mic) Liberty Airways is considering an investment of $830,000 in ticket purchasing kiosks at selected airports. The kiosks (hardware and software) have an expected life of four years. Extra ticket sales are expecte be 57,000 per year at a discount price of $35 per ticket Fixed costs, excluding depreciation of the equipment, are $440,000 per year, and variable costs are $26 per ticket. The kiosks will be depreciated over four years, using the SL method with a zero salvage value. The onetime commitment of working capital is expected to be 1/8 of annual sales dollars. The after-tax MARR is 12% per year, and the company pa income tax at the rate of 21%. What's the after-tax PW of this proposed investment? Should the investment be made? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The after-tax PW of this proposed investment is $ thousand (Round to the nearest whole number.) The investment be made. T

mic) Liberty Airways is considering an investment of $830,000 in ticket purchasing kiosks at selected airports. The kiosks (hardware and software) have an expected life of four years. Extra ticket sales are expecte be 57,000 per year at a discount price of $35 per ticket Fixed costs, excluding depreciation of the equipment, are $440,000 per year, and variable costs are $26 per ticket. The kiosks will be depreciated over four years, using the SL method with a zero salvage value. The onetime commitment of working capital is expected to be 1/8 of annual sales dollars. The after-tax MARR is 12% per year, and the company pa income tax at the rate of 21%. What's the after-tax PW of this proposed investment? Should the investment be made? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The after-tax PW of this proposed investment is $ thousand (Round to the nearest whole number.) The investment be made. T

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 3E

Related questions

Question

Transcribed Image Text:mic)

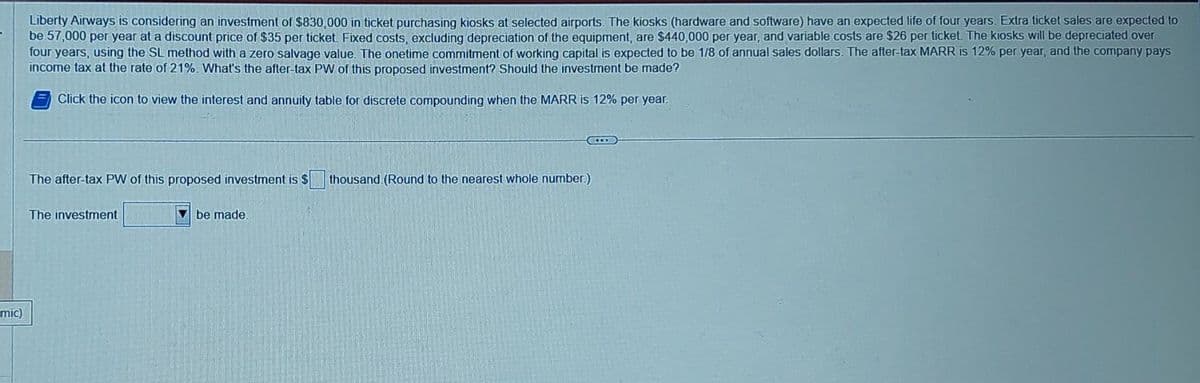

Liberty Airways is considering an investment of $830,000 in ticket purchasing kiosks at selected airports. The kiosks (hardware and software) have an expected life of four years. Extra ticket sales are expected to

be 57,000 per year at a discount price of $35 per ticket. Fixed costs, excluding depreciation of the equipment, are $440,000 per year, and variable costs are $26 per ticket. The kiosks will be depreciated over

four years, using the SL method with a zero salvage value. The onetime commitment of working capital is expected to be 1/8 of annual sales dollars. The after-tax MARR is 12% per year, and the company pays

income tax at the rate of 21%. What's the after-tax PW of this proposed investment? Should the investment be made?

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year.

The after-tax PW of this proposed investment is $

The investment

be made.

thousand (Round to the nearest whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning