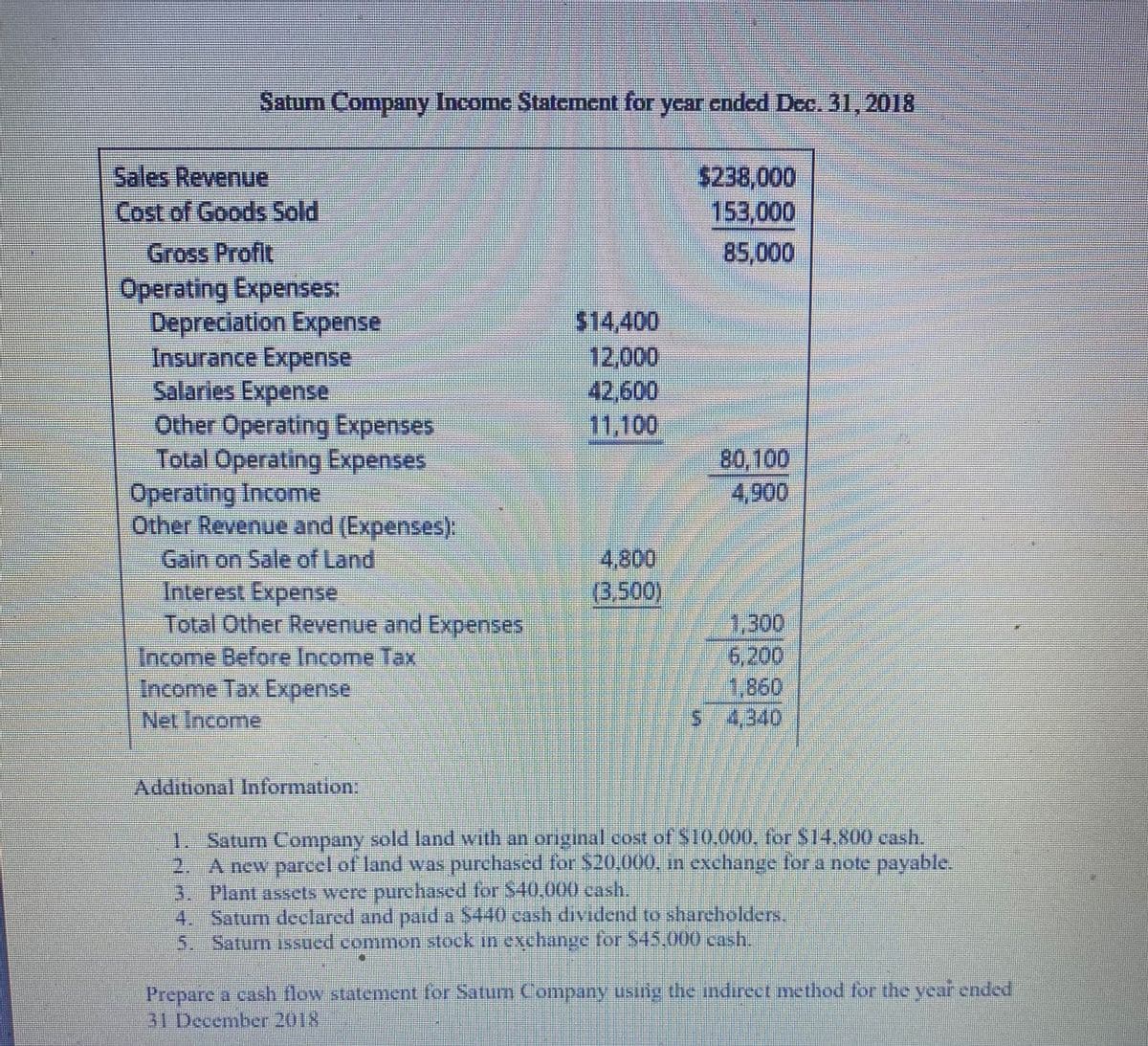

Saturn Company Income Statement for ycar cnded Dec. 31, 2018 Sales Revenue Cost of Goods Sold $238,000 153,000 Gross Profit Operating Expenses: Depreciation Expense Insurance Expense Salaries Expense Other Operating Expenses Total Operating Expenses Operating Income Other Revenue and (Expenses): 85,000 $14,400 12,000 42,600 11,100 80,100 4,900 Gain on Sale of Land Interest Expense Total Other Revenue and Expenses 4,800 (3.500) Income Before Income Tax Income Tax Expense Net Income 1,300 6,200 1,860 $ 4,340 Additional Information: 1. Saturn Company sold land with an original cost of $10.000, for $14,800 cash. 2. A new parcel of land was purchased for $20,000, in exchange for a note payable. 3. Plant assets were purchased for $40,0000 cash. 4. Saturn declared and paid a $440 cash dividend to sharcholders. 5. Saturn issued common stock in exchange for S45,000 cash. Prepare a cash flow statement for Saturn Company using the indirect method for the year ended 31 December 2018

