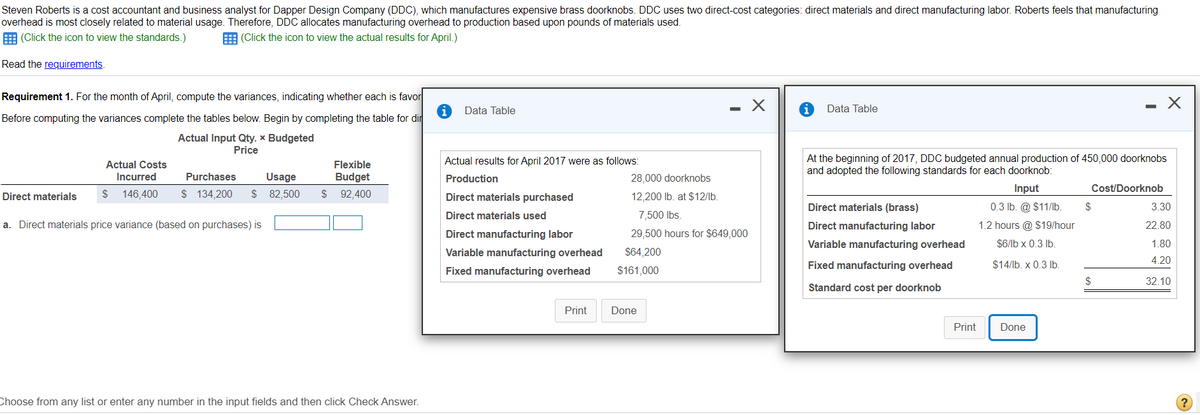

Steven Roberts is a cost accountant and business analyst for Dapper Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct-cost categories: direct materials and direct manufacturing labor. Roberts feels that manufacturing overhead is most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon pounds of materials used. E (Click the icon to view the standards.) E (Click the icon to view the actual results for April.) Read the requirements Requirement 1. For the month of April, compute the variances, indicating whether each is favor - X - X O Data Table O Data Table %3D Before computing the variances complete the tables below. Begin by completing the table for dir Actual Input Qty, x Budgeted Price At the beginning of 2017, DDC budgeted annual production of 450,000 doorknobs and adopted the following standards for each doorknob: Actual Costs Flexible Actual results for April 2017 were as follows: Incurred Purchases Usage Budget Production 28,000 doorknobs Input Cost/Doorknob Direct materials $ 146,400 $ 134,200 S 82,500 $ 9,400 12,200 lb. at $12/lb. Direct materials purchased 03 lb. @ $11/b. . Direct materials (brass) %24 3.30 Direct materials used 7.500 Ibs. a. Direct materials price variance (based on purchases) is Direct manufacturing labor 1.2 hours @ $19/hour 22.80 Direct manufacturing labor 29,500 hours for $649,000 S6lb x 0.3 lb. $14/lb. x 0.3 lb. Variable manufacturing overhead 1.80 Variable manufacturing overhead S64,200 4 20 Fixed manufacturing overhead $161,000 Fixed manufacturing overhead 32.10 Standard cost per doorknob Print Done Print Done

Steven Roberts is a cost accountant and business analyst for Dapper Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct-cost categories: direct materials and direct manufacturing labor. Roberts feels that manufacturing overhead is most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon pounds of materials used. E (Click the icon to view the standards.) E (Click the icon to view the actual results for April.) Read the requirements Requirement 1. For the month of April, compute the variances, indicating whether each is favor - X - X O Data Table O Data Table %3D Before computing the variances complete the tables below. Begin by completing the table for dir Actual Input Qty, x Budgeted Price At the beginning of 2017, DDC budgeted annual production of 450,000 doorknobs and adopted the following standards for each doorknob: Actual Costs Flexible Actual results for April 2017 were as follows: Incurred Purchases Usage Budget Production 28,000 doorknobs Input Cost/Doorknob Direct materials $ 146,400 $ 134,200 S 82,500 $ 9,400 12,200 lb. at $12/lb. Direct materials purchased 03 lb. @ $11/b. . Direct materials (brass) %24 3.30 Direct materials used 7.500 Ibs. a. Direct materials price variance (based on purchases) is Direct manufacturing labor 1.2 hours @ $19/hour 22.80 Direct manufacturing labor 29,500 hours for $649,000 S6lb x 0.3 lb. $14/lb. x 0.3 lb. Variable manufacturing overhead 1.80 Variable manufacturing overhead S64,200 4 20 Fixed manufacturing overhead $161,000 Fixed manufacturing overhead 32.10 Standard cost per doorknob Print Done Print Done

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 1CMA: Pelder Products Company manufactures two types of engineering diagnostic equipment used in...

Related questions

Question

please, look at image.

Transcribed Image Text:Steven Roberts is a cost accountant and business analyst for Dapper Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct-cost categories: direct materials and direct manufacturing labor. Roberts feels that manufacturing

overhead is most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon pounds of materials used.

E (Click the icon to view the standards.)

E (Click the icon to view the actual results for April.)

Read the requirements.

Requirement 1. For the month of April, compute the variances, indicating whether each is favor

Data Table

Data Table

Before computing the variances complete the tables below. Begin by completing the table for dir

Actual Input Qty. * Budgeted

Price

At the beginning of 2017, DDC budgeted annual production of 450,000 doorknobs

and adopted the following standards for each doorknob:

Actual Costs

Flexible

Actual results for April 2017 were as follows:

Incurred

Purchases

Usage

Budget

Production

28,000 doorknobs

$

$ 134,200

$ 82,500

92,400

Input

Cost/Doorknob

Direct materials

146.400

Direct materials purchased

12,200 lb. at $12/lb.

Direct materials (brass)

0.3 lb. @ $11/Ib.

3.30

Direct materials used

7,500 Ibs.

a. Direct materials price variance (based on purchases) is

Direct manufacturing labor

1.2 hours @ $19/hour

22.80

Direct manufacturing labor

29,500 hours for $649,000

Variable manufacturing overhead

$6/lb x 0.3 lb.

1.80

Variable manufacturing overhead

$64,200

4.20

Fixed manufacturing overhead

$14/lb. x 0.3 lb.

Fixed manufacturing overhead

$161,000

$

32.10

Standard cost per doorknob

Print

Done

Print

Done

Choose from any list or enter any number in the input fields and then click Check Answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College