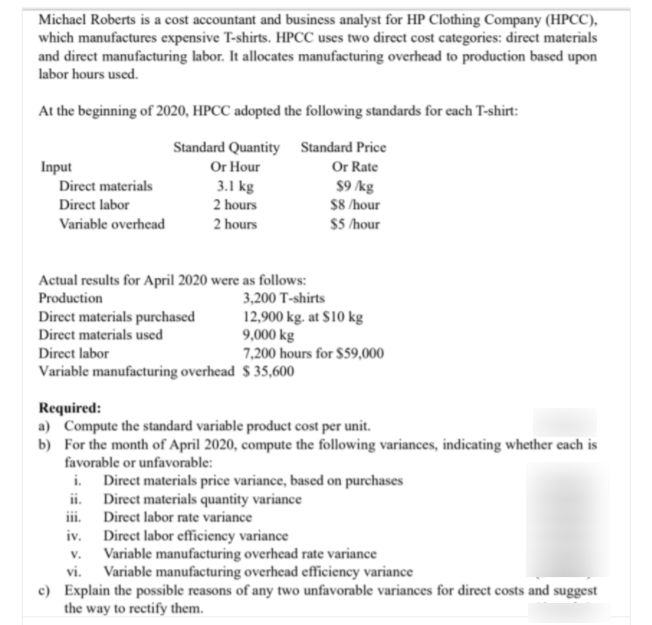

Michael Roberts is a cost accountant and business analyst for HP Clothing Company (HPCC), which manufactures expensive T-shirts. HPCC uses two direct cost categories: direct materials and direct manufacturing labor. It allocates manufacturing overhead to production based upon labor hours used. At the beginning of 2020, HPCC adopted the following standards for each T-shirt: Standard Quantity Standard Price Or Hour 3.1 kg 2 hours 2 hours Or Rate $9 /kg $8/hour Input Direct materials Direct labor Variable overhead $5 /hour Actual results for April 2020 were as follows: Production 3,200 T-shirts Direct materials purchased Direct materials used 12,900 kg. at S10 kg 9,000 kg 7,200 hours for $59,000 Direct labor Variable manufacturing overhead $ 35,600 Required: a) Compute the standard variable product cost per unit. b) For the month of April 2020, compute the following variances, indicating whether each is favorable or unfavorable: i. Direct materials price variance, based on purchases ii. Direct materials quantity variance iii. Direct labor rate variance iv. Direct labor efficiency variance v. Variable manufacturing overhead rate variance vi. Variable manufacturing overhead efficiency variance c) Explain the possible reasons of any two unfavorable variances for direct costs and suggest the way to rectify them.

Michael Roberts is a cost accountant and business analyst for HP Clothing Company (HPCC), which manufactures expensive T-shirts. HPCC uses two direct cost categories: direct materials and direct manufacturing labor. It allocates manufacturing overhead to production based upon labor hours used. At the beginning of 2020, HPCC adopted the following standards for each T-shirt: Standard Quantity Standard Price Or Hour 3.1 kg 2 hours 2 hours Or Rate $9 /kg $8/hour Input Direct materials Direct labor Variable overhead $5 /hour Actual results for April 2020 were as follows: Production 3,200 T-shirts Direct materials purchased Direct materials used 12,900 kg. at S10 kg 9,000 kg 7,200 hours for $59,000 Direct labor Variable manufacturing overhead $ 35,600 Required: a) Compute the standard variable product cost per unit. b) For the month of April 2020, compute the following variances, indicating whether each is favorable or unfavorable: i. Direct materials price variance, based on purchases ii. Direct materials quantity variance iii. Direct labor rate variance iv. Direct labor efficiency variance v. Variable manufacturing overhead rate variance vi. Variable manufacturing overhead efficiency variance c) Explain the possible reasons of any two unfavorable variances for direct costs and suggest the way to rectify them.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 17E: Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the...

Related questions

Question

Transcribed Image Text:Michael Roberts is a cost accountant and business analyst for HP Clothing Company (HPCC),

which manufactures expensive T-shirts. HPCC uses two direct cost categories: direct materials

and direct manufacturing labor. It allocates manufacturing overhead to production based upon

labor hours used.

At the beginning of 2020, HPCC adopted the following standards for each T-shirt:

Standard Quantity Standard Price

Or Hour

3.1 kg

2 hours

2 hours

Or Rate

$9 /kg

$8/hour

Input

Direct materials

Direct labor

Variable overhead

$5 /hour

Actual results for April 2020 were as follows:

Production

3,200 T-shirts

Direct materials purchased

Direct materials used

12,900 kg. at S10 kg

9,000 kg

7,200 hours for $59,000

Direct labor

Variable manufacturing overhead $ 35,600

Required:

a) Compute the standard variable product cost per unit.

b) For the month of April 2020, compute the following variances, indicating whether each is

favorable or unfavorable:

i. Direct materials price variance, based on purchases

ii. Direct materials quantity variance

iii. Direct labor rate variance

iv. Direct labor efficiency variance

v. Variable manufacturing overhead rate variance

vi. Variable manufacturing overhead efficiency variance

c) Explain the possible reasons of any two unfavorable variances for direct costs and suggest

the way to rectify them.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning