Smith,

Service

Rent

Utilities

Date

Cash

+ Supplies +

Land

Payable

Withdrawal + Revenue - Expense - Expense

Expense

July 6

+55,000

55,000

-46,000

9,000

Bal.

9

+46,000

46,000

55,000

Bal.

12

9,000 +

+1,800

1,800 +

+1,800

1,800 +

55,000

46,000

Bal.

15

1,800 +

55,000

9,000 +

-2,600

6,400 +

1,800 +

Bal.

20

46,000

-1,600

1,600

-900

-100

Bal.

1,800 +

46,000

1,800 +

55,000

900

100

+8,000

14,400 +

-1,100

13,300 +

31

+8,000

8,000

1,800 +

-1,100

1,800 +

Bal.

31

46,000

55,000

1,600

900

100

Bal.

1,800 +

46,000

700

55,000

8,000

1,600

900

100

a. Increase asset (Cash); Increase equity (, Capital)

b. Increase asset (Accounts Receivable); Increase equity (Rental Revenue)

c. Increase asset (Office Furniture); Increase liability (Accounts Payable)

d. Increase asset (Cash); Decrease asset (Accounts Receivable)

e. Decrease asset (Cash); Decrease liability (Accounts Payable)

f. Increase asset (Cash); Increase equity (Rental Revenue)

g. Decrease asset (Cash); Decrease equity (Office Rent Expense)

h. Decrease asset (Cash); Increase asset (Office Supplies).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning