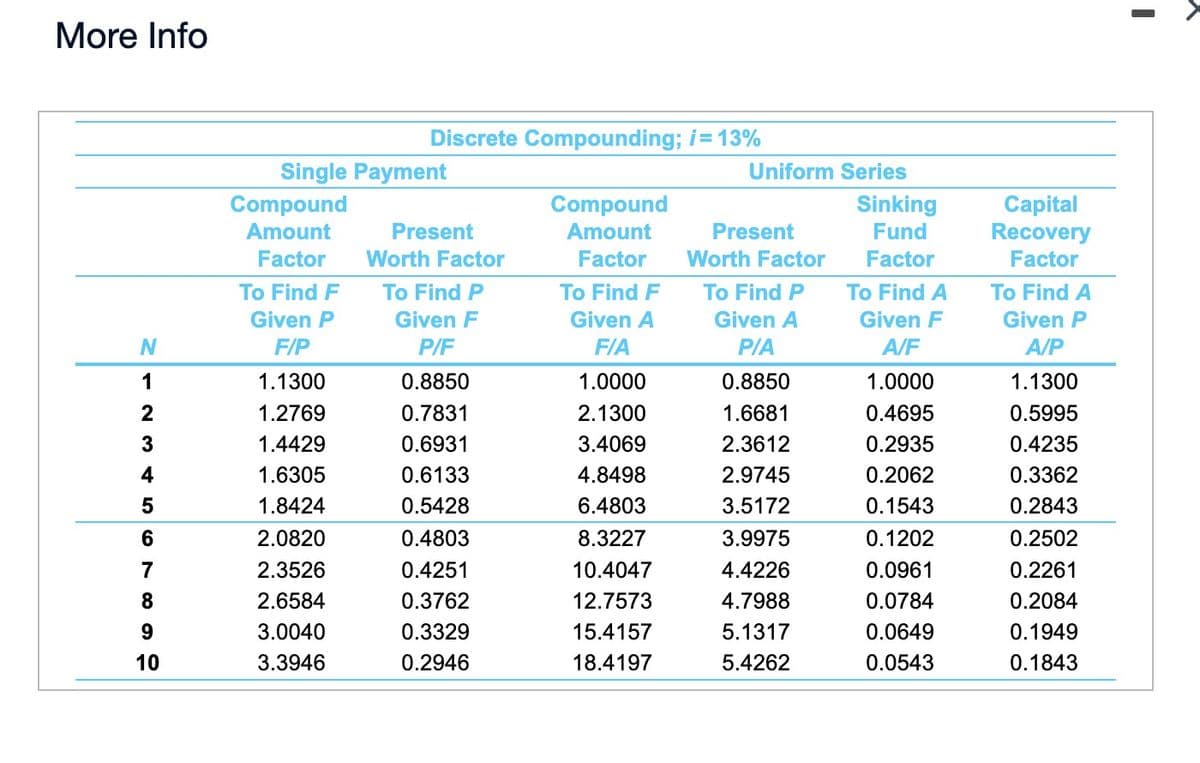

N 1 2 3 4 5 6 7 8 9 10 Single Payment Discrete Compounding; i = 13% Compound Amount Present Factor Worth Factor To Find F Given P F/P 1.1300 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 To Find P Given F P/F 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 Compound Amount Factor To Find F Given A FIA 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 Uniform Series Present Worth Factor To Find P Given A P/A 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4695 0.2935 0.2062 0.1543 0.1202 0.0961 0.0784 0.0649 0.0543 Capital Recovery Factor To Find A Given P A/P 1.1300 0.5995 0.4235 0.3362 0.2843 0.2502 0.2261 0.2084 0.1949 0.1843

N 1 2 3 4 5 6 7 8 9 10 Single Payment Discrete Compounding; i = 13% Compound Amount Present Factor Worth Factor To Find F Given P F/P 1.1300 1.2769 1.4429 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 To Find P Given F P/F 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 Compound Amount Factor To Find F Given A FIA 1.0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 Uniform Series Present Worth Factor To Find P Given A P/A 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4695 0.2935 0.2062 0.1543 0.1202 0.0961 0.0784 0.0649 0.0543 Capital Recovery Factor To Find A Given P A/P 1.1300 0.5995 0.4235 0.3362 0.2843 0.2502 0.2261 0.2084 0.1949 0.1843

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 2E

Related questions

Question

Subject: Economics

Transcribed Image Text:More Info

N

1

2345

6

7

8

9

10

Single Payment

Compound

Amount

Factor

To Find F

Given P

F/P

Discrete Compounding; i = 13%

1.1300

1.2769

1.4429

1.6305

1.8424

2.0820

2.3526

2.6584

3.0040

3.3946

Present

Worth Factor

To Find P

Given F

P/F

0.8850

0.7831

0.6931

0.6133

0.5428

0.4803

0.4251

0.3762

0.3329

0.2946

Compound

Amount

Factor

To Find F

Given A

F/A

1.0000

2.1300

3.4069

4.8498

6.4803

8.3227

10.4047

12.7573

15.4157

18.4197

Uniform Series

Present

Worth Factor

To Find P

Given A

PIA

0.8850

1.6681

2.3612

2.9745

3.5172

3.9975

4.4226

4.7988

5.1317

5.4262

Sinking

Fund

Factor

To Find A

Given F

A/F

1.0000

0.4695

0.2935

0.2062

0.1543

0.1202

0.0961

0.0784

0.0649

0.0543

Capital

Recovery

Factor

To Find A

Given P

A/P

1.1300

0.5995

0.4235

0.3362

0.2843

0.2502

0.2261

0.2084

0.1949

0.1843

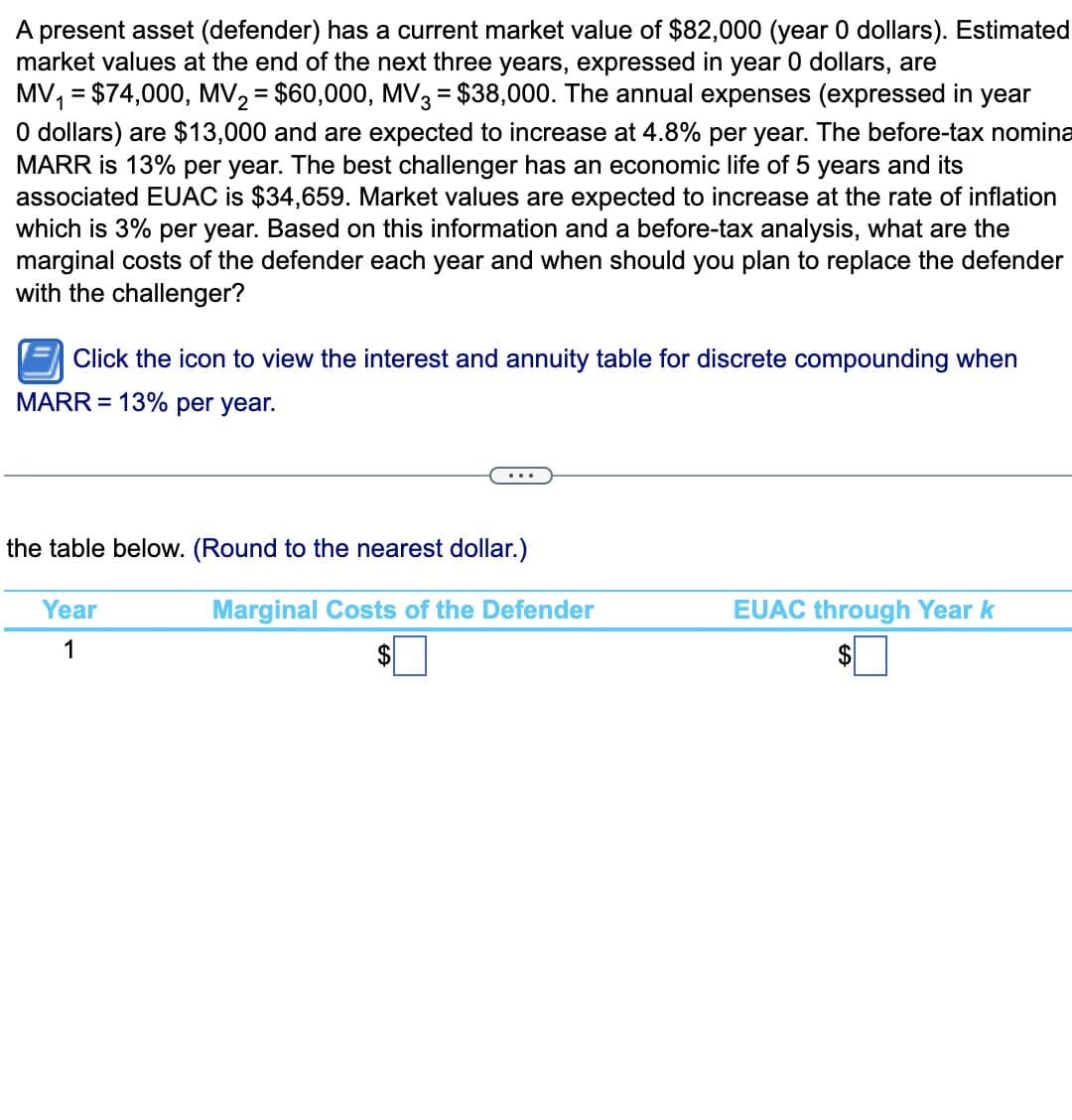

Transcribed Image Text:A present asset (defender) has a current market value of $82,000 (year 0 dollars). Estimated

market values at the end of the next three years, expressed in year 0 dollars, are

MV₁ = $74,000, MV₂ = $60,000, MV3 = $38,000. The annual expenses (expressed in year

0 dollars) are $13,000 and are expected to increase at 4.8% per year. The before-tax nomina

MARR is 13% per year. The best challenger has an economic life of 5 years and its

associated EUAC is $34,659. Market values are expected to increase at the rate of inflation

which is 3% per year. Based on this information and a before-tax analysis, what are the

marginal costs of the defender each year and when should you plan to replace the defender

with the challenger?

Click the icon to view the interest and annuity table for discrete compounding when

MARR = 13% per year.

...

the table below. (Round to the nearest dollar.)

Year

1

Marginal Costs of the Defender

EUAC through Year k

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning