For the year ended December 31, 2021 Sales P 6,100,0 Cost of sales 3,700,00 Gross profit Gain on sale of equipment 2,400,0 100,0 2,500,0 Total revenues Operating expenses Salaries 820,000 Insurance 380,000 Depreciation 220,000 1,420,00 Income before interest and income tax 1,080,0 Interest expense Income before income tax expense 120,00 960,0 Income tax expense 288,00 Net income after tax 672,00 The following information is also available: 120,0 280,0 160,0 100,0 180,0 Decrease in accounts receivable Increase in inventory Decrease in accounts payable Increase in salaries payable Increase in prepaid insurance Decrease in interest payable Increase in income tax payable 30,0 18,0

For the year ended December 31, 2021 Sales P 6,100,0 Cost of sales 3,700,00 Gross profit Gain on sale of equipment 2,400,0 100,0 2,500,0 Total revenues Operating expenses Salaries 820,000 Insurance 380,000 Depreciation 220,000 1,420,00 Income before interest and income tax 1,080,0 Interest expense Income before income tax expense 120,00 960,0 Income tax expense 288,00 Net income after tax 672,00 The following information is also available: 120,0 280,0 160,0 100,0 180,0 Decrease in accounts receivable Increase in inventory Decrease in accounts payable Increase in salaries payable Increase in prepaid insurance Decrease in interest payable Increase in income tax payable 30,0 18,0

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 16E

Related questions

Question

OPERATING ACTIVITIES

HOW MUCH IS THE NET CASH PROVIDED BY/(USED IN) OPERATING ACTIVITIES

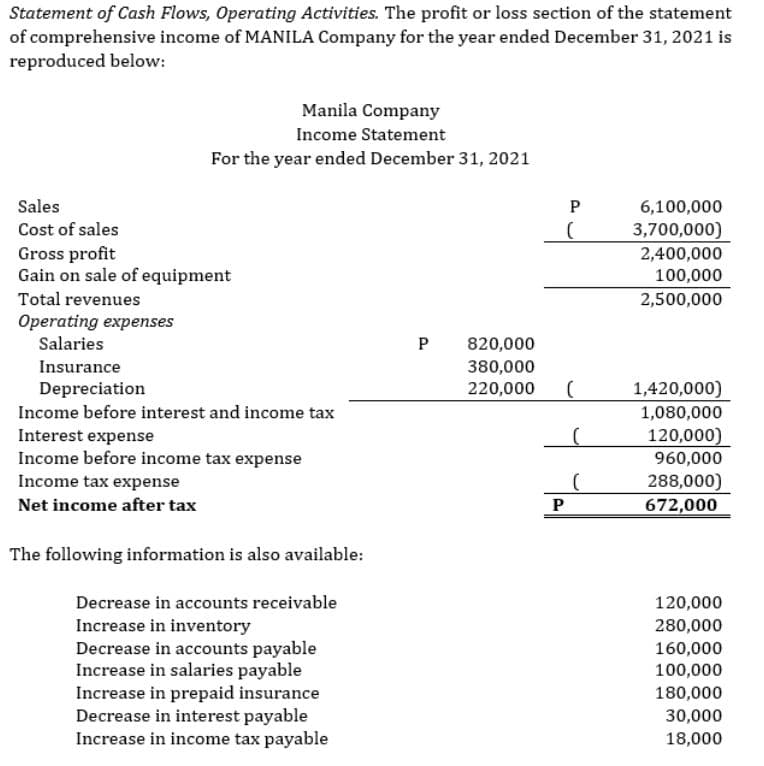

Transcribed Image Text:Statement of Cash Flows, Operating Activities. The profit or loss section of the statement

of comprehensive income of MANILA Company for the year ended December 31, 2021 is

reproduced below:

Manila Company

Income Statement

For the year ended December 31, 2021

Sales

6,100,000

Cost of sales

3,700,000)

Gross profit

Gain on sale of equipment

2,400,000

100,000

Total revenues

2,500,000

Operating expenses

Salaries

820,000

Insurance

380,000

Depreciation

220,000

1,420,000)

Income before interest and income tax

1,080,000

120,000)

960,000

Interest expense

Income before income tax expense

288,000)

672,000

Income tax expense

Net income after tax

P

The following information is also available:

Decrease in accounts receivable

120,000

Increase in inventory

Decrease in accounts payable

Increase in salaries payable

Increase in prepaid insurance

Decrease in interest payable

Increase in income tax payable

280,000

160,000

100,000

180,000

30,000

18,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College