Saturn Company Income Statement for ycar cnded Dec. 31, 2018 Sales Revenue Cost of Goods Sold $238,000 153,000 Gross Profit Operating Expenses: Depreciation Expense Insurance Expense Salaries Expense Other Operating Expenses Total Operating Expenses Operating Income Other Revenue and (Expenses): 85,000 $14,400 12,000 42,600 11,100 80,100 4,900 Gain on Sale of Land Interest Expense Total Other Revenue and Expenses 4,800 (3.500) Income Before Income Tax Income Tax Expense Net Income 1,300 6,200 1,860 $ 4,340 Additional Information: 1. Saturn Company sold land with an original cost of $10.000, for $14,800 cash. 2. A new parcel of land was purchased for $20,000, in exchange for a note payable. 3. Plant assets were purchased for $40,0000 cash. 4. Saturn declared and paid a $440 cash dividend to sharcholders. 5. Saturn issued common stock in exchange for S45,000 cash. Prepare a cash flow statement for Saturn Company using the indirect method for the year ended 31 December 2018

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.10E

Related questions

Question

100%

Transcribed Image Text:Saturn Company Income Statement for year cnded Dec. 31,2018

Sales Revenue

Cost of Goods Sold

$238,000

153,000

Gross Profit

Operating Expenses:

Depreciation Expense

Insurance Expense

Salaries Expense

Other Operating Expenses

Total Operating Expenses

Operating Income

Other Revenue and (Expenses):

Gain on Sale of Land

Interest Expense

Total Other Revenue and Expenses

Income Before Income Tax

Income Tax Expense

Net Income

85,000

$14,400

12,000

42,600

11,100

80,100

4,900

4,800

(3,500)

1,300

6,200

1,860

S 4,340

Additional Information:

1. Saturn Company sold land with an original cost of $10.000, for $14,800 cash.

2. A new parcel of land was purchased for $20,000. in exchange for a note payable.

3. Plant assets were purehased for $40.000 cash.

4. Saturn declared and paid a $440 cash dividend to shareholders.

5. Saturn issued common stock in exchange for S45.000 cash.

Prepare a cash flow statement for Saturm Company using the indireet method for the year ended

31 December 2018

![[Question 1]

Saturn Company

Comparative Balance Sheet

2018

2017

Assets

Cash

Accounts Recelvable

Prepaid Insurance

Inventory

Land

Plant Assets

$ 47,500

21,500

2,500

48,000

20.000

230,000

(85,500)

$284.000

S 24,300

26,000

1,800

45,500

10,000

190,000

(71,100)

$226,500

Accumulated Depreciation

Total Assets

Llabilities and Equity

Liabilities:

Accounts Payable

Salaries Payable

Notes Payable

$ 17,200

1,900

85,000

$ 19,000

1,500

75,000

95,500

Total Liabiltes

104.100

Equity

Common Stock

Retained Earnings

Total Equity

Total Liabilities and Equity

115.000

64.900

70,000

61,000

179.900

00000

$284.000

$226,500](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fccbb213c-415b-48c3-830c-f78c17784d1d%2F5da9b49d-b566-4fda-9dce-7a15e8672e33%2Fgzs5tn6i_processed.jpeg&w=3840&q=75)

Transcribed Image Text:[Question 1]

Saturn Company

Comparative Balance Sheet

2018

2017

Assets

Cash

Accounts Recelvable

Prepaid Insurance

Inventory

Land

Plant Assets

$ 47,500

21,500

2,500

48,000

20.000

230,000

(85,500)

$284.000

S 24,300

26,000

1,800

45,500

10,000

190,000

(71,100)

$226,500

Accumulated Depreciation

Total Assets

Llabilities and Equity

Liabilities:

Accounts Payable

Salaries Payable

Notes Payable

$ 17,200

1,900

85,000

$ 19,000

1,500

75,000

95,500

Total Liabiltes

104.100

Equity

Common Stock

Retained Earnings

Total Equity

Total Liabilities and Equity

115.000

64.900

70,000

61,000

179.900

00000

$284.000

$226,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning